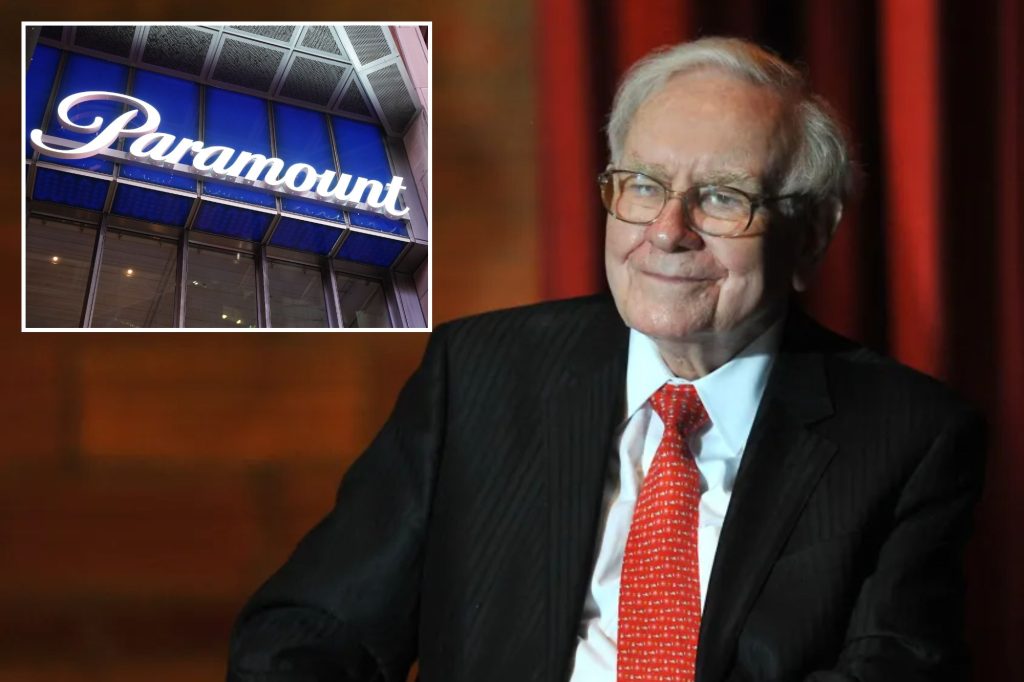

Paramount Global Stock Wobbles on Buffett Buyout Buzz and Stake Sale

Paramount Global, the media entertainment giant behind studios like Paramount Pictures and the popular streaming platform Paramount+, saw its stock plunge after two major developments: a significant stake sale by its biggest outside investor, Warren Buffett’s Berkshire Hathaway, and whispers of potential acquisition deals.

Buffett Trims the Hedges: A One-Third Stake Reduction

On February 15th, 2024, Berkshire Hathaway revealed it had reduced its stake in Paramount Global by approximately one-third during the fourth quarter of 2023. This move, which saw 30.4 million shares sold, coincided with market speculation surrounding several potential takeover scenarios involving Paramount Global.

Takeover Talk Heats Up: Skydance, RedBird, and Byron Allen in the Mix

Two major players emerged as potential suitors for Sheri Redstone’s controlling stake in Paramount Global: David Ellison’s Skydance Media and RedBird Capital. Additionally, media mogul Byron Allen submitted a $14.3 billion offer to acquire all outstanding shares in the studio, further stirring the pot.

These potential acquisitions raise questions about the future of Paramount Global’s assets. Analysts believe a deal could lead to significant divestitures, such as merging Skydance and Paramount’s filmed entertainment studios and potentially selling off Paramount+ or linear TV channels.

Uncertain Future for Paramount+: Streaming Slump and Shareholder Value

Paramount+ has faced challenges in the competitive streaming landscape, experiencing subscriber losses alongside many other platforms. The studio’s stock value also took a hit in 2023 due to these setbacks, only rebounding upon speculation of potential acquisitions.

With the future of Paramount+ hanging in the balance, and a possible change in ownership looming, investors remain cautious about the company’s trajectory.

Key Players and Upcoming Events:

- Warren Buffett: Berkshire Hathaway remains a major investor despite the stake sale.

- Sheri Redstone: Controls Paramount Global through National Amusements, facing potential buyout offers.

- David Ellison & Skydance Media: One potential buyer alongside RedBird Capital.

- Byron Allen: Made a separate bid for all Paramount Global shares.

- Paramount Global Earnings Report: Scheduled for February 28th, 2024, could shed light on financial performance and future plans.

Impact and Analysis:

- Paramount Global’s stock volatility reflects the uncertainty surrounding potential acquisitions and asset divestitures.

- Questions remain about the future of Paramount+, especially considering its subscriber struggles.

- The upcoming earnings report and any official announcements regarding potential deals will be crucial for understanding Paramount Global’s future direction.

Beyond Speculation: Industry Implications

The recent developments involving Paramount Global highlight the ever-shifting landscape of the media and entertainment industry. Streaming wars continue to rage, studios are seeking consolidation, and established players like Paramount Global face pressure to adapt and compete.

This situation serves as a case study for how industry giants navigate changing consumer preferences, the rise of streaming platforms, and the potential disruption caused by potential mergers and acquisitions.

1. Why did Warren Buffett sell part of his Paramount Global stake?

Buffett’s investment strategy is not publicly known, but the sale could be due to various factors like portfolio rebalancing, concerns about Paramount Global’s future, or other investment opportunities.

2. Who is most likely to acquire Paramount Global?

It is impossible to predict with certainty. Each potential buyer, from Skydance and RedBird to Byron Allen, presents different possibilities and potential outcomes.

3. What will happen to Paramount+ if Paramount Global is acquired?

The fate of Paramount+ depends on the specific terms of any acquisition deal. It could be merged with another platform, spun off, or continue operating independently.

4. How will this situation affect the media and entertainment industry?

The potential consolidation of studios and platforms could reshape the industry landscape, impacting content creation, distribution, and ultimately, what viewers see on their screens.

5. What should investors do?

Investors should carefully consider the risks and potential rewards before making any investment decisions based on speculation surrounding Paramount Global’s future.