Benefits of Consolidating Student Loans

Consolidating student loans can provide numerous benefits for borrowers. In this article, we will explore the advantages of consolidating student loans and how it can help individuals manage their debt more effectively.

Streamlined Repayment

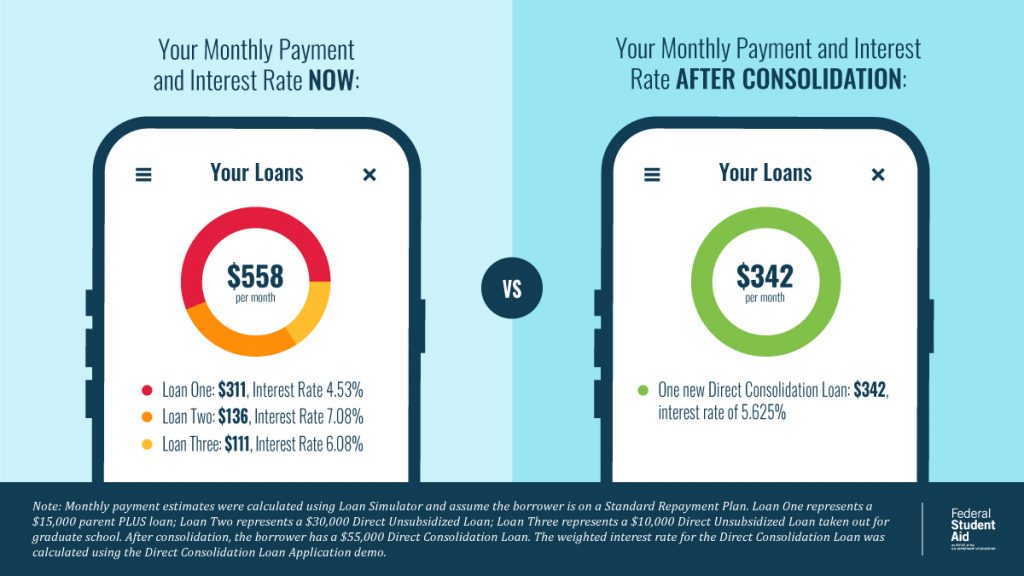

One of the key benefits of consolidating student loans is the ability to streamline repayment. Instead of juggling multiple loan payments with different due dates and interest rates, consolidation allows borrowers to combine all their loans into a single, more manageable loan. This simplifies the repayment process, making it easier to keep track of payments and avoid missed deadlines.

Lower Monthly Payments

Consolidating student loans can also lead to lower monthly payments. When borrowers consolidate their loans, they often have the option to extend the repayment term. This results in a reduction in the monthly payment amount, making it more affordable for individuals who may be struggling to meet their financial obligations. Lower monthly payments can provide much-needed relief and help borrowers better allocate their funds towards other essential expenses.

Fixed Interest Rate

Another advantage of consolidating student loans is the opportunity to secure a fixed interest rate. Many student loans have variable interest rates that can fluctuate over time, potentially causing payment amounts to vary. By consolidating, borrowers can lock in a fixed interest rate, providing stability and predictability in their monthly payments. This can be particularly beneficial in an environment of increasing interest rates, as borrowers can protect themselves from potential future rate hikes.

Simplified Financial Management

Consolidating student loans simplifies financial management by reducing the number of loan accounts and lenders to deal with. With a single loan, borrowers only need to keep track of one lender, one interest rate, and one payment schedule. This consolidation can save time and effort, allowing individuals to focus on other aspects of their financial well-being.

Potential Interest Savings

Consolidating student loans can potentially lead to interest savings over the long term. If borrowers have loans with high interestlidating them into a single loan with a lower interest rate can result in significant savings. By reducing the overall interest paid, borrowers can save money and potentially pay off their loans faster.

Improved Credit Score

Consolidating student loans can also have a positive impact on borrowers’ credit scores. When borrowers consolidate their loans, it shows as a single loan on their credit report. If they make timely payments and manage their debt responsibly, it can improve their creditworthiness and boost their credit score. A higher credit score can open doors to better financial opportunities, such as lower interest rates on future loans or credit cards.

Consolidating student loans offers several benefits, including streamlined repayment, lower monthly payments, a fixed interest rate, simplified financial management, potential interest savings, and improved credit scores. By understanding these advantages, borrowers can make informed decisions about consolidating their student loans and taking control of their financial future.

Frequently Asked Questions

1. What is student loan consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan, often with a lower interest rate and a longer repayment term.

2. What are the benefits of consolidating student loans?

Consolidating student loans can provide several benefits, such as:

Lower monthly payments

Simplified repayment process

Potential for a lower interest rate

Extended repayment term

Ability to switch from variable to fixed interest rate

3. Will consolidating my student loans save me money?

Consolidating student loans can potentially save you money by securing a lower interest rate. However, it’s essential to consider the overall cost of the loan, including any fees or extended repayment terms.

4. Can I consolidate both federal and private student loans?

Yes, you can consolidate both federal and private student loans. However, keep in mind that federal and private loans have different terms and benefits, so it’s important to evaluate the impact of consolidation on each type of loan.

5. Can I consolidate my student loans more than once?

Yes, it is possible to consolidate your student loans more than once. However, it’s important to carefully consider the potential benefits and drawbacks of doing so, as multiple consolidations may affect your repayment terms and interest rates.

6. Will consolidating my student loans affect my credit score?

Consolidating student loans typically does not have a significant negative impact on your credit score. It may even have a positive effect by reducing your debt-to-income ratio and simplifying your repayment process.

7. Can I include loans from different lenders in the consolidation?

Yes, you can include loans from different lenders in the consolidation process. Consolidating allows you to combine multiple loans into a single loan, regardless of the lenders involved.

8. Are there any fees associated with consolidating student loans?

While federal loan consolidations do not have application or origination fees, some private lenders may charge fees for consolidating student loans. It’s important to carefully review the terms and conditions of any consolidation offer to understand any associated fees.

9. Can I still qualify for loan forgiveness if I consolidate my student loans?

Consolidating federal student loans may affect your eligibility for certain loan forgiveness programs. It’s crucial to research and understand the specific requirements of the forgiveness programs you are interested in before consolidating.

10. How can I determine if consolidating my student loans is the right choice for me?

Deciding whether to consolidate your student loans depends on various factors, such as your financial situation, interest rates, and repayment goals. It’s recommended to evaluate the potential benefits and drawbacks and consider consulting with a financial advisor or student loan expert to make an informed decision.