Benefits of FHA Loan vs Conventional

In the world of mortgage loans, two popular options that borrowers often consider are FHA loans and conventional loans. Both types of loans have their own set of advantages and disadvantages. In this article, we will explore the benefits of FHA loans compared to conventional loans.

Lower Down Payment

One of the major advantages of an FHA loan is the lower down payment requirement. While conventional loans typically require a down payment of 20%, FHA loans allow borrowers to put down as little as 3.5% of the purchase price. This lower down payment requirement makes FHA loans more accessible to individuals who may not have a large amount of savings.

Flexible Credit Requirements

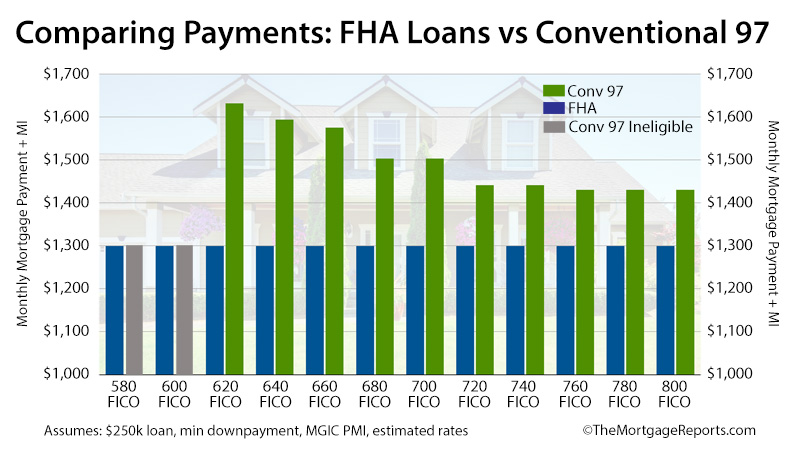

Another significant benefit of FHA loans is the flexible credit requirements. Conventional loans often require borrowers to have a higher credit score, typically above 620, to qualify for a loan. In contrast, FHA loans are more lenient and may be available to borrowers with lower credit scores. This flexibility makes FHA loans a viable option for individuals with less-than-perfect credit.

Assumable Loans

An interesting advantage of FHA loans is that they are assumable. This means that if you decide to sell your home, the buyer may be able to take over your FHA loan. This feature can be beneficial in a rising interest rate environment, as assumable loans can be an attractive option for potential buyers. Conventional loans, on the other hand, are generally not assumable.

Lower Interest Rates

FHA loans often have lower interest rates compared to conventional loans. This can result in significant savings over the life of the loan. However, it’s important to note that FHA loans also require borrowers to pay mortgage insurance premiums, which can offset some of the interest rate savings. It’s essential to consider all costs and factors when comparing loan options.

Flexible Debt-to-Income Ratio

FHA loans also offer more flexibility when it comes to the debt-to-income ratio. Conventional loans typically have stricter guidelines regarding the amount of debt a borrower can have compared to their income. FHA loans allow for a higher debt-to-income ratio, making it easier for borrowers with higher levels of debt to qualify for a loan.

Government Backing

One of the key features of FHA loans is that they are backed by the Federal Housing Administration (FHA), which is part of the U.S. Department of Housing and Urban Development (HUD). This government backing provides lenders with an added level of security, allowing them to offer more favorable terms and conditions to borrowers. Conventional loans do not have this government backing.

In summary, FHA loans offer several benefits compared to conventional loans. These include lower down payment requirements, flexible credit requirements, assumable loans, potentially lower interest rates, flexible debt-to-income ratios, and government backing. However, it’s important to carefully consider your circumstances and financial goals before deciding which type of loan is the best fit for you.

Frequently Asked Questions – Benefits of FHA Loan vs Conventional

1. What is an FHA loan?

An FHA loan is a mortgage insured by the Federal Housing Administration, which allows borrowers to qualify for lower down payments and more lenient credit requirements compared to conventional loans.

2. What are the benefits of an FHA loan?

Some benefits of an FHA loan include:

Lower down payment requirements

Flexible credit score requirements

Lower interest rates

Higher debt-to-income ratio allowances

Assumable loans

3. How does an FHA loan differ from a conventional loan?

An FHA loan differs from a conventional loan in terms of:

Down payment requirements

Credit score requirements

Interest rates

Debt-to-income ratio allowances

Loan limits

4. Can anyone qualify for an FHA loan?

No, not everyone can qualify for an FHA loan. There are certain eligibility criteria that borrowers must meet, including income requirements and a minimum credit score.

5. Are FHA loans only for first-time homebuyers?

No, FHA loans are not exclusively for first-time homebuyers. Anyone can apply for an FHA loan as long as they meet the eligibility requirements.

6. What is the minimum down payment required for an FHA loan?

The minimum down payment required for an FHA loan is typically 3.5% of the purchase price.

7. Are FHA loans more expensive than conventional loans?

FHA loans may have higher upfront mortgage insurance premiums and ongoing mortgage insurance costs compared to conventional loans. However, the lower down payment and more lenient credit requirements can make them more affordable for some borrowers.

8. Can I refinance my FHA loan into a conventional loan?

Yes, it is possible to refinance an FHA loan into a conventional loan. This may be beneficial if you have improved your credit score or if you want to remove the mortgage insurance premium.

9. Can I use an FHA loan to buy an investment property?

No, FHA loans are intended for primary residences only. They cannot be used to finance investment properties.

10. How do I apply for an FHA loan?

To apply for an FHA loan, you need to find an FHA-approved lender and complete the necessary application forms. The lender will review your financial information and determine if you meet the eligibility requirements.