Advantages of LLC

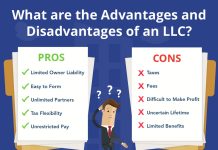

In this article, we will discuss the advantages of forming a Limited Liability Company (LLC). LLCs have become a popular choice for entrepreneurs and small business owners due to the numerous benefits they offer in terms of liability protection, flexibility, and tax advantages.

Liability Protection

One of the key advantages of an LLC is the limited liability protection it provides to its owners, known as members. Unlike sole proprietorships and partnerships, where the owners are personally liable for the business debts and liabilities, an LLC separates the personal assets of the members from the company’s liabilities. This means that if the LLC faces legal action or financial difficulties, the personal assets of the members are generally protected.

Flexibility

LLCs offer a great deal of flexibility in terms of management and ownership. Unlike corporations, which have a rigid structure with a board of directors and shareholders, LLCs can be managed by the members themselves or by appointed managers. This allows for a more streamlined decision-making process and avoids the need for complex corporate formalities.

Tax Advantages

Another significant advantage of forming an LLC is the flexibility in taxation. By default, an LLC is considered a “pass-through” entity for tax purposes. This means that the profits and losses of the LLC are passed through to the member’s tax returns, avoiding double taxation. However, LLCs also have the option to choose to be taxed as a corporation if it is more beneficial for their specific circumstances.

Operational Simplicity

Compared to other business structures, such as corporations, LLCs offer operational simplicity. There are fewer formalities and paperwork requirements involved in setting up and maintaining an LLC. This makes it easier and less costly to start and run a business, especially for small businesses and startups with limited resources.

Flexible Profit Distribution

In an LLC, profit distribution is not limited to ownership percentages. Members have the flexibility to distribute profits in a way that best suits their needs and agreements. This allows for a more customized and fair distribution of profits among the members, based on their contributions and roles within the company.

In conclusion, forming an LLC offers several advantages, including liability protection, flexibility in management and ownership, tax advantages, operational simplicity, and flexible profit distribution. These benefits make LLCs an attractive option for entrepreneurs and small business owners looking for a business structure that provides both legal protection and flexibility in managing their business.

Frequently Asked Questions – Advantages of LLC

1. What is an LLC?

An LLC, or Limited Liability Company, is a legal business entity that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability protection of a corporation.

2. What are the advantages of forming an LLC?

Forming an LLC offers several advantages such as:

Limited liability protection for the owners

Pass-through taxation

Flexibility in management and operations

Less paperwork and formalities compared to corporations

3. How does limited liability protection work in an LLC?

Owners of an LLC are generally not personally liable for the company’s debts or legal obligations. This means their assets are protected in case of business-related liabilities.

4. Can a single person form an LLC?

Yes, a single individual can form a single-member LLC. It provides the benefits of limited liability protection and pass-through taxation while allowing the individual to run their business as a separate legal entity.

5. Are there any tax advantages to having an LLC?

Yes, one of the main advantages of an LLC is its pass-through taxation. This means that the profits and losses of the LLC are “passed through” to the owners’ tax returns, avoiding double taxation.

6. Can an LLC have multiple owners?

Yes, an LLC can have multiple owners, known as members. This allows for shared ownership and management of the business.

7. How is an LLC different from a corporation?

While both offer limited liability protection, LLCs have more flexibility in terms of management and taxation. LLCs have fewer formalities, fewer ongoing requirements, and offer pass-through taxation, unlike corporations.

8. Do I need an attorney to form an LLC?

No, it is not required to hire an attorney to form an LLC. However, seeking legal advice can be beneficial to ensure compliance with state laws and to understand the implications of forming an LLC.

9. Can an LLC be taxed as a corporation?

Yes, an LLC can choose to be taxed as a corporation by filing an election with the IRS. This might be advantageous in certain situations, but most LLCs opt for pass-through taxation.

10. Can an LLC be owned by another business entity?

Yes, another business entity, such as a corporation or another LLC, can be an owner (member) of an LLC. This provides flexibility in structuring ownership and allows for separate legal entities to have ownership interests.

11. Are there any disadvantages of forming an LLC?

While LLCs offer numerous advantages, some potential disadvantages include limited life span, self-employment taxes for members, and varying regulations across different states.

12. Can an LLC be converted into a corporation?

Yes, it is possible to convert an LLC into a corporation, although the process and requirements may vary depending on the state and specific circumstances. Seeking legal advice is recommended for such conversions.

13. Can an LLC raise capital through investments?

Yes, an LLC can raise capital by bringing in new members or issuing ownership interests. This allows for flexibility in attracting investments and expanding the business.

14. Are there any industry-specific restrictions on forming an LLC?

Some industries, such as banking and insurance, may have specific regulations that restrict or limit the formation of an LLC. It is important to research and understand any industry-specific restrictions before forming an LLC.

15. Can an LLC have foreign owners?

Yes, an LLC can have foreign owners. However, additional requirements may apply, such as obtaining an Individual Taxpayer Identification Number (ITIN) for foreign members and complying with any applicable tax laws.