The Benefits of a Traditional IRA

A Traditional Individual Retirement Account (IRA) is a powerful financial tool that offers numerous benefits for individuals planning for their retirement. In this article, we will explore the advantages of a Traditional IRA and how it can help you secure a comfortable future.

Tax Advantages

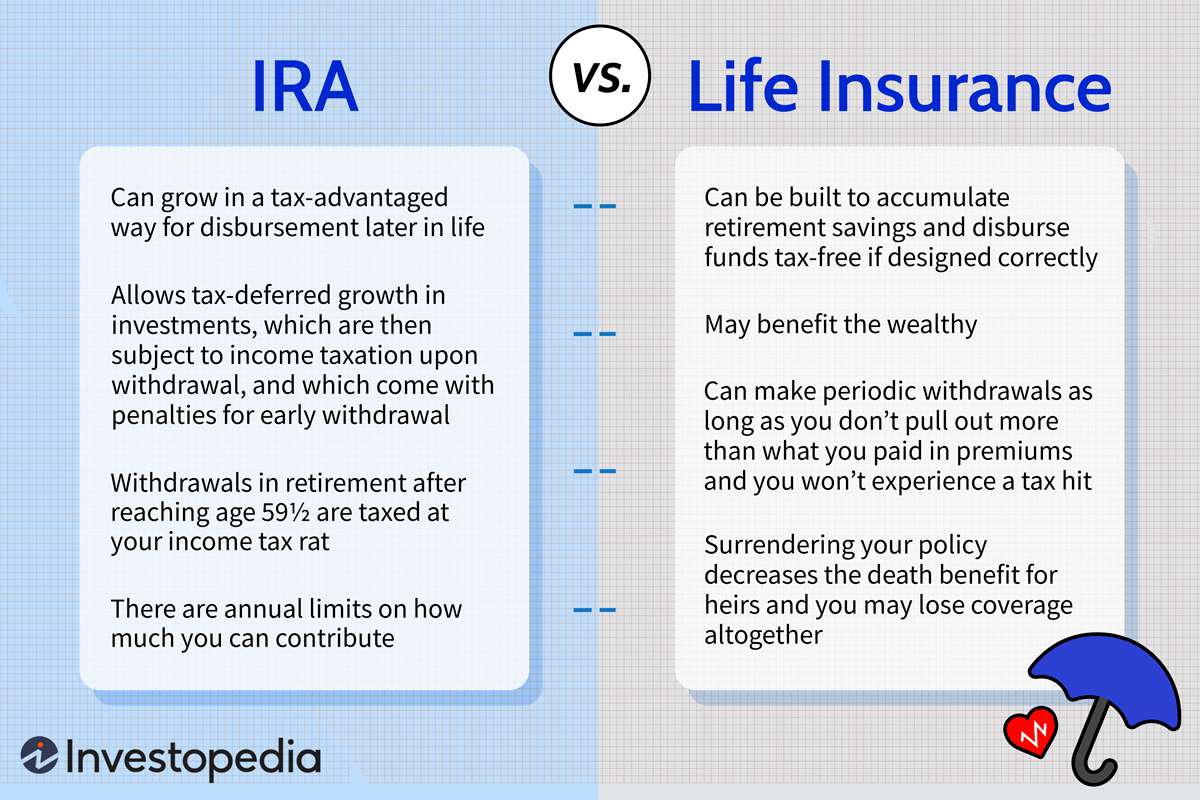

One of the key benefits of a Traditional IRA is the potential for tax deductions. Contributions made to a Traditional IRA are often tax-deductible, meaning they can reduce your taxable income for the year in which you contribute. This can result in significant savings, especially for individuals in higher tax brackets.

Additionally, the earnings on your Traditional IRA investments grow on a tax-deferred basis. This means that you won’t pay taxes on the growth until you start making withdrawals during retirement. By deferring taxes, you can potentially accumulate more wealth over time.

