Investor sentiment has weakened globally

Venture capital investment in China fell nearly 30% year-on-year in the first 10 months of 2023 as economic uncertainty continues to weigh on investor sentiment.

In China, US$34.6 billion was invested in 2,675 venture capital funding deals between January and October this year, a “significant decrease” from the same period last year, according to a report published by data analytics company GlobalData. The data reflects a 29.1% drop in deal value and a 15.7% drop in venture capital deal volume over the period, according to GlobalData.

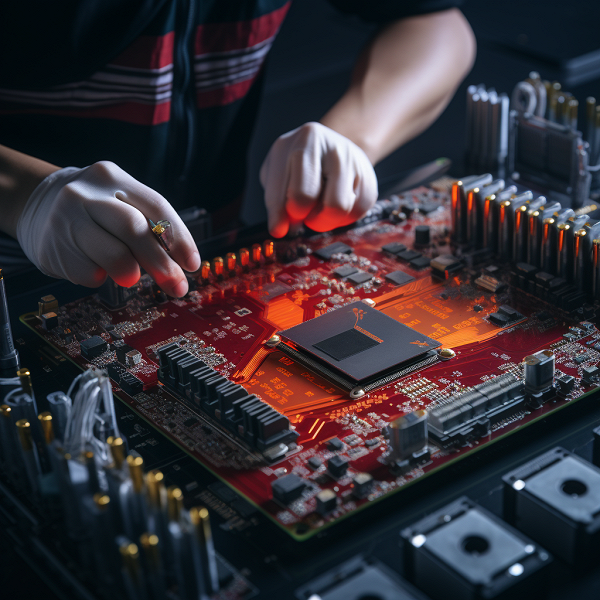

Some of China’s most notable deals during this time include a US$1.8 billion government investment in automotive chip maker GTA Semiconductor, as well as a US$1 billion fundraising by electric vehicle maker Rox Motor Tech.

Venture capital investment in China has collapsed by almost 30%

Chinese research firm Zero2IPO Research found that the number of deals in the country in the first nine months from venture capital firms, private equity firms and other early-stage investment firms fell 25.9% year on year. China’s total private investment value over the same period also fell 31.8% year-on-year, according to Zero2IPO.

The decline in venture capital activity in China comes as the country struggles to recover from years of tough anti-pandemic restrictions, regulatory crackdowns on the private sector and escalating geopolitical tensions that have Washington scrutinizing cross-border investment.

Funding from venture capital firms focused on investing in China fell 54.2% from April to June this year compared with the previous quarter, as investors become increasingly reluctant to bet on the country engaged in a trade war with the United States.

US venture capital giant Sequoia Capital said in June it was splitting its business into three geographical divisions, each with a separate brand, including an independent Chinese company, amid intensifying rivalry between the world’s two largest economies.

The decline in private equity deals in China comes amid a global industry slowdown as governments and central banks battle inflation by raising interest rates.

“The decline in the volume and value of venture capital funding deals is now a global phenomenon, and China is no exception to this trend,” writes GlobalData lead analyst Aurojyoti Bose. “China continues to dominate the Asia-Pacific venture capital market despite the downturn.”

China also remains a “key” market in the venture capital industry. China accounted for 15.8% of the total number of venture capital funding deals worldwide between January and October and 17.1% of the total value of global deals. The US accounted for 35% and 48.8% of the number and value of transactions, respectively.