Benefits of a Family Trust

A family trust is a legal arrangement that allows individuals to protect and manage their assets for the benefit of their family members. It provides numerous advantages, both in terms of estate planning and financial management. In this article, we will explore the various benefits of having a family trust and how it can help you secure your family’s future.

Asset Protection

One of the primary advantages of a family trust is asset protection. By transferring your assets into a trust, you effectively separate them from your ownership. This means that in the event of a lawsuit or bankruptcy, your assets held in the trust are shielded and protected. This can be particularly beneficial if you have a high-risk profession or if you want to safeguard your wealth for future generations.

Estate Planning

Another significant benefit of a family trust is its role in estate planning. By establishing a trust, you can ensure that your assets are distributed according to your wishes after your passing. This can help avoid probate, which can be a lengthy and costly process. Additionally, a family trust allows you to maintain privacy as the details of your estate plan are not made public through probate proceedings.

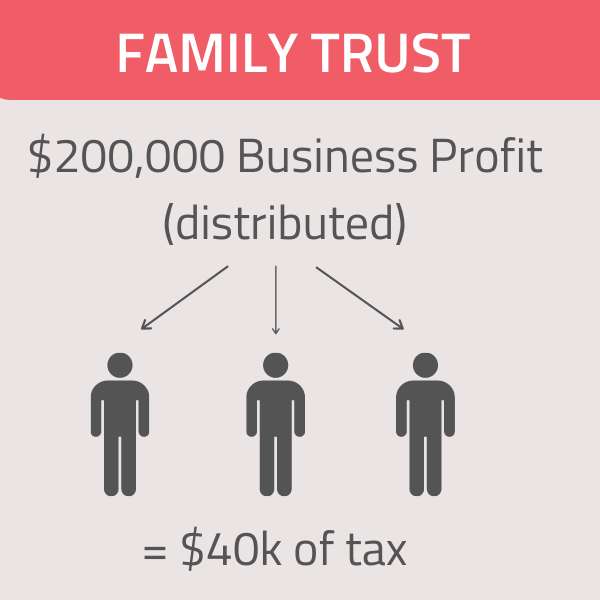

Tax Efficiency

A family trust can also offer tax benefits. By placing your assets in a trust, you may be able to minimize estate taxes and reduce the tax burden on your beneficiaries. Trusts can provide opportunities for tax planning, such as taking advantage of tax deductions and exemptions. It is advisable to consult with a tax professional or financial advisor to fully understand the tax implications and potential savings associated with a family trust.

Continuity and Control

Creating a family trust allows you to maintain control over your assets even after your passing. You can specify detailed instructions regarding how your assets should be managed and distributed among your family members. This ensures that your wealth is used in a manner that aligns with your values and goals. Additionally, a trust can provide continuity for your business or investments, allowing them to be seamlessly managed by your chosen trustees.

Flexibility

A family trust offers flexibility in terms of managing and distributing your assets. You can appoint trustees who will oversee the trust and make decisions based on your instructions. This allows you to customize the trust to meet the unique needs and circumstances of your family. You can also include provisions that allow for changes in beneficiaries or trustees over time, ensuring that the trust remains relevant and adaptable to future situations.

Privacy

Privacy is an important consideration for many individuals when it comes to their financial affairs. With a family trust, you can maintain a higher level of privacy compared to other estate planning methods. Trusts are not subject to public records, unlike wills or probate proceedings. This means that the details of your assets, beneficiaries, and distribution plans remain confidential, providing an additional layer of protection and privacy for your family.

A family trust offers a wide range of benefits, including asset protection, estate planning, tax efficiency, continuity and control, flexibility, and privacy. By establishing a family trust, you can secure your assets, ensure the smooth transfer of wealth to your loved ones, and maintain control over your financial affairs. It is essential to consult with a legal and financial professional to understand the specific implications and requirements of setting up a family trust based on your unique circumstances.

Frequently Asked Questions

1. What is a family trust?

A family trust, also known as a discretionary trust, is a legal arrangement where a trustee manages assets on behalf of family members or beneficiaries.

2. What are the benefits of a family trust?

The benefits of a family trust include:

Asset protection

Tax planning and minimization

Control and flexibility

Succession planning

Privacy

3. How does a family trust provide asset protection?

A family trust can protect assets from potential risks such as lawsuits, creditors, or bankruptcy, as the trust legally owns the assets, not the individual beneficiaries.

4. How can a family trust help with tax planning and minimization?

A family trust allows for income splitting among family members, potentially reducing the overall tax burden by utilizing lower income tax brackets.

5. What control and flexibility does a family trust offer?

A family trust enables the trustee to distribute income and assets at their discretion, ensuring the needs of individual family members are met while maintaining control over the trust assets.

6. How does a family trust assist with succession planning?

By transferring assets into a family trust, future generations can be provided for, ensuring a smooth transfer of wealth while minimizing potential estate disputes.

7. Can a family trust provide privacy?

Yes, a family trust offers privacy as the trust deed is not a public document, unlike a will. This means that the details of the trust’s assets and beneficiaries can remain confidential.

8. Are there any downsides to a family trust?

While family trusts offer numerous benefits, they also come with certain complexities, including initial setup costs, ongoing administrative requirements, and potential tax implications. It is important to seek professional advice before establishing a family trust.

9. Can a family trust be revoked or changed?

Yes, a family trust can be revoked or amended, but the process typically involves legal procedures and the agreement of all beneficiaries and trustees.

10. Who should consider setting up a family trust?

Individuals or families with significant assets, business owners, and those concerned about protecting their wealth for future generations should consider setting up a family trust.