Benefits of a Credit Union over a Bank

Welcome to our comprehensive guide on the benefits of choosing a credit union over a traditional bank. In this article, we will explore the advantages that credit unions offer and why they might be a better choice for your financial needs.

Lower Fees and Better Rates

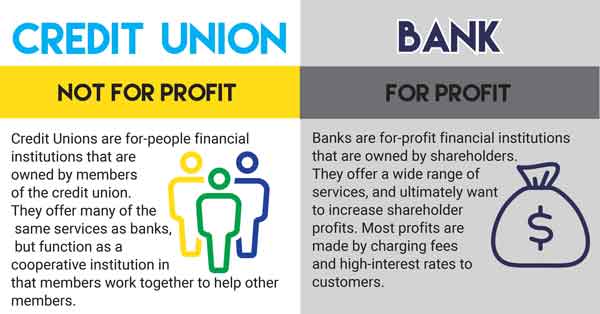

One of the primary benefits of a credit union is the potential for lower fees and better interest rates compared to traditional banks. Credit unions are not-for-profit organizations, which means they can pass on their earnings to their members in the form of reduced fees and competitive interest rates.

Personalized Customer Service

Unlike banks that often prioritize profit margins, credit unions focus on providing personalized customer service to their members. Credit union staff members are typically more accessible and willing to go the extra mile to assist you with your financial needs. Whether you need help with a loan application or have a question about your account, credit unions prioritize building strong relationships with their members.

Community Focus

Credit unions are deeply rooted in the communities they serve. By choosing a credit union, you are supporting a local financial institution that reinvests in the community. Credit unions often offer financial education programs, sponsor local events, and support charitable initiatives. When you join a credit union, you become part of a community-focused organization that aims to improve the lives of its members and the surrounding community.

Member Ownership and Control

As a credit union member, you also become an owner. Unlike traditional banks that prioritize shareholders, credit unions are owned and controlled by their members. This ownership structure means that credit unions are accountable to their members and make decisions based on what benefits them rather than external stakeholders.

Access to Financial Services

Credit unions offer a wide range of financial services, often comparable to those offered by traditional banks. From checking and savings accounts to loans, credit cards, and mortgages, credit unions provide comprehensive financial solutions. Additionally, credit unions are part of a network that allows their members to access services at other credit unions across the country, providing convenience and flexibility.

Focus on Financial Education

Another advantage of credit unions is their emphasis on financial education. They strive to empower their members with the knowledge and skills needed to make informed financial decisions. Credit unions often offer workshops, seminars, and online resources to help members understand topics such as budgeting, saving, investing, and credit management.

Enhanced Security and Privacy

Credit unions prioritize the security and privacy of their members’ financial information. They employ robust security measures to protect against fraud and unauthorized access. Additionally, credit unions are governed by strict privacy regulations, ensuring that your personal and financial information remains confidential.

Choosing a credit union over a bank can offer numerous benefits, including lower fees, better rates, personalized customer service, community focus, member ownership, access to financial services, financial education, and enhanced security and privacy. Consider joining a credit union to experience these advantages and become part of a financial institution that puts its members first.

Frequently Asked Questions

1. What is a credit union?

A credit union is a non-profit financial institution owned and operated by its members who share a common bond, such as living in the same community or working for the same employer.

2. How is a credit union different from a bank?

A credit union is member-owned, whereas a bank is typically owned by shareholders. Credit unions prioritize serving their members’ needs and often offer lower fees and better interest rates compared to banks.

3. What are the benefits of joining a credit union?

Joining a credit union can provide you with lower loan rates, higher savings rates, personalized customer service, and a sense of community. Credit unions also often have fewer fees than traditional banks.

4. Can anyone join a credit union?

Each credit union has its membership eligibility requirements, which can include factors such as where you live, where you work, or your affiliation with certain organizations. However, many credit unions have broad membership criteria that allow almost anyone to join.

5. Are credit unions insured like banks?

Yes, most credit unions are insured by the National Credit Union Administration (NCUA), which provides similar protection to the Federal Deposit Insurance Corporation (FDIC) for banks. This means your deposits in a credit union are generally insured up to $250,000 per account.

6. Do credit unions offer the same services as banks?

Yes, credit unions offer a wide range of financial services, including checking and savings accounts, loans, credit cards, online banking, and more. They strive to provide the same services as banks while maintaining a member-focused approach.

7. Can I access my money easily at a credit union?

Yes, credit unions typically provide access to your money through ATMs, debit cards, online banking, mobile apps, and shared branches. Many credit unions also participate in nationwide ATM networks, allowing you to access your funds conveniently.

8. How are credit union interest rates different from banks?

Credit unions often offer higher interest rates on savings accounts and lower interest rates on loans compared to banks. This is because credit unions are not-for-profit organizations, and their primary goal is to benefit their members rather than generate profits for shareholders.

9. What is the advantage of personalized customer service at a credit union?

Credit unions are known for their personalized customer service, as they prioritize building relationships with their members. You can expect more individual attention, tailored financial advice, and a focus on your specific needs and goals.

10. How can I find a credit union near me?

You can search online directories, use the NCUA’s Credit Union Locator tool, or inquire with your employer or community organizations to find credit unions in your area. Many credit unions also have websites where you can learn more and join online.