Benefits of Having a High Credit Score

When it comes to managing your finances, having a high credit score can make a significant difference. A high credit score not only opens doors to various financial opportunities but also provides numerous benefits that can positively impact your financial well-being. In this article, we will explore the advantages of having a high credit score and how it can help you achieve your financial goals.

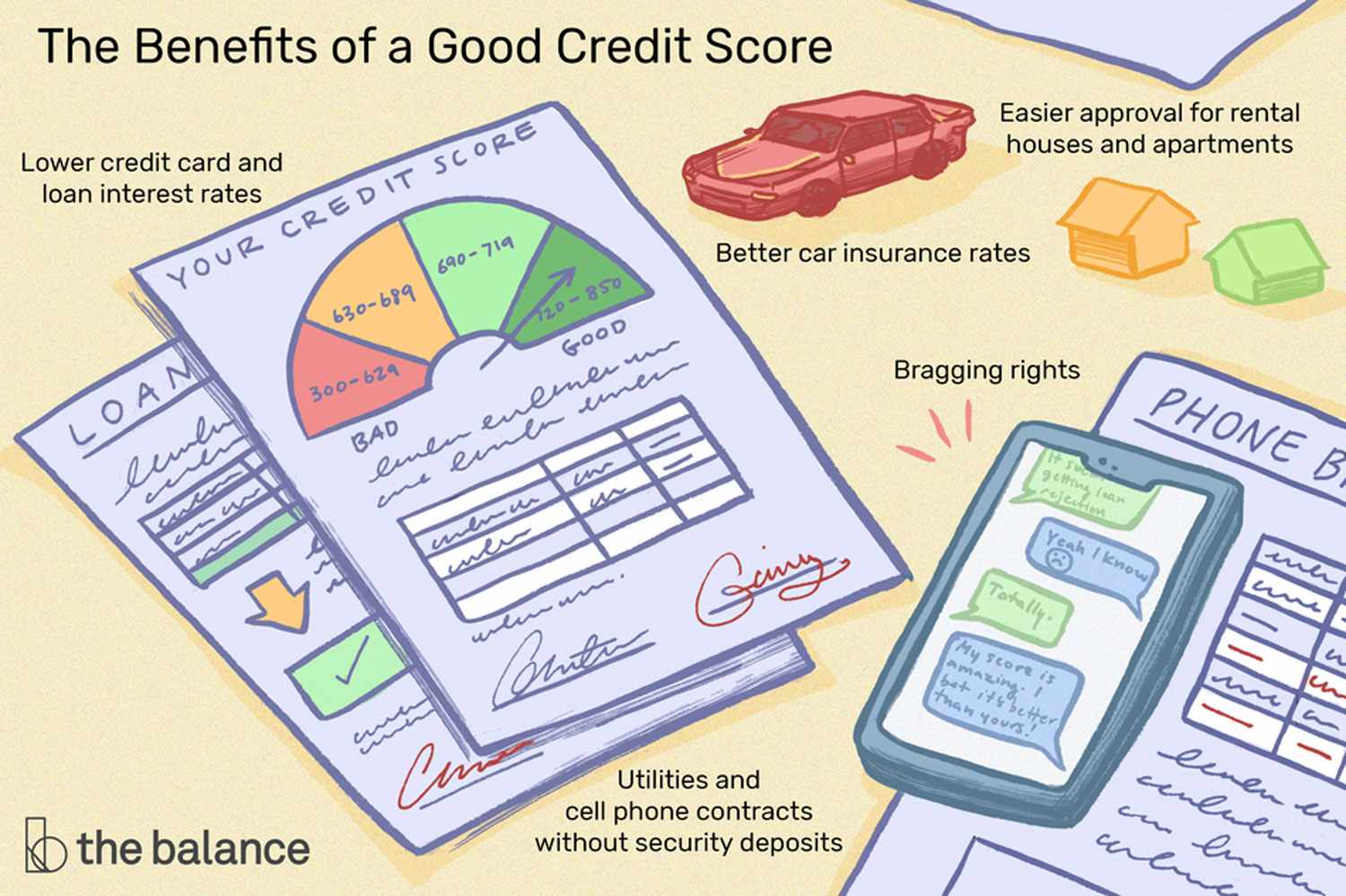

Access to Better Interest Rates

One of the most significant benefits of having a high credit score is the ability to access better interest rates on loans and credit cards. Lenders consider individuals with high credit scores as low-risk borrowers, making them eligible for lower interest rates. This means that you can save a substantial amount of money over time by paying less interest on your loans and credit card balances.

