Benefits of Having a Savings Account

The Importance of a Savings Account

A savings account is a crucial financial tool that offers numerous benefits to individuals and businesses alike. In this article, we will explore the advantages of having a savings account and how it can positively impact your financial well-being.

Financial Security

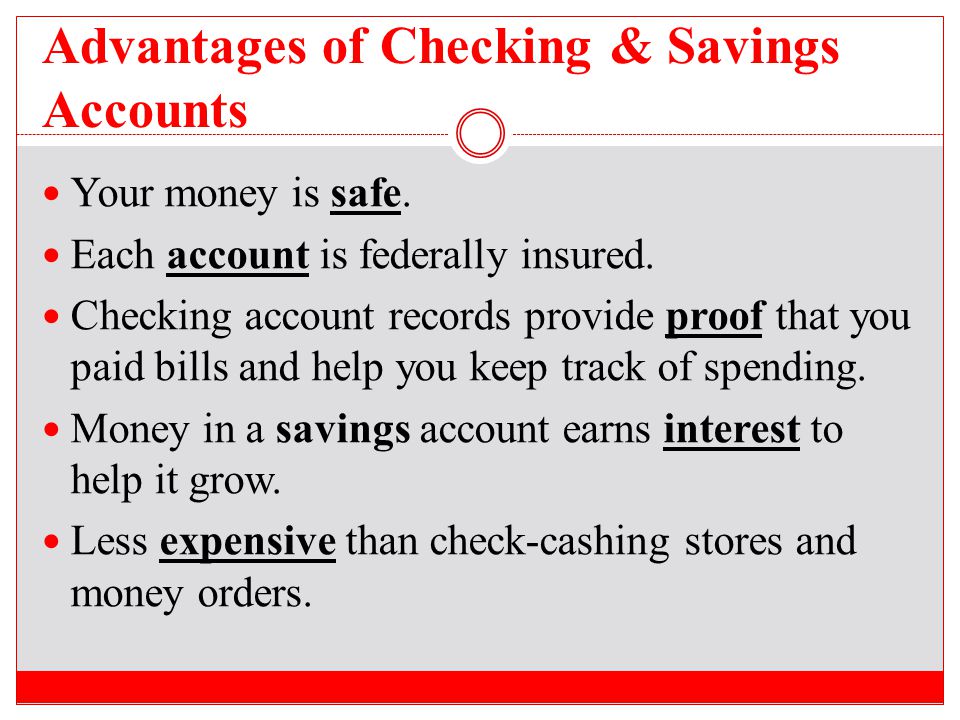

One of the primary benefits of having a savings account is the financial security it provides. By setting aside a portion of your income regularly, you create a safety net for unexpected expenses, emergencies, or unforeseen circumstances. This financial cushion can help you avoid debt and maintain stability during challenging times.

Earn Interest on Savings

Unlike a regular checking account, a savings account allows you to earn interest on your deposited funds. The interest rate may vary depending on the bank and account type, but even a modest interest rate can help your savings grow over time. By maximizing your savings potential, you can achieve your financial goals faster.

Achieve Financial Goals

Having a savings account is an effective way to work towards your financial goals. Whether you are saving for a down payment on a house, a dream vacation, or retirement, a dedicated savings account helps you track your progress and stay motivated. It provides a separate and organized space for your savings, making it easier to manage and monitor your financial objectives.

Easy Access to Funds

While it’s important to save for the future, a savings account also offers convenient access to your funds when needed. Most savings accounts provide various withdrawal options, such as online transfers, ATM withdrawals, or in-person transactions. This accessibility ensures that your money remains readily available whenever you require it.

Establishing Financial Discipline

By maintaining a savings account, you develop essential financial discipline and responsible money management habits. Regularly contributing to your savings teaches you the importance of budgeting, setting financial priorities, and distinguishing between wants and needs. These skills are invaluable for long-term financial success.

Additional Banking Benefits

Besides the core advantages, many savings accounts come with additional banking benefits. These may include free online banking, mobile apps, e-statements, and automatic transfers. Such features enhance your overall banking experience and make it more convenient to manage your finances.

Protection of Funds

Most savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States. This insurance protects your funds up to a certain amount, typically $250,000 per depositor, per insured bank. Knowing that your savings are safeguarded provides peace of mind and reassurance.

A savings account offers a multitude of benefits, including financial security, the opportunity to earn interest, and the ability to achieve your financial goals. It serves as a valuable tool for managing your money, developing financial discipline, and ensuring easy access to funds. By utilizing the advantages of a savings account, you can take control of your financial future and enjoy long-term prosperity.

Frequently Asked Questions – Benefits of Having a Savings Account

1. What is a savings account?

A savings account is a type of bank account where you can deposit and save money while earning interest on your savings.

2. What are the benefits of having a savings account?

Having a savings account offers several benefits, including:

Interest earnings on your savings

Safe storage for your money

Easy access to your funds

Financial security for emergencies

Opportunity to build wealth over time

3. How does a savings account earn interest?

A savings account earns interest based on the annual percentage yield (APY) set by the bank. The interest is usually calculated daily and added to your account on a monthly or quarterly basis.

4. Are savings accounts safe?

Yes, savings accounts are generally safe as they are insured by the Federal Deposit Insurance Corporation (FDIC) in the United States. This means that even if the bank fails, your deposits up of to $250,000 are protected.

5. Can I access my money in a savings account anytime?

Yes, you can usually access your money in a savings account anytime through various methods such as ATM withdrawals, online transfers, or in-person visits to the bank branch.

6. Can I have multiple savings accounts?

Yes, you can have multiple savings accounts with different banks or even with the same bank. This can help you organize your savings for different purposes or goals.

7. Is there a minimum balance requirement for a savings account?

Some savings accounts may have a minimum balance requirement, which means you need to maintain a certain amount of money in the account to avoid fees or earn higher interest rates. The minimum balance requirement varies depending on the bank and type of account.

8. Can I set up automatic transfers to my savings account?

Yes, many banks offer the option to set up automatic transfers from your checking account to your savings account. This allows you to save regularly without having to manually transfer the money each time.

9. Are there any fees associated with a savings account?

Some savings accounts may have fees, such as monthly maintenance fees or fees for exceeding a certain number of withdrawals per month. However, many banks also offer fee-free savings accounts, especially for basic savings needs.

10. How can a savings account help me reach my financial goals?

A savings account can help you reach your financial goals by providing a dedicated place to save money. Whether you’re saving for a vacation, a down payment on a house, or an emergency fund, a savings account allows you to accumulate funds over time while earning interest on your savings.