The Indian smartphone manufacturing industry has witnessed remarkable growth in 2024, with a 6% year-on-year increase in production. This surge is primarily driven by Apple and Samsung’s expanding exports, making up a staggering 94% of India’s smartphone exports. This trend underscores India’s strategic push to become a global manufacturing powerhouse while reducing dependency on imports.

India’s Manufacturing Boom: Key Drivers of Growth

Government’s Role: The Production-Linked Incentive (PLI) Scheme

The Indian government’s Production-Linked Incentive (PLI) scheme has played a crucial role in fostering this growth. By offering financial incentives to global manufacturers, the initiative has encouraged them to expand or establish manufacturing units in India. This policy has significantly contributed to strengthening India’s local manufacturing capabilities, boosting employment, and reducing reliance on foreign imports.

Rise in Local Production & Export Growth

India’s growing prominence in smartphone production is reflected in its increasing export volumes. Apple and Samsung have scaled up their manufacturing operations, leveraging India as a key export hub. Their investments align with India’s vision of enhancing its position in the global supply chain while promoting self-reliance in electronics production.

Performance Analysis of Key Smartphone Manufacturers in India

Samsung: Market Leader with Strong Export Growth

Samsung has continued its dominance in India’s smartphone manufacturing sector, achieving a 7% year-on-year growth in production. The brand’s export-focused strategy has fueled its success, ensuring a strong market presence.

Tanvi Sharma, a research analyst at Counterpoint, highlighted Samsung’s strategic expansion as a major factor in its sustained growth. The company’s increasing investment in production facilities has solidified its leadership in the market.

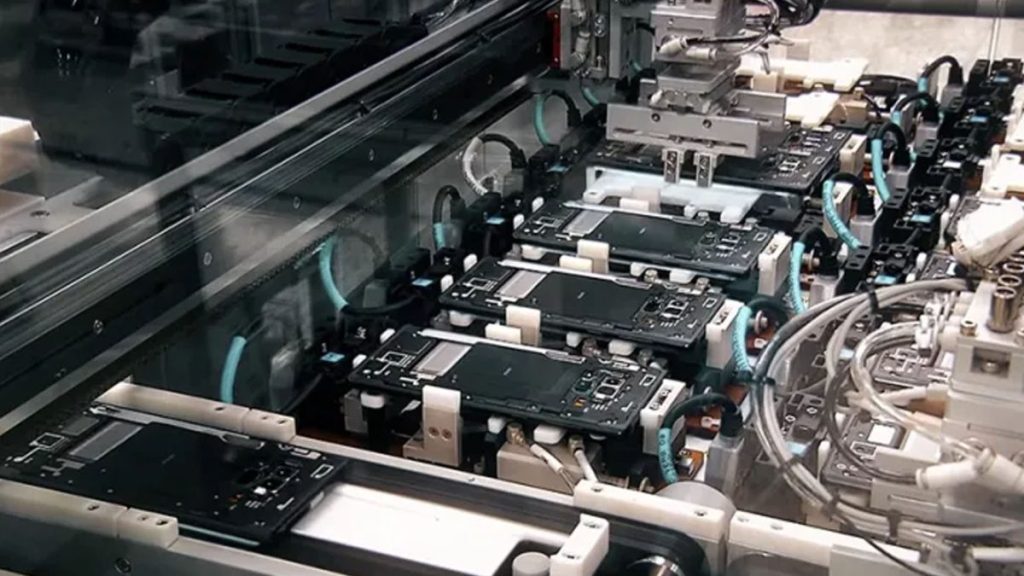

Apple’s Expansion: Foxconn Hon Hai Leads the Way

Apple’s contract manufacturer, Foxconn Hon Hai, reported a 19% rise in manufacturing volumes in 2024. The company is set to further strengthen its local production by establishing a smartphone display module assembly unit. This expansion highlights Apple’s commitment to growing its footprint in India.

vivo’s Offline Retail Strategy Pays Off

vivo secured a 14% market share in 2024, showing consistent year-on-year growth. The brand’s success can be attributed to its robust offline retail network and improved distribution channels. According to Counterpoint’s shipment tracker, vivo remained the top smartphone brand in India in terms of shipments.

OPPO Faces Challenges Amidst Rising Competition

In contrast, OPPO struggled in 2024, slipping to the fourth position among manufacturers. The brand saw a 34% decline in shipments due to heightened competition and an increased reliance on contract manufacturing for both OPPO and realme.

Emerging Players and Market Dynamics

Tata Electronics: The Fastest Growing Manufacturer

Tata Electronics made significant strides in 2024, reporting an astonishing 107% year-on-year growth. The company’s success was fueled by its contributions to Apple’s iPhone 15 and iPhone 16 production.

Additionally, Tata Electronics expanded its operations by venturing into semiconductor fabrication, setting up a new plant in Dholera, Gujarat. The company also announced plans for an OSAT (Outsourced Semiconductor Assembly and Test) facility in Assam, marking its entry into advanced electronics manufacturing.

DBG Strengthens Ties with Xiaomi and realme

DBG also recorded notable double-digit growth, primarily due to its strengthened partnerships with Xiaomi and realme. The company’s increasing role in contract manufacturing is positioning it as a key player in the industry.

Dixon Technologies: Leading the Mobile Handset Segment

Dixon Technologies emerged as the top manufacturer in India’s mobile handset segment, which includes both smartphones and feature phones. The company reported a 39% year-on-year growth in the smartphone sector, bolstered by strong shipments from Transsion brands and Motorola.

Future Outlook: India’s Role in Global Smartphone Manufacturing

The Road Ahead for Indian Smartphone Production

Senior Research Analyst Prachir Singh has projected continued double-digit growth in 2025 for India’s smartphone manufacturing sector. Key factors contributing to this outlook include:

- Diversification of production hubs by global manufacturers to mitigate risks associated with over-reliance on a single country.

- India’s favorable policies that offer incentives to manufacturers and investors.

- Affordable labor and skilled workforce, making India an attractive destination for large-scale manufacturing.

- Increased local value addition, with companies expanding component production domestically.

India is poised to become a major global hub for smartphone manufacturing, attracting further investments from industry giants. As more manufacturers expand their presence in the country, India’s role in the global electronics supply chain is expected to strengthen significantly.

FAQs

1. What led to the 6% growth in India’s smartphone production in 2024?

The growth was driven by Apple and Samsung’s rising exports, supported by India’s PLI scheme, which incentivizes global manufacturers to expand production in India.

2. How significant is Apple and Samsung’s role in India’s smartphone exports?

Apple and Samsung collectively accounted for 94% of India’s smartphone exports, highlighting their dominance in the country’s manufacturing sector.

3. Which company experienced the highest growth in 2024?

Tata Electronics recorded the highest year-on-year growth at 107%, driven by its involvement in Apple’s iPhone production and its expansion into semiconductor manufacturing.

4. Why did OPPO face a decline in shipments?

OPPO saw a 34% decline in shipments due to intense competition and increased dependence on contract manufacturers like DBG and realme.

5. What are the future prospects for smartphone manufacturing in India?

India’s smartphone production is expected to continue growing at double-digit rates in 2025, with increased investments in local manufacturing and expanded component production.