The Benefits of a Home Equity Line of Credit (HELOC)

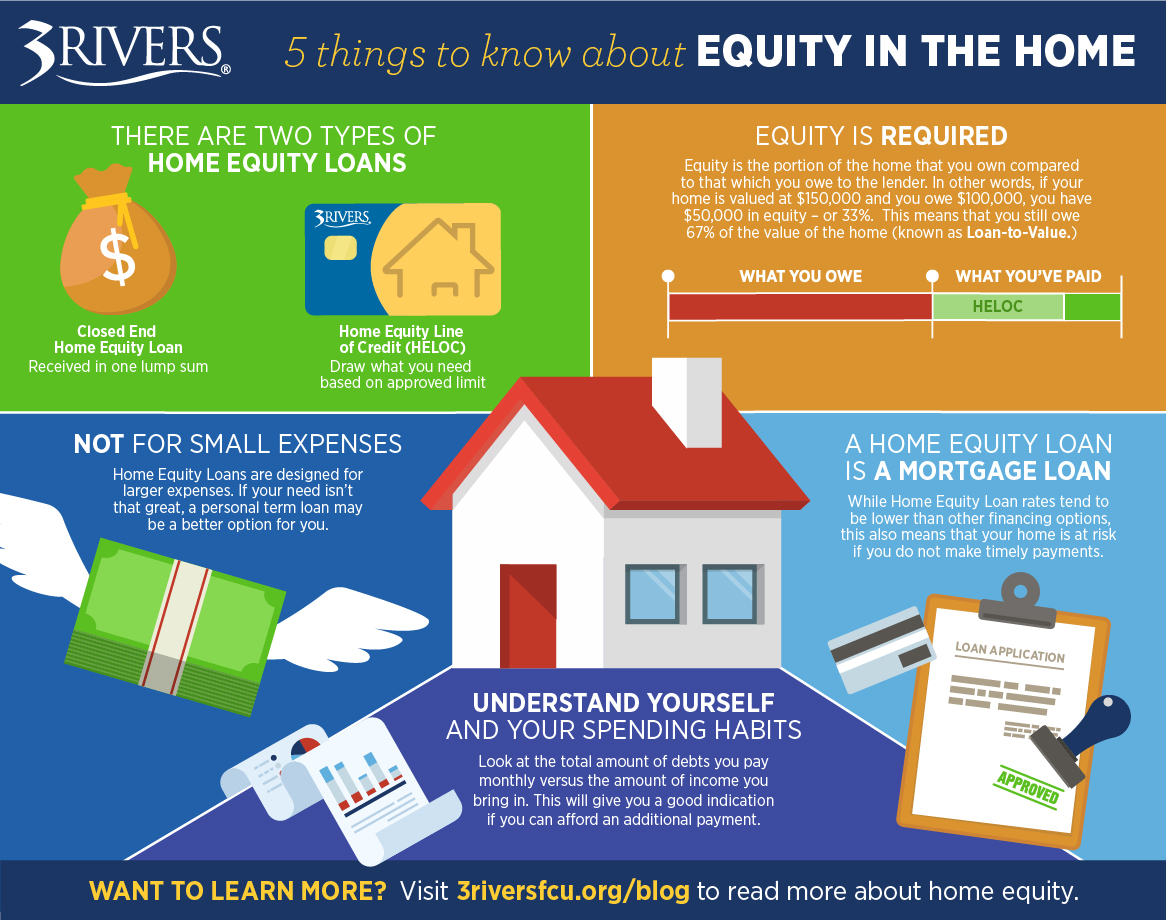

A home equity line of credit, or HELOC, is a versatile financial tool that allows homeowners to tap into the equity they have built up in their homes. It provides a flexible and convenient way to access funds for various purposes, such as home improvements, debt consolidation, education expenses, and more. In this article, we will explore the numerous benefits of a HELOC and how it can be advantageous for homeowners.

Flexibility and Convenience

One of the key advantages of a HELOC is its flexibility. Unlike a traditional loan, where you receive a lump sum of money, a HELOC works like a credit card. You have a predetermined credit limit, and you can borrow from it as needed. This flexibility allows you to access funds whenever you require them, giving you greater control over your finances.

Additionally, a HELOC provides convenience in terms of repayment. During the “draw period,” typically around 10 years, you only need to make interest payments on the amount you have borrowed. This feature enables you to manage your cash flow more effectively and focus on other financial priorities.

