Bitcoin Back Above $50,000: Halving Hype or Sustainable Climb?

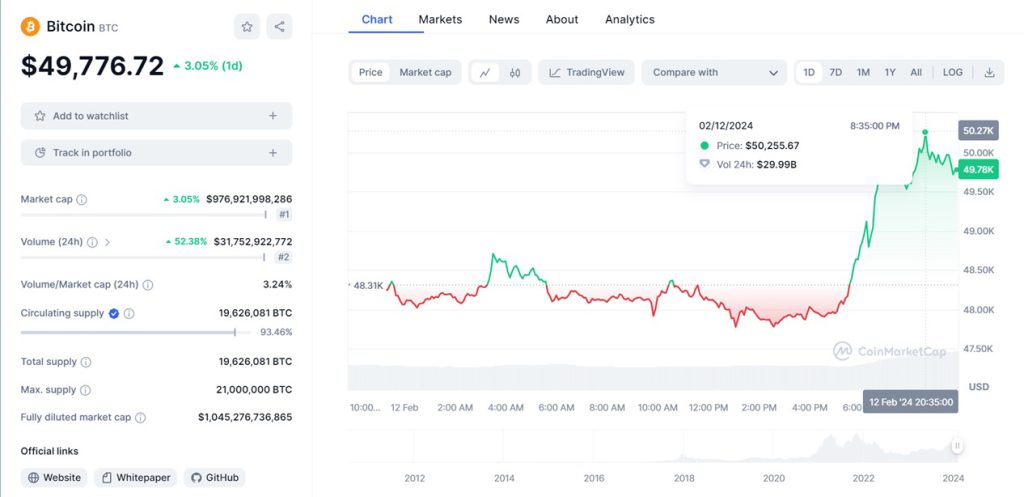

Buckle up, crypto enthusiasts! Bitcoin has breached the $50,000 threshold for the first time since December 2021, igniting excitement and speculation across the market. Let’s delve deeper into this significant surge and examine what it might mean for the future.

A Bullish Surge:

Bitcoin’s ascent to $50,000 marks a 3.5% gain within a single day and a staggering 12.2% growth over the past week. This bullish trend isn’t isolated – fellow top cryptocurrencies like Ethereum and Cardano are also experiencing significant climbs.

Halving on the Horizon:

With approximately 66 days remaining until the next Bitcoin halving event, which reduces the issuance of new coins by half, many believe this anticipated scarcity is fueling the current rally. Some speculate that Bitcoin could even reach new all-time highs in anticipation of this pivotal moment.

A Word of Caution:

While the recent surge is undoubtedly exciting, it’s crucial to approach any crypto investment with caution. The inherent volatility of the market means that sudden rises can be followed by equally sharp dips. Thorough research, risk management, and a long-term investment strategy are key to navigating this dynamic landscape.

Possible FAQs:

Q: Is the $50,000 mark a guarantee of further growth?

A: No, past performance is not indicative of future results. While the halving event could contribute to further growth, external factors and market fluctuations can cause prices to deviate.

Q: What are the risks involved in investing in Bitcoin?

A: Cryptocurrency investments are inherently volatile, meaning prices can experience dramatic swings and sudden losses.

Q: How can I safely invest in Bitcoin?

A: Thorough research, understanding your risk tolerance, and developing a long-term investment strategy are crucial before entering the market. Consider consulting with a financial advisor for personalized guidance.

Q: What is the halving event, and how does it affect Bitcoin?

A: The halving event occurs roughly every four years and reduces the number of new Bitcoin entering circulation by half. This intended scarcity could potentially increase demand and drive up the price.

Q: Will Bitcoin always go up in value?

A: This is impossible to predict. Historical data and current trends offer glimpses into potential future scenarios, but external factors and market sentiment can significantly impact price movements.