Benefits of 529 Plans

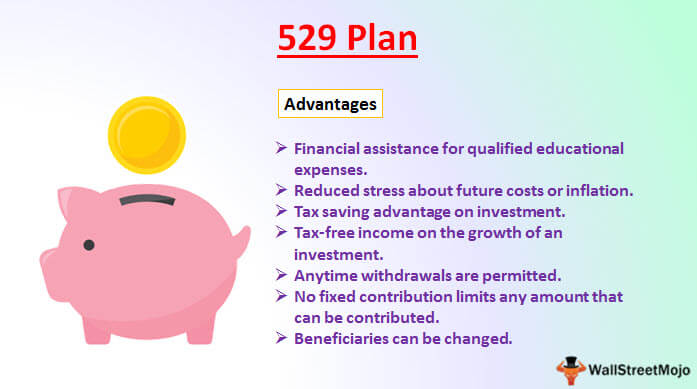

529 plans are tax-advantaged savings plans designed to encourage individuals and families to save for future education expenses. In this article, we will explore the numerous benefits of 529 plans and how they can help you achieve your education savings goals.

Tax Benefits

One of the key advantages of 529 plans is the potential for tax savings. Contributions to a 529 plan are made with after-tax dollars, meaning they are not tax-deductible at the federal level. However, many states offer tax deductions or credits for contributions made to their respective 529 plans. These deductions or credits can help reduce your state income tax liability, providing additional savings.

Tax-Free Growth

Another significant benefit of 529 plans is the potential for tax-free growth. Any earnings generated within the plan are not subject to federal income tax as long as the funds are used for qualified education expenses. This tax-free growth can significantly enhance the overall value of your savings over time.

Flexible Use of Funds

529 plans offer flexibility in how the funds can be used. Qualified education expenses include tuition, fees, books, supplies, and certain room and board costs for eligible educational institutions. In addition to traditional colleges and universities, 529 plan funds can also be used for qualified expenses at vocational schools and even some international institutions.

State-Sponsored Plans

Each state offers its own 529 plan, and you are not limited to investing in your own state’s plan. You can choose any state’s plan that best suits your needs. It’s important to consider factors such as investment options, fees, and potential tax benefits when selecting a plan. Researching and comparing different state-sponsored plans can help you make an informed decision.

High Contribution Limits

529 plans typically have high contribution limits, allowing you to save a substantial amount for education expenses. These limits vary by state and plan, but they often exceed $300,000 per beneficiary. For families with multiple children, this can be especially advantageous as the funds can be used for any eligible family member.

Gift and Estate Tax Benefits

Contributing to a 529 plan can also have gift and estate tax benefits. Under current tax laws, individuals can contribute up to $15,000 per year ($30,000 for married couples) to a 529 plan without incurring gift tax. Additionally, individuals have the option to front-load their contributions by utilizing the five-year gift tax averaging provision. This allows for a lump sum contribution of up to $75,000 ($150,000 for married couples) per beneficiary without triggering gift tax.

Protection from Market Volatility

529 plans offer peace of mind by protecting it from market volatility. As the funds are invested, they are typically allocated among a variety of investment options such as stocks, bonds, and mutual funds. This diversification helps mitigate the impact of market fluctuations, reducing the risk of losing a significant portion of your savings.

529 plans offer a range of benefits that make them an attractive option for saving for education expenses. From tax advantages to flexible use of funds, these plans provide individuals and families with a powerful tool to achieve their education savings goals. Consider exploring the various state-sponsored plans and consult with a financial advisor to determine the best approach for your specific needs. Start saving today and secure a brighter future for yourself or your loved ones.

Frequently Asked Questions about the Benefits of 529 Plans

1. What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education expenses.

2. What are the benefits of a 529 plan?

The benefits of a 529 plan include tax advantages, flexibility in using funds, potential growth of investments, and the ability to change beneficiaries.

3. Are contributions to a 529 plan tax-deductible?

Contributions to a 529 plan are not deductible on your federal income tax return, but some states offer tax deductions or credits for contributions.

4. How can funds from a 529 plan be used?

Funds from a 529 plan can be used for qualified education expenses, including tuition, fees, books, supplies, and certain room and board costs.

5. Can I use a 529 plan for K-12 education expenses?

Yes, the recent changes in tax laws allow up to $10,000 per year per beneficiary to be used for K-12 tuition expenses.

6. What happens if the beneficiary doesn’t use all the funds in the 529 plan?

If the beneficiary doesn’t use all the funds, you can change the beneficiary to another eligible family member or save the funds for future education expenses, including graduate school.

7. Can I open a 529 plan for someone other than my child?

Yes, you can open a 529 plan for anyone, including a grandchild, niece, nephew, or even yourself.

8. Are there any income limits or age restrictions for contributing to a 529 plan?

No, there are no income limits or age restrictions for contributing to a 529 plan. Anyone can contribute regardless of their income level or age.

9. What happens if my child doesn’t go to college?

If your child doesn’t go to college, you have several options. You can change the beneficiary to another eligible family member, use the funds for qualified education expenses at a later time, or withdraw the funds (subject to taxes and penalties).

10. Can I have multiple 529 plans for the same beneficiary?

Yes, you can have multiple 529 plans for the same beneficiary, but the total contributions to all plans must not exceed the maximum limit set by each state.