Lower Interest Rates

Compared to other forms of borrowing, such as personal loans or credit cards, HELOCs often offer lower interest rates. The reason for this is that the loan is secured by your home’s equity, which reduces the lender’s risk. As a result, you can save a significant amount of money on interest payments over the life of the loan.

Furthermore, the interest you pay on a HELOC may be tax deductible subject to certain conditions. This potential tax benefit can further enhance the cost-effectiveness of a HELOC, making it an attractive option for homeowners.

Potential for Home Value Appreciation

As you continue to make mortgage payments and the housing market fluctuates, the value of your home may appreciate over time. This increase in equity can provide you with additional borrowing power through a HELOC. By tapping into your home’s increased value, you can access more funds for larger expenses or financial goals.

It’s important to note that the value of your home can also decline, so it’s essential to carefully consider your financial situation and consult with a trusted financial advisor before utilizing a HELOC.

Versatile Use of Funds

HELOCs offer homeowners the flexibility to use the funds for a wide range of purposes. Some common uses include:

Home Improvements: Whether you’re renovating your kitchen, adding an extension, or upgrading your bathroom, a HELOC can provide the necessary funds to enhance your living space.

Debt Consolidation: If you have high-interest debts, such as credit card balances or personal loans, consolidating them into a HELOC can help simplify your finances and potentially reduce your overall interest payments.

Education Expenses: HELOCs can be a valuable source of funding for educational purposes, whether it’s paying for college tuition, financing vocational training, or covering other educational expenses.

Emergency Funds: Having a HELOC in place can serve as a financial safety net during unexpected circumstances, such as medical emergencies or major home repairs.

Potential for Credit Score Improvement

Proper utilization and management of a HELOC can positively impact your credit score. By making timely payments and maintaining a low credit utilization ratio, you demonstrate responsible financial behavior. This can lead to an improvement in your credit score over time, which can open up more favorable borrowing opportunities in the future.

A home equity line of credit (HELOC) offers homeowners a flexible and convenient way to access their home’s equity for various financial needs. With its flexibility, lower interest rates, potential for home value appreciation, versatile use of funds, and potential credit score improvement, a HELOC can be a valuable financial tool. However, it’s crucial to carefully consider your financial situation and consult with a trusted financial advisor before utilizing a HELOC to ensure it aligns with your long-term goals and objectives.

Frequently Asked Questions about the Benefits of HELOC

1. What is a HELOC?

A HELOC (Home Equity Line of Credit) is a type of loan that allows homeowners to borrow against the equity in their homes.

2. How does a HELOC work?

A HELOC works like a credit card, where you have a revolving line of credit that you can borrow from as needed, up to a certain limit, using your home as collateral.

3. What are the benefits of a HELOC?

Some benefits of a HELOC include:

Flexibility to borrow funds as needed

Potentially lower interest rates compared to other types of loans

Ability to use the funds for various purposes (home improvements, debt consolidation, education, etc.)

Interest may be tax-deductible (consult a tax advisor for specific details)

4. How can I use the funds from a HELOC?

The funds from a HELOC can be used for various purposes such as home renovations, paying off high-interest debts, funding education expenses, or even starting a small business.

5. Can I pay off my HELOC early?

Yes, you can pay off your HELOC early without any prepayment penalties, allowing you to save on interest payments.

6. How is the interest rate determined for a HELOC?

The interest rate for a HELOC is usually variable and based on a benchmark such as the prime rate, plus a margin determined by the lender based on your creditworthiness.

7. Are there any fees associated with a HELOC?

Yes, there may be fees associated with a HELOC, such as an application fee, appraisal fee, annual maintenance fee, or early termination fee. It’s important to review the terms and conditions with your lender.

8. Can I use a HELOC for investment purposes?

While it is possible to use a HELOC for investment purposes, it’s important to carefully consider the risks and potential returns before doing so. Consulting with a financial advisor is recommended.

9. What happens if I can’t repay my HELOC?

If you can’t repay your HELOC, you risk losing your home as it serves as collateral for the loan. It’s crucial to make timely payments and manage your finances responsibly.

10. How do I qualify for a HELOC?

To qualify for a HELOC, lenders typically consider factors such as your credit score, income, debt-to-income ratio, and the amount of equity you have in your home.