The Coordination of Benefits: Maximizing Your Insurance Coverage

Understanding the Coordination of Benefits

When it comes to managing your healthcare expenses, understanding the coordination of benefits is crucial. This process ensures that you receive the maximum coverage from multiple insurance policies, eliminating any potential gaps in coverage.

How Does Coordination of Benefits Work?

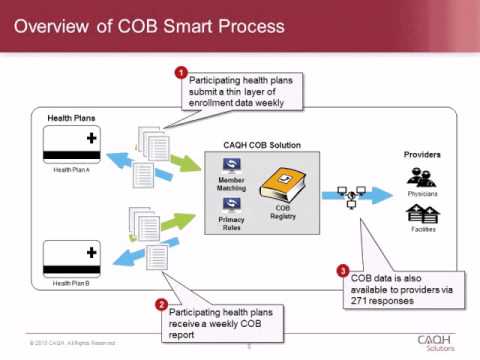

The coordination of benefits occurs when you have multiple insurance policies that cover the same medical expenses. It helps determine which policy will be the primary payer and which will be the secondary payer. By coordinating benefits, you can avoid overpaying or double-dipping on claims.

Primary and Secondary Payers

In the coordination of benefits, the primary payer is the insurance policy that pays first, up to its coverage limits. The secondary payer is the policy that pays any remaining costs, up to its coverage limits. This ensures that you receive the maximum benefit from both policies.

How to Determine the Primary Payer

The primary payer is typically determined based on specific rules:

Employer Coverage: If you have coverage through your employer, that policy is usually the primary payer.

Spouse’s Coverage: If you are covered under your spouse’s policy, it may be considered the primary payer.

Dependent Coverage: For dependents, the policy of the parent with the earlier birthday in the calendar year is often the primary payer.

Medicare and Medicaid: In cases involving Medicare or Medicaid, these programs have specific rules for determining primary and secondary payers.

Coordinating Benefits for Maximum Coverage

To ensure you receive the maximum coverage, follow these steps:

Notify Both Insurers: Inform both insurance companies about your multiple coverage. Provide them with the necessary details, including policy numbers and other relevant information.

Submit Claims to Primary Payer: File your claims with the primary payer first. This allows them to process the claims and determine their portion of the coverage.

Submit Claims to Secondary Payer: Once the primary payer has processed the claims, submit the remaining balance to the secondary payer. They will cover the eligible expenses not paid by the primary payer.

Keep Track of Payments: Monitor the payments made by both insurers to ensure they are correctly coordinating benefits and covering the appropriate portion of the expenses.

Benefits of Coordinating Benefits

Coordinating benefits offers several advantages:

Maximized Coverage: By coordinating benefits, you can potentially receive coverage for the full cost of your medical expenses.

Reduced Out-of-Pocket Expenses: Coordinating benefits helps minimize your out-of-pocket expenses by leveraging multiple insurance policies.

Simplified Claims Process: Coordinating benefits streamlines the claims process, reducing the administrative burden on your end.

Elimination of Duplicate Payments: By coordinating benefits, you avoid overpaying or duplicating claims, saving both time and money.

Understanding and effectively coordinating benefits is essential to maximize your insurance coverage. By following the steps outlined above, you can navigate the complexities of multiple insurance policies and ensure that you receive the maximum benefits available to you. Take control of your healthcare expenses and make the most of your insurance coverage through the coordination of benefits.

FAQS:

What is the coordination of benefits?

Coordination of benefits is a process that determines the order in which multiple insurance policies pay for healthcare expenses.

Why is coordination of benefits important?

Coordination of benefits helps prevent overpayment by ensuring that the total reimbursement from all insurance policies does not exceed the actual cost of healthcare services.

How does the coordination of benefits work?

When a person has multiple insurance policies, the primary policy pays first, and the secondary policy covers the remaining expenses up to the policy limits.

Can I have coordination of benefits with Medicare?

Yes, coordination of benefits applies to Medicare as well. Medicare becomes the primary payer, and other insurance policies act as secondary payers.

What happens if I don’t coordinate my benefits?

If you don’t coordinate your benefits, you may end up paying more out-of-pocket expenses because the secondary insurance policy might not cover the remaining costs.

Do I need to inform my insurance companies about other policies I have?

Yes, it is important to inform all your insurance companies about other policies you have to ensure proper coordination of benefits.

Can coordination of benefits be applied to dental insurance?

Yes, coordination of benefits can be applied to dental insurance as well. The primary dental insurance pays first, and the secondary dental insurance covers the remaining costs.

Is coordination of benefits the same as dual coverage?

No, the coordination of benefits and dual coverage are not the same. Dual coverage refers to having two insurance policies, while coordination of benefits determines how those policies work together.

What information do I need to provide for the coordination of benefits?

You will typically need to provide information about your primary and secondary insurance policies, including policy numbers and contact details.

Can coordination of benefits apply to prescription medications?

Yes, coordination of benefits can apply to prescription medications. The primary prescription insurance pays first, and the secondary prescription insurance covers the remaining costs.