Benefits of Debt Consolidation

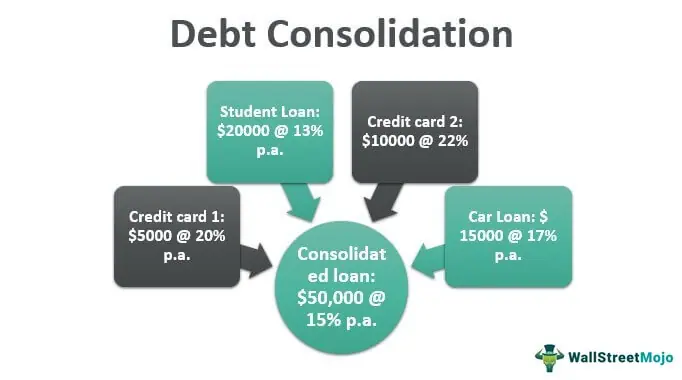

Debt consolidation is a financial strategy that can provide numerous benefits to individuals struggling with multiple debts. It involves combining multiple debts into a single loan or payment plan, making it easier to manage and potentially saving money in the long run. In this article, we will explore the various benefits of debt consolidation and how it can help individuals regain control of their finances.

Lower Interest Rates

One of the significant advantages of debt consolidation is the potential for lower interest rates. When you consolidate your debts, you can often secure a loan or payment plan with a lower interest rate compared to the average interest rates of your existing debts. This can result in substantial savings over time, as you’ll be paying less in interest charges each month.

Simplified Repayment

Managing multiple debts can be overwhelming and confusing. Debt consolidation simplifies the repayment process by combining all your debts into a single payment. Instead of juggling multiple due dates and varying interest rates, you only need to focus on one monthly payment. This streamlines your finances and makes it easier to stay organized and on top of your debt obligations.

Debt Repayment Plan

Debt consolidation often involves creating a structured repayment plan. This plan outlines the timeline for paying off your consolidated debt and provides a clear roadmap for becoming debt-free. With a well-defined plan in place, you can set realistic goals and track your progress as you work towards financial freedom.

Improved Credit Score

Consolidating your debts can have a positive impact on your credit score. By making consistent and timely payments on your consolidated loan, you demonstrate responsible financial behavior to credit bureaus. Over time, this can help improve your credit score, making it easier to qualify for future loans and secure better interest rates.

Reduced Stress

The burden of multiple debts can take a toll on your mental and emotional well-being. Debt consolidation can alleviate this stress by simplifying your financial obligations and providing a clear path toward debt repayment. With a consolidated loan, you can focus on a single payment and gradually eliminate your debts, leading to a sense of relief and reduced stress.

Potential Savings

As mentioned earlier, debt consolidation can potentially save you money in the long run. By securing a lower interest rate and streamlining your repayment process, you may be able to pay off your debts faster and with less overall interest. This can result in significant savings over time, allowing you to put those funds towards other financial goals or investments.

FAQs about the Benefits of Debt Consolidation

1. What is debt consolidation?

Debt consolidation is the process of combining multiple debts into a single loan or payment to simplify repayment and potentially reduce interest rates.

2. What are the benefits of debt consolidation?

Debt consolidation offers several benefits:

Lower interest rates

Single monthly payment

Simplified debt management

Potential for improved credit score

3. How can debt consolidation help lower interest rates?

When you consolidate your debts, you may be able to secure a loan with a lower interest rate compared to the average interest rates of your existing debts.

4. Will debt consolidation reduce my monthly payments?

Debt consolidation can potentially reduce your monthly payments by extending the repayment term, which spreads out the total debt over a longer period.

5. Can debt consolidation help me simplify my debt management?

Absolutely! By consolidating your debts, you’ll have only one monthly payment to make instead of managing multiple payments to different creditors.

6. How does debt consolidation affect my credit score?

Debt consolidation can positively impact your credit score if you make timely payments on the consolidated loan. It shows responsible financial behavior and reduces your overall debt utilization ratio.

7. Is debt consolidation a good option for everyone?

Debt consolidation may not be suitable for everyone. It depends on your financial situation, credit score, and the terms and conditions offered by lenders. It’s recommended to consult with a financial advisor to determine if it’s the right choice for you.

8. Can I consolidate different types of debts?

Absolutely! You can consolidate various types of debts, including credit card debts, personal loans, medical bills, and more.

9. Are there any risks associated with debt consolidation?

While debt consolidation can offer benefits, there are potential risks. Some people may be tempted to accumulate more debt after consolidating, leading to a worse financial situation. It’s important to have a disciplined approach to managing your finances after consolidation.

10. How can I find a reputable debt consolidation service?

Research and compare different debt consolidation services. Look for reputable companies with positive customer reviews, clear terms, and fair interest rates. It’s advisable to choose a service that is accredited by recognized financial organizations.

Debt consolidation offers numerous benefits for individuals struggling with multiple debts. From lower interest rates and simplified repayment to improved credit scores and reduced stress, it can be a powerful tool in regaining control of your finances. If you are overwhelmed by multiple debts, consider exploring debt consolidation options to help you achieve financial freedom.