State of Michigan Retiree Benefits for a Secure Future

Retirement marks a significant life transition, and understanding the intricacies of State of Michigan retiree benefits is crucial for a secure and fulfilling future. In this comprehensive guide, we delve into recent updates, pension options, healthcare coverage, and strategies for optimizing your retirement journey in the great state of Michigan.

Recent Updates in Michigan Retiree Benefits:

Michigan’s retiree benefits landscape is dynamic, with recent updates shaping the experience for retirees. Stay informed about policy changes, enhancements, and adjustments to ensure you make the most of the available benefits. Whether it’s revised healthcare offerings or adjustments to pension plans, staying current is key to maximizing your retirement advantages.

Understanding Michigan State Retirement Plans:

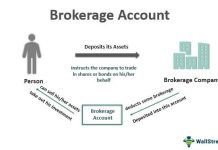

Navigating the multitude of retirement plans offered by the state can be complex but is essential for strategic financial planning. Explore the array of options available, from 401(k) equivalents to pension plans, and grasp the eligibility criteria that govern them. A clear understanding of the state’s retirement framework lays the foundation for a financially secure future.

Healthcare Coverage for Michigan Retirees:

As you approach retirement, securing comprehensive healthcare coverage becomes paramount. Michigan offers a range of healthcare benefits for retirees, encompassing medical, dental, and vision plans. Understanding the details of these benefits ensures you make informed decisions about your health and well-being in retirement.

Financial Planning and Pension Options:

Financial planning is a cornerstone of a successful retirement, and Michigan provides retirees with various pension options. Delve into the details of these plans, considering factors such as contribution limits, distribution options, and potential tax implications. Whether you opt for a defined benefit pension or a 401(k)-style plan, strategic financial planning can enhance your retirement income.

Navigating Social Security Benefits:

The interplay between state benefits and Social Security is a crucial aspect of retirement planning. Uncover the strategies to optimize your Social Security benefits as a Michigan retiree. From understanding the best time to claim benefits to considering spousal and survivor benefits, strategic navigation of Social Security can significantly impact your overall retirement income.

Legal and Regulatory Considerations:

Navigating the legal landscape is imperative to ensure a seamless transition into retirement. Explore the legal considerations that impact Michigan retiree benefits, covering topics such as eligibility criteria, documentation requirements, and any recent legislative changes. Understanding the legal framework safeguards your benefits and contributes to a stress-free retirement journey.

Optimizing Benefits through NLP Techniques:

In the age of advanced technology, Natural Language Processing (NLP) can revolutionize the way retirees access and utilize their benefits. Learn how NLP techniques can simplify complex information, making it easier to comprehend and act upon. From chatbots providing instant assistance to personalized recommendation systems, incorporating NLP can streamline your benefit optimization process.

Success Stories: Realizing the Full Potential:

Inspiration often comes from real-life success stories. Discover how Michigan retirees have successfully navigated the state’s benefit programs to achieve financial security and a fulfilling retirement lifestyle. These stories offer practical insights and motivation, illustrating that with strategic planning, anyone can unlock the full potential of their Michigan retiree benefits.

Frequently Asked Questions about State of Michigan Retiree Benefits

1. Q: What are the recent updates in Michigan retiree benefits?

A: Stay informed about policy changes, enhanced healthcare offerings, and adjustments to pension plans to maximize your retirement advantages.

2. Q: How do I understand Michigan state retirement plans?

A: Explore the array of retirement plans, from 401(k) equivalents to pension plans, and grasp the eligibility criteria for strategic financial planning.

3. Q: What healthcare coverage options are available for Michigan retirees?

A: Michigan offers comprehensive healthcare benefits, including medical, dental, and vision plans. Understand the details to make informed health-related decisions in retirement.

4. Q: What are the pension options for Michigan retirees?

A: Delve into details like contribution limits, distribution options, and tax implications to optimize your retirement income through various pension plans.

5. Q: How can I navigate Social Security benefits as a Michigan retiree?

A: Learn strategies to optimize Social Security benefits, including the best time to claim, spousal benefits, and survivor benefits for enhanced retirement income.

6. Q: What legal considerations should I be aware of in Michigan retirement?

A: Explore eligibility criteria, documentation requirements, and any legislative changes to navigate the legal landscape for a seamless retirement transition.

7. Q: How can Natural Language Processing (NLP) enhance benefit optimization?

A: Discover how NLP techniques simplify complex information, providing instant assistance and personalized recommendations to streamline benefit utilization.

8. Q: Are there any success stories of retirees maximizing Michigan benefits?

A: Gain inspiration from real-life success stories, showcasing how retirees have successfully navigated benefit programs for financial security and a fulfilling retirement.

9. Q: What are the key takeaways for securing retirement in Michigan?

A: Summarize the importance of strategic planning, staying informed, and navigating legal considerations to optimize benefits for a secure retirement.

10. Q: How can I make the most of Michigan retiree benefits throughout my retirement journey?

A: Embrace proactive steps, stay informed, plan strategically, and enjoy the fruits of your labor for a fulfilling retirement lifestyle in the beautiful state of Michigan.

Conclusion:

As we conclude our in-depth exploration of State of Michigan retiree benefits, it’s clear that strategic planning is the key to a secure and prosperous retirement. By staying informed about recent updates, understanding retirement plans, and navigating legal considerations, you can make the most of the benefits offered by the state.