Benefits of Credit Union vs Bank

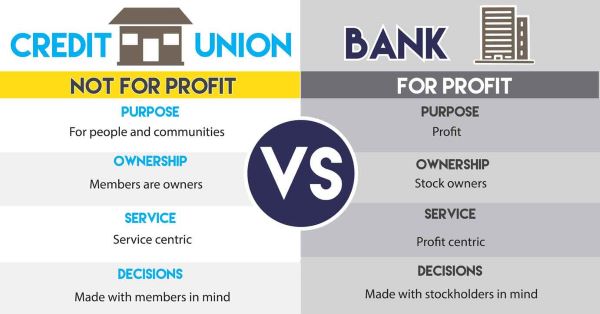

Credit unions and banks are financial institutions that provide various services to individuals and businesses. While they both offer similar services, there are distinct differences between the two. In this article, we will explore the benefits of credit unions compared to traditional banks.

Lower Fees and Better Interest Rates

One of the primary advantages of credit unions is their ability to offer lower fees and better interest rates compared to banks. Credit unions are not-for-profit organizations owned by their members, which allows them to prioritize the financial well-being of their members rather than maximizing profits. This often results in lower fees for services such as checking accounts, credit cards, and loans.

Additionally, credit unions tend to offer higher interest rates on savings accounts and certificates of deposit (CDs) compared to banks. This means that your money can grow faster in a credit union, helping you achieve your financial goals more efficiently.

Personalized Customer Service

Unlike banks, credit unions are known for providing personalized customer service. Since credit unions are member-owned, they have a vested interest in building strong relationships with their members. This often translates into a more personalized approach when it comes to addressing customer needs and concerns.

At a credit union, you are not just a number. You have the opportunity to work with dedicated professionals who understand your unique financial situation and can provide tailored advice and solutions. This personalized customer service can make a significant difference in your overall banking experience.

Community Focus

Credit unions have a strong focus on the communities they serve. Unlike banks, which may have branches nationwide or even globally, credit unions are typically local or regional institutions. This localized approach allows credit unions to have a deep understanding of the community’s needs and to provide targeted financial services accordingly.

Furthermore, credit unions often actively participate in community development initiatives and support local businesses. By banking with a credit union, you can contribute to the growth and prosperity of your community.

Membership Benefits

When you join a credit union, you become a member rather than just a customer. This membership status often comes with additional benefits that are not available at traditional banks. For example, credit unions may offer exclusive discounts on various products and services, such as insurance or financial planning.

Additionally, credit unions typically have a democratic structure, allowing members to have a voice in the decision-making process. This means that you have the opportunity to participate in the governance of the credit union and influence its policies and direction.

Financial Education and Counseling

Credit unions are known for their commitment to financial education and counseling. They understand that empowering their members with financial knowledge and skills is essential for their long-term financial success.

Many credit unions offer educational resources, workshops, and seminars on topics such as budgeting, saving, and investing. They may also provide one-on-one financial counseling sessions to help members make informed decisions and achieve their financial goals.

In summary, credit unions offer several advantages over traditional banks. From lower fees and better interest rates to personalized customer service and a community-focused approach, credit unions prioritize the well-being of their members. By joining a credit union, you can enjoy the benefits of membership, access financial education, and contribute to the growth of your community. Consider exploring credit unions as a viable alternative to traditional banks for your financial needs.

Frequently Asked Questions

1. What is a credit union?

A credit union is a financial cooperative owned and operated by its members, who share a common bond such as working for the same company or living in the same community.

2. How is a credit union different from a bank?

A credit union is not-for-profit, while a bank is for-profit. Credit unions prioritize serving their members and often offer better interest rates, lower fees, and personalized customer service compared to banks.

3. What are the benefits of joining a credit union?

Joining a credit union can provide various benefits such as higher interest rates on savings accounts, lower interest rates on loans, fewer fees, and a sense of community.

4. Are credit unions insured?

Yes, most credit unions are insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor, similar to the Federal Deposit Insurance Corporation (FDIC) coverage for banks.

5. Can anyone join a credit union?

Each credit union has specific membership criteria, but many credit unions have expanded their eligibility requirements, allowing more individuals to join. Some credit unions may require you to live or work in a specific area or be affiliated with a certain organization.

6. Do credit unions offer the same services as banks?

Yes, credit unions offer a wide range of services similar to banks, including checking and savings accounts, loans, credit cards, online and mobile banking, and more.

7. How can credit unions offer better interest rates?

As not-for-profit institutions, credit unions can offer higher interest rates on savings and lower interest rates on loans because they don’t have to generate profits for shareholders. Instead, they return earnings to their members in the form of better rates and lower fees.

8. Are credit unions more customer-focused than banks?

Credit unions are known for their customer-centric approach. They often provide personalized service, take the time to understand members’ needs, and offer financial education and guidance.

9. Are credit unions limited in their accessibility?

No, many credit unions participate in shared branching networks, allowing members to access their accounts at other credit unions’ branches nationwide. Additionally, credit unions often offer online and mobile banking services for convenient access.

10. Can I switch from a bank to a credit union?

Yes, you can switch from a bank to a credit union at any time. Simply research credit unions in your area, find one that suits your needs and follow their membership application process.