Benefits of Leasing a Car

Leasing a car can be a smart financial decision for many individuals. It offers several advantages over traditional car ownership. In this article, we will explore the key benefits of leasing a car and why it might be the right choice for you.

Lower Monthly Payments

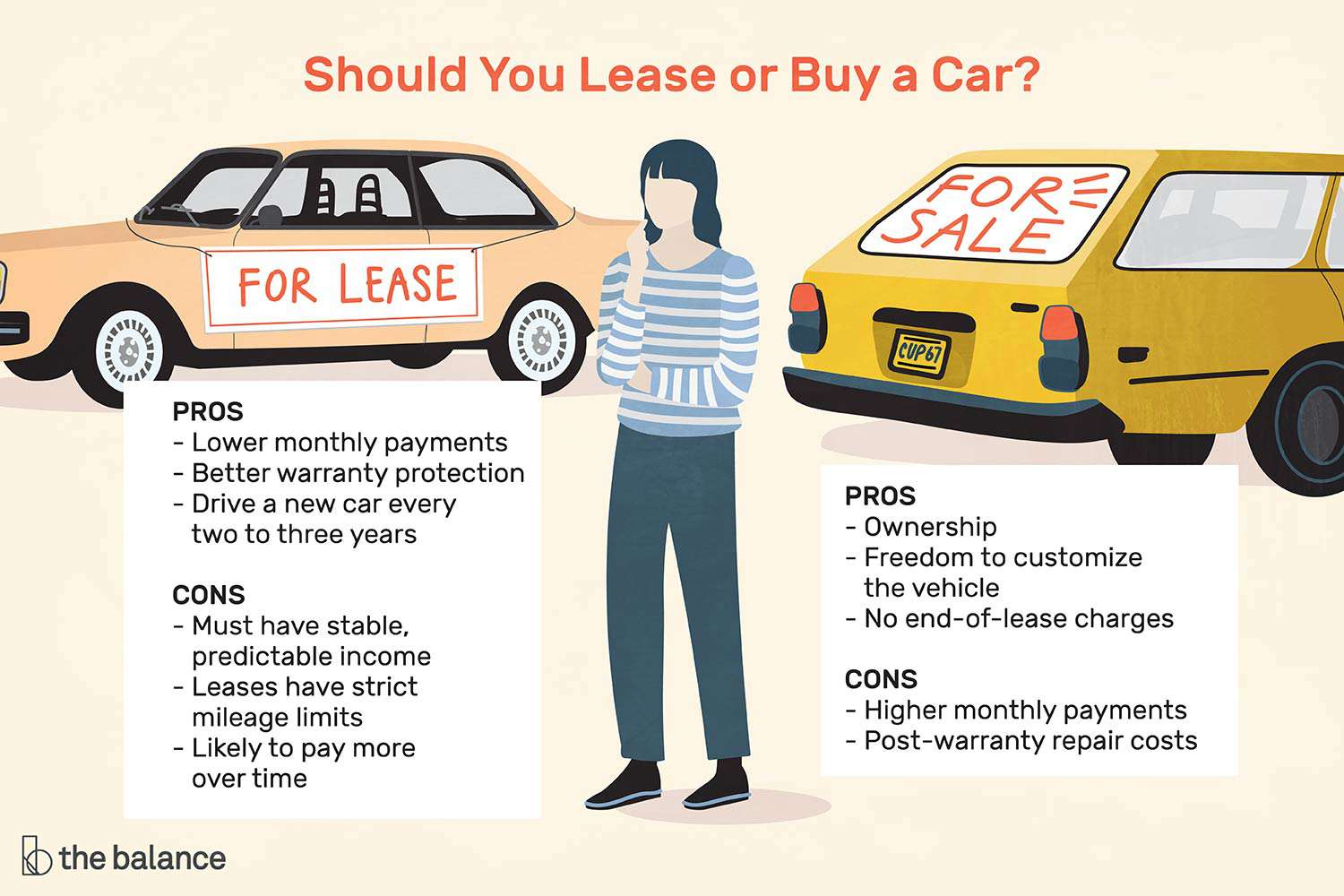

One of the primary advantages of leasing a car is the lower monthly payments compared to buying. When you lease a car, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full value of the car. This means that your monthly payments are typically lower than if you were to finance the purchase of a new car.

