Benefits of Auto Insurance

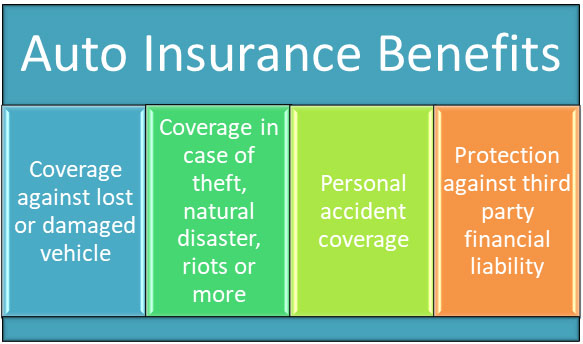

Auto insurance is a crucial aspect of owning and driving a vehicle. It provides financial protection and peace of mind in the event of accidents, theft, or damage. In this article, we will explore the numerous benefits of having auto insurance and why it is essential for every driver.

Financial Security

One of the primary benefits of auto insurance is the financial security it offers. In the unfortunate event of a car accident, insurance can cover the costs of repairs or replacements, medical expenses, and legal liabilities. Without insurance, these expenses can be overwhelming and put a significant burden on your finances.

Property Damage Coverage

Auto insurance typically includes property damage coverage, which protects you if your vehicle causes damage to someone else’s property. Whether it’s a collision with another vehicle, a fence, or a building, your insurance will help cover the costs of repairs or replacements, ensuring that you are not held personally responsible for the expenses.

Medical Expense Coverage

Injuries resulting from car accidents can be severe and require extensive medical treatment. Auto insurance often includes medical expense coverage, which helps pay for medical bills, hospital stays, surgeries, and rehabilitation. This coverage ensures that you receive the necessary medical care without worrying about the financial implications.

Legal Liability Protection

Auto insurance also provides legal liability protection. If you are at fault in an accident and someone else is injured or their property is damaged, you may be held legally responsible for the expenses. Insurance helps cover these costs, including legal fees, settlements, or judgments, protecting you from potential financial ruin.

Peace of Mind

Having auto insurance gives you peace of mind while driving. Knowing that you are protected financially in case of an accident or theft allows you to focus on the road and drive with confidence. It eliminates worries about potential financial hardships and allows you to enjoy your driving experience.

Additional Benefits

Auto insurance often offers additional benefits that vary depending on the policy and provider. These may include roadside assistance, rental car coverage, and coverage for personal belongings inside the vehicle. These added benefits further enhance your overall protection and convenience as a driver.

Auto insurance is not just a legal requirement in many places but also a vital financial safety net for drivers. The benefits of auto insurance, including financial security, property damage coverage, medical expense coverage, legal liability protection, and peace of mind, make it an essential investment for every vehicle owner. Don’t compromise your financial well-being and protection ensure you have adequate auto insurance coverage.

Frequently Asked Questions about the Benefits of Auto Insurance

1. What is auto insurance?

Auto insurance is a contract between you and an insurance company that protects you against financial loss in case of an accident or theft involving your vehicle.

2. Why is auto insurance important?

Auto insurance is important because it provides financial protection in case of an accident, covers medical expenses, repairs or replaces your vehicle, and protects you from potential lawsuits.

3. What are the benefits of having auto insurance?

The benefits of having auto insurance include peace of mind knowing you are financially protected, coverage for medical expenses, coverage for vehicle repairs or replacement, and legal protection in case of lawsuits.

4. What does auto insurance typically cover?

Auto insurance typically covers liability for bodily injury and property damage, medical expenses, collision and comprehensive damage, uninsured/underinsured motorist coverage, and personal injury protection.

5. How does auto insurance help in case of an accident?

Auto insurance helps in case of an accident by covering the costs of vehicle repairs, medical expenses for injuries, and potential legal expenses if you are sued by the other party involved in the accident.

6. Can auto insurance help with theft or vandalism?

Yes, auto insurance can help with theft or vandalism by providing coverage for the stolen or damaged vehicle, as well as any personal belongings that may have been stolen or damaged.

7. Are there any additional benefits to auto insurance?

Yes, some auto insurance policies offer additional benefits such as roadside assistance, rental car coverage, and reimbursement for towing expenses.

8. How does auto insurance protect against lawsuits?

Auto insurance protects against lawsuits by providing liability coverage, which helps cover legal expenses, settlements, or judgments if you are found responsible for causing an accident that resulted in injuries or property damage to others.

9. Can auto insurance help with medical expenses?

Yes, auto insurance can help with medical expenses by providing coverage for injuries sustained in an accident, including hospital bills, doctor visits, rehabilitation, and sometimes even lost wages due to the injuries.

10. Is auto insurance mandatory?

Auto insurance is mandatory in most states to ensure that drivers have financial responsibility in case of accidents. It is important to check the specific requirements of your state.