The Benefits of Life Insurance

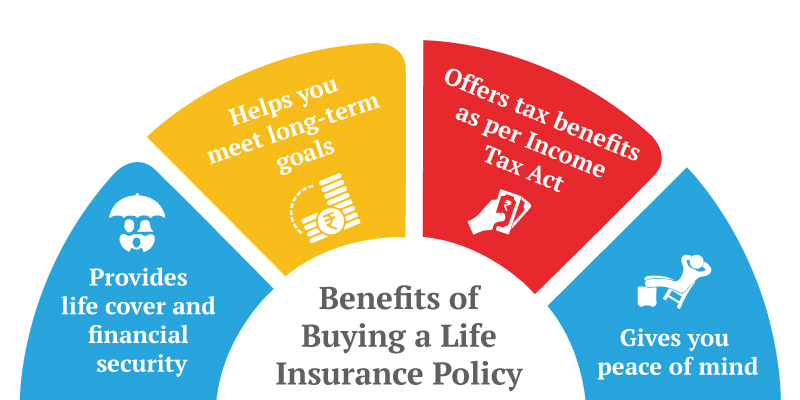

Life insurance is an essential financial tool that provides protection and peace of mind to individuals and their families. In this article, we will explore the various benefits of life insurance and why it is important to consider having a life insurance policy.

Financial Security

One of the primary benefits of life insurance is the financial security it offers. In the event of the policyholder’s death, life insurance provides a lump sum payment, known as the death benefit, to the designated beneficiaries. This financial support can help cover funeral expenses, outstanding debts, mortgage payments, and other financial obligations.

Income Replacement

Life insurance can also serve as a valuable tool for income replacement. If the policyholder is the primary income earner in the family, their sudden death can leave their loved ones in a difficult financial situation. The death benefit from a life insurance policy can help replace lost income and provide ongoing financial support to the surviving family members.

Estate Planning

Life insurance can play a crucial role in estate planning. It can help cover estate taxes and ensure that the policyholder’s assets are distributed according to their wishes. By naming specific beneficiaries, life insurance policies bypass the probate process, allowing for a faster and smoother transfer of assets.

Debt and Loan Repayment

Life insurance can be used to pay off outstanding debts and loans, such as mortgages, car loans, and credit card balances. This can prevent the burden of debt from falling on the shoulders of the policyholder’s loved ones, giving them financial relief during a challenging time.

Business Continuity

For business owners, life insurance can be a vital component of business continuity planning. It can provide funds to cover business expenses, repay debts, and ensure the smooth transition of ownership in the event of the owner’s death. This helps protect the business and its employees from financial instability.

Tax Benefits

In many cases, life insurance policies offer tax benefits. The death benefit is generally tax-free, providing a significant financial advantage to the beneficiaries. Additionally, some types of life insurance policies, such as permanent life insurance, can accumulate cash value over time, which grows on a tax-deferred basis.

Peace of Mind

Above all, life insurance provides peace of mind. Knowing that your loved ones will be financially protected in the event of your death can alleviate stress and worry. It allows you to focus on enjoying life without the constant fear of leaving your family in a vulnerable financial state.

Life insurance offers a wide range of benefits, including financial security, income replacement, estate planning, debt repayment, business continuity, tax advantages, and peace of mind. It is a valuable tool for protecting your loved ones and ensuring their financial well-being. Consider speaking with a trusted financial advisor to explore the different types of life insurance policies available and find the one that best suits your needs.

Life Insurance FAQs

1. What is the benefit of having life insurance?

Life insurance provides financial protection to your loved ones in the event of your death. It ensures that they will receive a sum of money, known as the death benefit, which can help cover funeral expenses, pay off debts, replace lost income, and maintain their standard of living.

2. How does life insurance help with estate planning?

Life insurance can play a crucial role in estate planning. It can provide liquidity to pay estate taxes and other final expenses, ensuring that your assets are not depleted. Additionally, life insurance proceeds can be used to equalize inheritances among beneficiaries.

3. Can life insurance be used as an investment?

Some types of life insurance, such as whole life or universal life, have a cash value component that grows over time. This cash value can be accessed during your lifetime and used as an investment or for other financial needs. However, it’s important to consider the costs and potential returns before using life insurance primarily as an investment vehicle.

4. Is life insurance necessary for single individuals with no dependents?

While life insurance is typically purchased to protect dependents financially, there are still reasons why single individuals may consider it. It can help cover any debts or funeral expenses, and some policies allow for the accumulation of cash value that can be used later in life.

5. What factors should I consider when determining the amount of life insurance coverage I need?

Several factors should be considered, such as your current and future financial obligations, including mortgage or rent, outstanding debts, education expenses for your children, and potential funeral costs. It’s also important to consider your income replacement needs and any existing savings or investments.

6. Can I change my life insurance policy if my needs change?

Yes, many life insurance policies offer flexibility. You can often increase or decrease coverage, change beneficiaries, or convert term policies to permanent policies. It’s important to review your policy regularly and make adjustments as needed to ensure it aligns with your current circumstances.

7. What happens if I stop paying my life insurance premiums?

If you stop paying your life insurance premiums, your coverage will typically lapse. However, some policies may have a grace period during which you can make late payments. It’s important to understand the terms of your policy and the consequences of not paying premiums to avoid losing coverage.

8. Can I have multiple life insurance policies?

Yes, it is possible to have multiple life insurance policies. This can be beneficial if you have different financial needs or if you want to supplement your existing coverage. However, it’s important to consider the overall cost and whether the additional coverage is necessary.

9. Are the premiums for life insurance tax-deductible?

In most cases, life insurance premiums are not tax-deductible. However, the death benefit received by your beneficiaries is generally tax-free. It’s always recommended to consult with a tax professional for specific advice related to your situation.

10. Can I purchase life insurance for my parents or other family members?

Yes, you can purchase life insurance for your parents or other family members if you have an insurable interest in their lives. This can help provide financial protection and cover any potential expenses in the event of their death. However, it’s important to have their consent and involvement in the process.