Benefits of a Revocable Trust

A revocable trust, also known as a living trust, is a legal arrangement that allows individuals to manage and distribute their assets during their lifetime and after their death. This type of trust offers several benefits compared to other estate planning tools, such as wills. In this article, we will explore the advantages of having a revocable trust and how it can benefit you and your loved ones.

Asset Management and Privacy

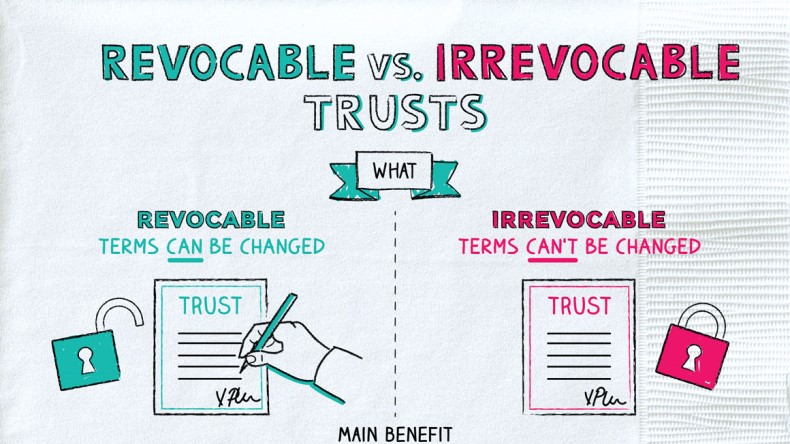

One of the key benefits of a revocable trust is that it allows for efficient asset management. By transferring your assets to the trust, you retain control as the trustee while enjoying flexibility in managing and modifying the trust’s terms. This means you can add or remove assets from the trust as your circumstances change, providing you with a high level of control over your estate.

Additionally, a revocable trust offers privacy advantages. Unlike a will, which becomes a public record upon probate, a revocable trust allows for the private transfer of assets outside of the probate process. This means that your financial affairs can remain confidential, and your beneficiaries can avoid the time-consuming and costly probate proceedings.

Probate Avoidance and Cost Savings

Another significant benefit of a revocable trust is the avoidance of probate. Probate is a legal process that validates a will and oversees the distribution of assets. By utilizing a revocable trust, you can bypass probate entirely, ensuring a faster and smoother transfer of assets to your beneficiaries.

Furthermore, probate can be an expensive process, involving court fees, attorney fees, and other administrative costs. By establishing a revocable trust, you can potentially save your estate and beneficiaries a significant amount of money by avoiding these probate-related expenses.

Flexibility and Control

A revocable trust provides you with the flexibility to make changes to the trust’s provisions during your lifetime. As the name suggests, a revocable trust can be modified, amended, or even revoked entirely if your circumstances or wishes change. This flexibility ensures that your estate plan remains up-to-date and aligned with your evolving needs.

Moreover, a revocable trust allows you to maintain control over the distribution of your assets even after your passing. You can specify detailed instructions on how your assets should be managed and distributed, ensuring that your wishes are carried out precisely.

Disability Planning

In addition to facilitating the transfer of assets after death, a revocable trust can also provide disability planning benefits. If you become incapacitated or unable to manage your affairs, the successor trustee named in the trust can step in and handle your financial matters on your behalf. This ensures that your assets are managed according to your instructions without the need for court-appointed guardianship or conservatorship.

Tax Efficiency

While a revocable trust does not offer direct tax advantages, it can still contribute to overall tax efficiency. By properly structuring your trust, you can minimize estate taxes and potentially reduce the tax burden on your beneficiaries. Consulting with a qualified tax professional or estate planning attorney can help you optimize your trust’s tax benefits based on your specific circumstances.

A revocable trust offers numerous benefits, including efficient asset management, privacy, probate avoidance, cost savings, flexibility, control, disability planning, and potential tax efficiency. By considering a revocable trust as part of your estate planning strategy, you can protect your assets, streamline the transfer process, and ensure your wishes are carried out effectively. Consult with a qualified estate planning professional to determine if a revocable trust is the right choice for you.

Frequently Asked Questions about the Benefits of a Revocable Trust

1. What is a revocable trust?

A revocable trust, also known as a living trust, is a legal arrangement where an individual (the grantor) transfers their assets into a trust, managed by a trustee, for the benefit of themselves during their lifetime and the benefit of their beneficiaries after their death.

2. What are the main benefits of a revocable trust?

The main benefits of a revocable trust include:

Probate avoidance

Privacy

Flexibility

Incapacity planning

Continuity of asset management

Minimization of estate taxes

3. How does a revocable trust help in avoiding probate?

A revocable trust helps avoid probate by transferring assets into the trust, which allows those assets to pass directly to beneficiaries upon the grantor’s death, without the need for court involvement.

4. Can a revocable trust provide privacy?

Yes, a revocable trust provides privacy as it is not a public document like a will. The trust’s terms and beneficiaries remain private, unlike the probate process which is a matter of public record.

5. What flexibility does a revocable trust offer?

A revocable trust offers flexibility as the grantor can amend or revoke the trust at any time during their lifetime, allowing for changes in beneficiaries, assets, or terms of distribution.

6. How does a revocable trust help in incapacity planning?

A revocable trust helps in incapacity planning by appointing a successor trustee to manage the trust assets in case the grantor becomes incapacitated. This ensures a smooth transition without the need for court-appointed guardianship.

7. What is meant by continuity of asset management in a revocable trust?

Continuity of asset management means that if the grantor becomes incapacitated or passes away, the successor trustee named in the trust can seamlessly take over the management and distribution of assets, avoiding any disruption.

8. Can a revocable trust help in minimizing estate taxes?

While a revocable trust does not provide direct estate tax benefits, it can be structured to include provisions that help minimize estate taxes, such as the use of marital or charitable deductions.

9. Are there any downsides to having a revocable trust?

One potential downside is the cost of setting up and maintaining a revocable trust, which can be higher compared to a simple will. Additionally, assets not transferred into the trust may still go through probate.

10. Is a revocable trust suitable for everyone?

No, a revocable trust may not be suitable for everyone. It depends on individual circumstances, the size of the estate, and specific estate planning goals. Consulting with an attorney is recommended to determine the best approach.