Benefits of High Yield Savings Account

The Importance of High-Yield Savings Accounts

High-yield savings accounts are a popular choice for individuals looking to grow their savings while minimizing risk. These accounts offer a range of benefits that can help you achieve your financial goals. In this article, we will explore the various advantages of high-yield savings accounts and how they can be a valuable addition to your financial strategy.

Higher Interest Rates

One of the primary benefits of a high-yield savings account is the higher interest rates they offer compared to traditional savings accounts. These accounts are designed to provide a greater return on your savings, allowing your money to grow at a faster pace. With the power of compounding, even a small increase in interest rates can make a significant difference in the long run.

Compound Interest

High-yield savings accounts often utilize compound interest, which means that your interest is calculated not only on your initial deposit but also on the accumulated interest. This compounding effect allows your savings to grow exponentially over time. By reinvesting the interest earned, you can maximize the growth potential of your savings and reach your financial goals sooner.

Security and FDIC Insurance

When choosing a high-yield savings account, it is important to consider the security of your funds. Most reputable financial institutions offer high-yield savings accounts that are insured by the Federal Deposit Insurance Corporation (FDIC). This means that even if the bank were to fail, your deposits would be protected up to the FDIC insurance limit, currently set at $250,000 per depositor. This assurance provides peace of mind and ensures the safety of your hard-earned money.

Liquidity and Flexibility

While high-yield savings accounts are designed for long-term savings, they still offer a level of liquidity and flexibility. Unlike other investment options, such as certificates of deposit (CDs) or retirement accounts, high-yield savings accounts allow you to access your funds whenever you need them without incurring penalties or fees. This makes them an ideal choice for emergency funds or short-term savings goals.

No Minimum Balance Requirements

Another advantage of high-yield savings accounts is that they often have no minimum balance requirements. This means that you can open an account and start earning higher interest rates with any amount of money. Whether you have a small sum to begin with or substantial savings, high-yield savings accounts provide an opportunity for growth without imposing restrictions.

Tax Benefits

High-yield savings accounts can also offer tax advantages. While the interest earned is generally taxable, contributions to certain types of high-yield savings accounts, such as individual retirement accounts (IRAs), may be tax-deductible. This can help reduce your taxable income and potentially lower your overall tax liability.

In summary, high-yield savings accounts offer a range of benefits that can help you grow your savings and achieve your financial goals. With higher interest rates, compound interest, security through FDIC insurance, liquidity, flexibility, no minimum balance requirements, and potential tax advantages, these accounts provide a valuable tool for individuals looking to maximize their savings. Consider opening a high-yield savings account today and take advantage of the benefits they offer.

Frequently Asked Questions

1. What is a high-yield savings account?

A high-yield savings account is a type of savings account that offers a higher interest rate compared to traditional savings accounts.

2. What are the benefits of having a high-yield savings account?

Some benefits of having a high-yield savings account include:

Earning a higher interest rate on your savings

Helping your money grow faster

Providing a safe and secure way to save

3. How does a high-yield savings account differ from a regular savings account?

A high-yield savings account typically offers a higher interest rate, which means you can earn more money on your savings compared to a regular savings account.

4. Are high-yield savings accounts safe?

Yes, high-yield savings accounts are generally safe. They are typically offered by reputable financial institutions and are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor.

5. Can I access my money easily with a high-yield savings account?

Yes, you can usually access your money easily with a high-yield savings account. Most accounts allow online and mobile banking access, as well as ATM withdrawals.

6. Are there any fees associated with high-yield savings accounts?

Some high-yield savings accounts may have monthly maintenance fees or minimum balance requirements. However, many banks offer fee-free options, so it’s important to compare different account options.

7. How much interest can I earn with a high-yield savings account?

The exact amount of interest you can earn will depend on the interest rate offered by the bank and the amount of money you have in your account. Generally, high-yield savings accounts offer higher interest rates than regular savings accounts.

8. Are high-yield savings accounts a good option for emergency funds?

Yes, high-yield savings accounts can be a good option for emergency funds. They provide a safe place to store your money while earning a higher interest rate, allowing your emergency fund to grow over time.

9. Can I open a high-yield savings account online?

Yes, many banks offer the option to open a high-yield savings account online. This makes it convenient and easy to start saving and earning higher interest on your money.

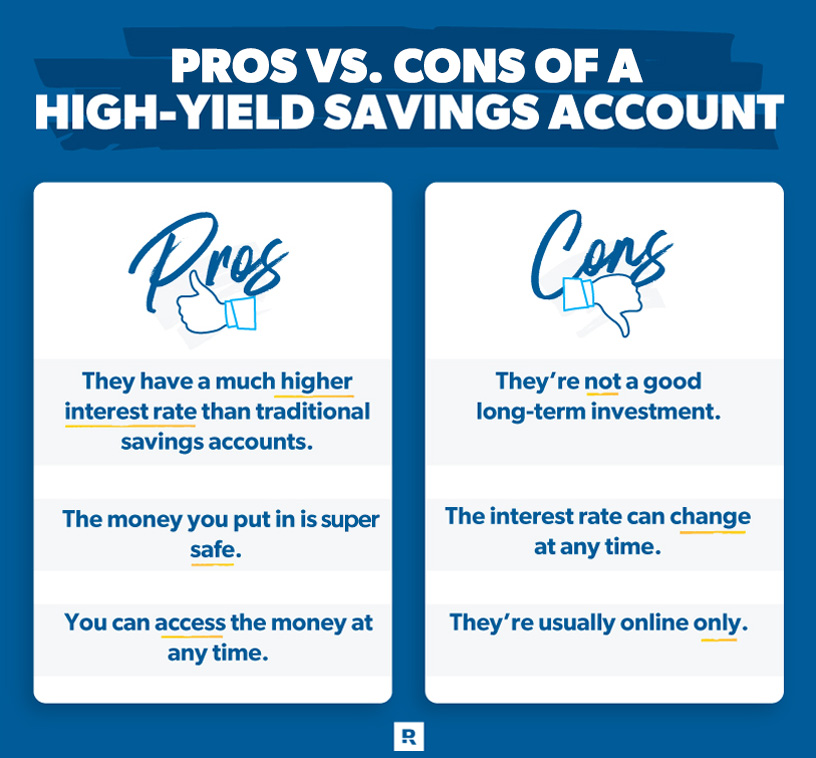

10. Are there any drawbacks to having a high-yield savings account?

One potential drawback of high-yield savings accounts is that they may have higher minimum balance requirements compared to regular savings accounts. Additionally, the interest rates offered can fluctuate over time.