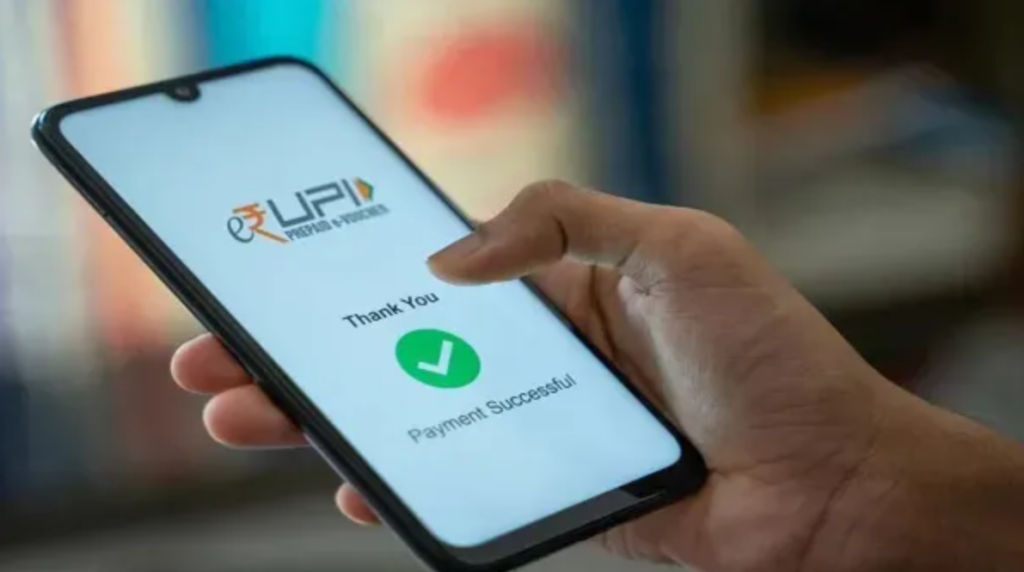

Hold onto your smartphones, folks! India’s revolutionary Unified Payments Interface (UPI) has officially landed in Sri Lanka and Mauritius, marking a significant milestone in the country’s digital financial outreach. This exciting development, celebrated by Prime Minister Narendra Modi himself, promises to weave a tapestry of historical ties with cutting-edge technology, offering a plethora of benefits for both nations.

A New Era of Seamless Transactions

Imagine exploring the serene beaches of Sri Lanka or the vibrant streets of Mauritius without worrying about currency exchange hassles. With UPI’s arrival, that dream becomes a reality! Indian nationals visiting these beautiful countries can now make instant, secure payments using their smartphones, just like they do back home. And guess what? The same applies to Sri Lankan and Mauritian citizens visiting India!

But wait, there’s more! This collaboration isn’t limited to just UPI. India’s RuPay card services have also joined the party in Mauritius, allowing Mauritian citizens to conveniently use their RuPay cards at countless shops, ATMs, and online platforms across the island nation.

Why This Matters: More Than Just Transactions

This expansion of UPI and RuPay signifies much more than just convenient cashless transactions. It symbolizes India’s commitment to:

- Strengthening regional ties: By simplifying financial interactions, India fosters closer economic and cultural connections with its neighbors, building a stronger Indian Ocean Region.

- Leading in digital innovation: India showcases its prowess in the digital payment arena, paving the way for future global expansion of its fintech solutions.

- Sharing advancements: This initiative reflects India’s willingness to share its digital expertise with partner countries, promoting a more inclusive and empowered digital community.

Frequently Asked Questions (FAQs)

Q: How does UPI work in Sri Lanka and Mauritius?

A: You can use your existing UPI app linked to your Indian bank account to make payments at merchants displaying the UPI logo in these countries. Similarly, Sri Lankan and Mauritian citizens can use their local UPI apps for transactions.

Q: Are there any transaction fees?

A: Charges may vary depending on the specific service provider and transaction type. It’s best to consult your bank or app for exact details.

Q: What about security?

A: Both UPI and RuPay are built with robust security features to ensure safe and secure transactions.

Q: Will UPI and RuPay be available in other countries soon?

A: The Indian government is actively exploring expansion to other countries, so stay tuned for exciting updates!

Q: How can I learn more about UPI and RuPay?

A: Visit the official websites of NPCI (National Payments Corporation of India) and RuPay for detailed information and resources.