State of Illinois Retiree Benefits

Welcome to our comprehensive guide on the state of Illinois retiree benefits. In this article, we will provide you with detailed information regarding the retirement benefits available to individuals in the state of Illinois. Whether you are a current retiree, planning for retirement, or simply interested in understanding the options available, this guide will serve as a valuable resource.

Understanding Illinois Retiree Benefits

Retiree benefits in the state of Illinois are designed to provide financial security and peace of mind to individuals after their retirement. These benefits encompass various aspects such as healthcare, pension plans, and other supplementary benefits. Understanding the eligibility criteria, enrollment process, and available options is crucial to make informed decisions regarding your retirement.

Healthcare Benefits

One of the most important aspects of retiree benefits is healthcare coverage. The state of Illinois offers comprehensive healthcare options for retirees, ensuring that their medical needs are taken care of. The healthcare benefits include:

Medical insurance coverage

Prescription drug coverage

Dental and vision insurance

Mental health services

Eligibility and Enrollment

Retirees who have met the eligibility criteria, which typically includes a minimum number of years of service, are eligible for healthcare benefits. The enrollment process involves submitting the necessary documents and completing the required forms within the specified timeframe.

Costs and Coverage

The cost of healthcare coverage varies depending on factors such as the retiree’s age, level of coverage, and any additional services opted for. The coverage is designed to meet the healthcare needs of retirees, including preventive care, hospitalization, and specialist visits.

Pension Plans

Retirees in the state of Illinois are entitled to pension plans that provide a steady income stream during their retirement years. These pension plans are designed to ensure financial stability and support retirees in maintaining their standard of living. The pension plans include:

Defined Benefit Plan

401(k) Plan

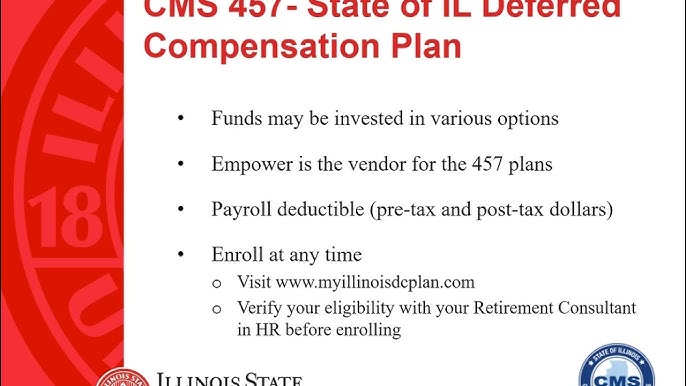

457 Plan

Eligibility and Enrollment

Eligibility for pension plans is typically based on factors such as years of service and age. Retirees who meet the eligibility criteria can enroll in the pension plans by completing the necessary paperwork and selecting the desired plan option.

Benefits and Withdrawals

Pension plans offer various benefits, including monthly income payments, survivor benefits, and the option to make withdrawals or rollovers. The specific details of each plan may vary, so it is essential to review the plan documents and consult with a financial advisor to make informed decisions.

Supplementary Benefits

In addition to healthcare and pension plans, the state of Illinois provides retirees with supplementary benefits to enhance their retirement experience. These benefits may include:

Life insurance coverage

Long-term care insurance

Retiree association memberships

Discount programs

Eligibility and Availability

Eligibility for supplementary benefits may vary based on factors such as years of service, retirement status, and specific program requirements. Retirees can explore the available options and enroll in the programs that best suit their needs and preferences.

In conclusion, the state of Illinois offers a comprehensive range of retiree benefits to ensure the financial security and well-being of retirees. Healthcare coverage, pension plans, and supplementary benefits form a crucial part of the retirement package. By understanding the eligibility criteria, enrollment process, and available options, retirees can make informed decisions to maximize their retirement benefits. It is advisable to consult with relevant authorities and financial advisors to navigate the complexities of retiree benefits effectively.

Frequently Asked Questions – State of Illinois Retiree Benefits

1. What are the retiree benefits offered by the State of Illinois?

The State of Illinois offers a range of retiree benefits, including health insurance coverage, dental and vision plans, life insurance, and pension plans.

2. How do I become eligible for retiree benefits in Illinois?

To be eligible for retiree benefits in Illinois, you typically need to meet certain age and service requirements. These requirements vary depending on the specific benefit program.

3. Can I continue my health insurance coverage after retiring from the State of Illinois?

Yes, as a retiree of the State of Illinois, you may be eligible to continue your health insurance coverage through the State Employee Group Insurance Program (SEGIP).

4. Are dental and vision plans available for Illinois retirees?

Yes, dental and vision plans are available for Illinois retirees. These plans provide coverage for various dental and vision services.

5. What life insurance options are available for retirees in Illinois?

Retirees in Illinois have the option to continue their life insurance coverage through the State Employees’ Group Life Insurance Program (SEGIP).

6. How can I access information about my pension plan as an Illinois retiree?

You can access information about your pension plan as an Illinois retiree through the State Retirement Systems website or by contacting the appropriate retirement system directly.

7. Are there any additional benefits or programs available for Illinois retirees?

Yes, in addition to the standard retiree benefits, Illinois retirees may have access to other programs such as the Retiree Health Insurance Premium Payment Program (RHIPP) or the State Employee Assistance Program (SEAP).

8. Can I change my retiree benefits options after retirement?

Generally, retiree benefit options cannot be changed after retirement. However, certain qualifying events may allow for changes or adjustments to be made. It is best to contact the relevant benefit program administrators for detailed information.

9. How do I enroll in retiree benefits as a new Illinois retiree?

As a new Illinois retiree, you will typically receive information and enrollment forms regarding retiree benefits from the appropriate benefit program administrators. Follow the instructions provided to complete the enrollment process.

10. Where can I find more information about State of Illinois retiree benefits?

You can find more information about State of Illinois retiree benefits on the official websites of the Illinois Department of Central Management Services (CMS) and the State Retirement Systems.