Increased Approval Chances

Having a high credit score significantly increases your chances of getting approved for credit applications. Whether you are applying for a mortgage, car loan, or personal loan, lenders are more likely to approve your application if you have a high credit score. This can save you from the frustration of being denied credit and allow you to secure the financing you need to achieve your goals.

Enhanced Credit Limit

A high credit score not only improves your chances of getting approved for credit but also increases the likelihood of receiving a higher credit limit. Lenders are more willing to provide individuals with high credit scores with larger credit limits, as they perceive them as responsible borrowers. Having a higher credit limit can provide you with greater financial flexibility and enable you to make larger purchases or handle unexpected expenses more comfortably.

Better Insurance Premiums

Believe it or not, your credit score can also impact your insurance premiums. Many insurance companies consider credit scores when determining premiums for auto, home, or even life insurance. Individuals with high credit scores are often rewarded with lower insurance premiums, as they are seen as financially responsible and less likely to file claims. By maintaining a high credit score, you can potentially save a significant amount of money on your insurance expenses.

Easier Rental Applications

When you are looking to rent a property, landlords and property management companies often conduct credit checks as part of the application process. Having a high credit score can make it easier for you to secure a rental property. Landlords are more likely to choose tenants with high credit scores, as they perceive them as reliable and trustworthy. By maintaining a high credit score, you can increase your chances of finding a desirable rental property and avoid the hassle of being turned down due to poor credit.

Negotiating Power

With a high credit score, you gain a significant advantage when it comes to negotiating terms and conditions with lenders. Whether you are applying for a loan, credit card, or mortgage, lenders are more willing to negotiate interest rates, fees, and repayment terms with individuals who have a proven track record of responsible credit management. This can save you money and provide you with more favorable terms, ultimately helping you achieve your financial goals more effectively.

Peace of Mind

Lastly, having a high credit score provides you with peace of mind and financial security. Knowing that you have a strong credit history and a high credit score can alleviate stress and worry when it comes to managing your finances. It gives you confidence in your ability to secure credit when needed and provides a sense of stability in your financial life.

In conclusion, maintaining a high credit score offers numerous benefits that can positively impact your financial well-being. From accessing better interest rates and increased approval chances to enjoying higher credit limits and lower insurance premiums, a high credit score opens doors to financial opportunities. Additionally, it simplifies the rental application process and provides you with negotiating power. Above all, it offers peace of mind and financial security. By understanding the benefits of a high credit score, you can take the necessary steps to build and maintain a strong credit history, ultimately helping you achieve your financial goals.

Frequently Asked Questions about the Benefits of a High Credit Score

1. What is a credit score?

A credit score is a numerical representation of an individual’s creditworthiness, which is used by lenders to assess the risk of lending money to that person.

2. How is a credit score calculated?

A credit score is calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit, and new credit inquiries.

3. What is considered a high credit score?

A high credit score typically falls within the range of 700 to 850, depending on the credit scoring model used.

4. What are the benefits of having a high credit score?

Having a high credit score can lead to lower interest rates on loans and credit cards, easier approval for rental applications, better insurance rates, and access to more favorable financial opportunities.

5. Can a high credit score save me money?

Absolutely! With a high credit score, you are likely to qualify for lower interest rates on loans and credit cards, resulting in significant savings over time.

6. Does a high credit score affect my ability to rent a home?

Yes, a high credit score can make it easier for you to rent a home. Landlords often consider credit scores when evaluating rental applications and may prefer tenants with good credit.

7. Can a high credit score help me get better insurance rates?

Yes, insurance companies may offer lower premiums to individuals with high credit scores as studies have shown a correlation between good credit and reduced insurance risk.

8. Are there any career benefits to having a high credit score?

While a credit score is not directly related to job performance, some employers may check credit history during the hiring process, especially for positions that involve financial responsibilities.

9. Can a high credit score improve my chances of getting approved for a mortgage?

Yes, a high credit score increases your chances of getting approved for a mortgage and may qualify you for more favorable terms, such as a lower down payment or a lower interest rate.

10. How can I improve my credit score?

To improve your credit score, make sure to pay bills on time, keep credit card balances low, avoid opening unnecessary new accounts, and regularly review your credit report for errors.