Minimal Upfront Costs

Leasing a car often requires minimal upfront costs. Unlike buying a car, where you may need to make a substantial down payment, leasing typically only requires a small initial payment, along with the first month’s lease payment. This can be particularly beneficial if you are on a tight budget or prefer to allocate your funds elsewhere.

Warranty Coverage

Another advantage of leasing a car is that it often comes with warranty coverage. Most lease agreements cover the vehicle for the duration of the lease term, which means you don’t have to worry about unexpected repair costs. This can provide peace of mind and save you money in the long run.

Access to Newer Models

Leasing a car allows you to drive a new vehicle every few years. This means you can enjoy the latest technology, safety features, and advancements in automotive engineering. If you like having access to the newest models and don’t want to commit to long-term ownership, leasing can be an excellent option.

No Resale Hassles

When you lease a car, you don’t have to deal with the hassle of selling it when you’re ready to move on to a different vehicle. At the end of the lease term, you simply return the car to the leasing company. This saves you time, effort, and the potential loss of value that often comes with selling a used car.

Flexibility

Leasing offers flexibility that buying doesn’t provide. At the end of your lease term, you have the option to either return the car or purchase it. This flexibility allows you to evaluate your needs and decide whether you want to continue with a new lease or explore other options. It gives you the freedom to adapt to changing circumstances without being tied down to a long-term commitment.

Lower Sales Tax

In many states, leasing a car can result in lower sales tax compared to buying. This is because you are only taxed on the portion of the car’s value that you use during the lease term, rather than the full value of the vehicle. Lower sales tax can help reduce your overall costs and make leasing even more financially appealing.

In conclusion, leasing a car offers several benefits that make it an attractive option for many individuals. From lower monthly payments and minimal upfront costs to warranty coverage and access to newer models, leasing provides flexibility and peace of mind. Additionally, the absence of resale hassles and potential tax advantages further enhance the appeal of leasing. Consider these advantages when deciding whether leasing a car is the right choice for you.

Frequently Asked Questions about Leasing a Car

1. What are the benefits of leasing a car?

Leasing a car offers several benefits, such as:

Lower monthly payments compared to buying a car

Ability to drive a new vehicle every few years

No worries about selling or trading in the car

Minimal upfront costs

Potential tax advantages for business use

2. Can I negotiate the lease terms?

Yes, lease terms are negotiable. You can negotiate the price of the car, the mileage allowance, and the lease duration to suit your needs.

3. Is leasing a car suitable for me if I drive a lot?

Leasing may not be the best option if you drive a high number of miles annually. Most leases have mileage restrictions, and exceeding them can result in additional fees.

4. Are there any maintenance responsibilities when leasing a car?

Yes, you are responsible for regular maintenance, such as oil changes and tire rotations. However, major repairs are typically covered under the manufacturer’s warranty.

5. Can I customize a leased car?

Modifications and customization are generally not allowed on leased vehicles. The car must be returned to its original condition.

6. What happens at the end of the lease term?

You have several options at the end of a lease term, including returning the car, purchasing it at a predetermined price, or leasing a new vehicle.

7. Can I transfer my lease to someone else?

Yes, many leases allow for lease transfers. However, there may be certain fees and requirements associated with transferring the lease.

8. Is it possible to buy the car before the lease term ends?

Yes, you can usually buy the car before the lease term ends. The buyout amount is predetermined and stated in the lease agreement.

9. What credit score is needed to lease a car?

The credit score requirements for leasing vary among lenders and dealerships. Generally, a good credit score (around 700 or above) increases your chances of getting a lease with favorable terms.

10. Can I lease a car if I have bad credit?

Leasing a car with bad credit can be more challenging, but it’s not impossible. Some dealerships offer special lease programs for individuals with lower credit scores, although the terms may not be as favorable.