Benefits of Financial Planning: Achieving Financial Success

At [Your Company Name], we understand the importance of financial planning in today’s fast-paced and ever-changing world. With the increasing complexity of personal and business finances, having a well-thought-out financial plan is crucial for achieving financial success and securing a stable future. In this article, we will explore the numerous benefits of financial planning and how it can help you take control of your financial well-being.

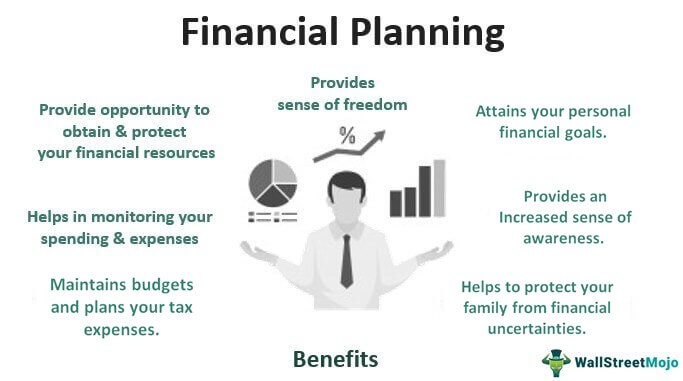

The Power of Financial Planning

Financial planning is the process of setting goals, assessing your current financial situation, and creating a roadmap to achieve those goals. It involves analyzing your income, expenses, investments, and assets to develop a comprehensive plan that aligns with your short-term and long-term objectives.

Building a Strong Foundation

One of the key benefits of financial planning is that it helps you build a solid foundation for your financial future. By evaluating your current financial situation, you can identify areas for improvement and make informed decisions about your spending, saving, and investing habits. This lays the groundwork for a secure and prosperous future.

Setting Realistic Goals

Financial planning allows you to set realistic and achievable financial goals. Whether you aim to buy a new home, start a business, or retire comfortably, a well-crafted financial plan can provide you with the roadmap to reach these milestones. It helps you prioritize your objectives and allocate your resources effectively.

Managing Income and Expenses

Effective financial planning enables you to manage your income and expenses more efficiently. By tracking your cash flow and creating a budget, you can gain better control over your spending habits and identify areas where you can save money. This helps you optimize your financial resources and make informed decisions about your financial priorities.

Minimizing Debt and Financial Stress

Financial planning plays a crucial role in minimizing debt and alleviating financial stress. By analyzing your debt obligations and creating a repayment strategy, you can reduce your debt burden and regain control over your finances. This not only improves your financial well-being but also reduces stress and allows you to focus on achieving your long-term goals.

Building Wealth and Investing Wisely

Another significant benefit of financial planning is its ability to help you build wealth and make wise investment decisions. By understanding your risk tolerance and investment goals, you can develop an investment strategy that aligns with your objectives. This ensures that you make informed investment choices and maximize your wealth creation potential.

Protecting Your Loved Ones

Financial planning also encompasses risk management and insurance planning. By assessing your insurance needs and implementing appropriate coverage, you can protect yourself and your loved ones from unexpected events. Whether it’s life insurance, health insurance, or property insurance, a comprehensive financial plan ensures that you have the necessary protection in place.

Planning for Retirement

Retirement planning is a critical aspect of financial planning. By evaluating your retirement goals, estimating your future income needs, and creating a retirement savings strategy, you can secure a comfortable and worry-free retirement. Financial planning helps you make the most of your retirement savings and ensures that you can enjoy your golden years without financial stress.

In conclusion, financial planning is an essential tool for achieving financial success. By building a strong foundation, setting realistic goals, managing income and expenses, minimizing debt, investing wisely, protecting your loved ones, and planning for retirement, you can take control of your financial future and enjoy the peace of mind that comes with it. At [Your Company Name], we are committed to helping you navigate the complex world of financial planning and guiding you toward a prosperous and secure future.

Frequently Asked Questions – Benefits of Financial Planning

1. What is financial planning?

Financial planning is the process of setting goals, assessing your current financial situation, and creating a roadmap to achieve those goals.

2. Why is financial planning important?

Financial planning helps you gain control over your finances, make informed decisions, and work towards a secure financial future.

3. What are the benefits of financial planning?

Financial planning provides several benefits, including:

Improved budgeting and spending habits

Increased savings and investments

Debt reduction and management

Protection against financial emergencies

Retirement planning

Estate planning

4. How does financial planning help with budgeting?

Financial planning helps you analyze your income, expenses, and financial goals to create a realistic budget that aligns with your objectives.

5. Can financial planning help me save more money?

Absolutely! Financial planning enables you to identify areas where you can cut expenses, allocate funds towards savings, and develop strategies to grow your savings over time.

6. Does financial planning address debt management?

Yes, financial planning includes strategies to manage and reduce debt. It helps you prioritize debt payments, negotiate lower interest rates, and create a plan to become debt-free.

7. How does financial planning protect against emergencies?

Financial planning involves building an emergency fund, which acts as a safety net during unforeseen circumstances such as job loss, medical emergencies, or major repairs.

8. What role does financial planning play in retirement?

Financial planning helps you determine how much money you need to save for retirement, choose appropriate investment options, and create a retirement income strategy.

9. Is estate planning part of financial planning?

Yes, estate planning is an essential component of financial planning. It involves creating a plan for the distribution of your assets and ensuring your loved ones are taken care of after your passing.

10. How can I get started with financial planning?

To get started with financial planning, you can consider consulting a certified financial planner or using online tools and resources to assess your financial situation and set goals.