Retirement Savings

A Traditional IRA serves as a valuable retirement savings vehicle. It allows you to contribute a certain amount of money each year, depending on your age and income. These contributions can be invested in a wide range of financial instruments such as stocks, bonds, and mutual funds, providing an opportunity for your savings to grow over time.

Furthermore, a Traditional IRA offers flexibility in terms of contribution limits. As of 2021, individuals under the age of 50 can contribute up to $6,000 per year, while those aged 50 and above can contribute up to $7,000 per year. This higher contribution limit for individuals aged 50 and above, known as a “catch-up” contribution, allows for accelerated retirement savings.

Tax-Deferred Growth

One of the key advantages of a Traditional IRA is the potential for tax-deferred growth. Unlike regular investment accounts, where you pay taxes on capital gains and dividends each year, a Traditional IRA allows your investments to grow without immediate tax consequences. This can result in a significant advantage over time, as your earnings compound on a tax-deferred basis.

Required Minimum Distributions (RMDs)

While a Traditional IRA offers tax advantages during the accumulation phase, it’s important to note that the IRS requires you to start taking withdrawals, known as Required Minimum Distributions (RMDs), once you reach the age of 72. These withdrawals are subject to income tax, but they also ensure that you gradually distribute your retirement savings over your lifetime.

It’s worth mentioning that RMDs can be an advantage for individuals in lower tax brackets during retirement. By spreading out the withdrawals over time, you may be able to manage your tax liability more effectively while still enjoying the benefits of your Traditional IRA.

A Traditional IRA provides numerous benefits for individuals planning their retirement. From tax advantages to the potential for tax-deferred growth, it offers an effective way to save for the future. However, it’s important to consider your financial situation and consult with a financial advisor to determine if a Traditional IRA is the right choice for you.

Frequently Asked Questions about the Benefits of a Traditional IRA

1. What is a Traditional IRA?

A Traditional IRA (Individual Retirement Account) is a type of retirement savings account that offers tax advantages for individuals who want to save for their retirement.

2. What are the main benefits of a Traditional IRA?

The main benefits of a Traditional IRA include tax-deductible contributions, tax-deferred growth, and potential tax savings during retirement.

3. Can anyone contribute to a Traditional IRA?

No, there are certain eligibility requirements to contribute to a Traditional IRA. You must have earned income and be below a certain income threshold, depending on your tax filing status.

4. How much can I contribute to a Traditional IRA?

The contribution limit for a Traditional IRA is $6,000 per year (as of 2021). If you are 50 years or older, you may be eligible for an additional catch-up contribution of $1,000.

5. Are there any income limits for deducting contributions to a Traditional IRA?

If you or your spouse are covered by a retirement plan at work, there are income limits for deducting contributions to a Traditional IRA. However, if neither of you are covered by a retirement plan, there are no income limits.

6. When can I start withdrawing money from my Traditional IRA?

You can start withdrawing money from your Traditional IRA penalty-free at age 59 ½. However, you must start taking the required minimum distributions (RMDs) once you reach age 72.

7. Are there any penalties for early withdrawals from a Traditional IRA?

Yes, if you withdraw money from your Traditional IRA before age 59 ½, you may be subject to a 10% early withdrawal penalty in addition to paying taxes on the withdrawn amount.

8. Can I convert my Traditional IRA to a Roth IRA?

Yes, you can convert your Traditional IRA to a Roth IRA, but you will have to pay taxes on the converted amount. It’s important to consider the potential tax implications before making this decision.

9. Can I contribute to both a Traditional IRA and a Roth IRA?

Yes, you can contribute to both a Traditional IRA and a Roth IRA in the same tax year, as long as your total contributions do not exceed the annual limit.

10. Are there any age limits for contributing to a Traditional IRA?

No, there are no age limits for contributing to a Traditional IRA, as long as you have earned income and meet the other eligibility requirements.