The Benefits of Incorporating in Delaware

Incorporating a business is a crucial decision that can have a significant impact on its success. When it comes to choosing a jurisdiction for incorporation, Delaware has long been a popular choice for businesses of all sizes. In this article, we will explore the numerous benefits of incorporating in Delaware and why it can help your business thrive.

Favorable Business Laws and Court System

Delaware is renowned for its business-friendly laws and well-established court system. The state has a separate Court of Chancery that focuses solely on business matters, providing expertise and specialized attention to corporate disputes. This specialized court system ensures efficient and predictable outcomes, giving businesses the confidence to operate in a stable legal environment.

Flexibility in Corporate Structure

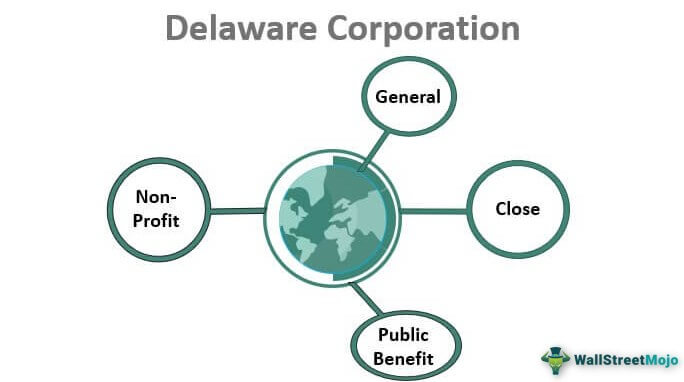

Delaware offers businesses a high degree of flexibility in terms of corporate structure. Whether you are a small startup or a large multinational corporation, Delaware allows you to customize your corporate structure to suit your specific needs. The state’s General Corporation Law provides a comprehensive framework that allows for various types of corporations, including close corporations, non-profit corporations, and benefit corporations.

Protection of Directors and Shareholders

Delaware has robust laws in place to protect directors and shareholders. The state’s corporate law provides a clear and well-defined framework that outlines the rights and responsibilities of directors and shareholders. This legal protection encourages investment and fosters a favorable business climate, attracting businesses from around the world.

Privacy and Confidentiality

Delaware offers a high level of privacy and confidentiality to businesses. The state does not require the disclosure of shareholder information in their filings, ensuring the privacy of business owners. This confidentiality can be particularly beneficial for businesses that value their competitive advantage and wish to keep their corporate information secure.

Tax Advantages

Delaware provides numerous tax advantages for businesses. The state does not impose sales tax on intangible assets, such as trademarks and copyrights. Additionally, Delaware has no state corporate income tax for companies that do not operate within the state. This tax-friendly environment can result in substantial savings for businesses.

Business-Friendly Government

Delaware’s government is known for its pro-business stance. The state has a history of working closely with businesses to create a favorable environment for economic growth. Delaware’s commitment to supporting businesses is evident through its infrastructure development, investment in education, and initiatives to attract new businesses.

Access to Skilled Workforce and Resources

Delaware is strategically located on the East Coast of the United States, providing businesses with easy access to major markets. The state boasts a highly skilled workforce, thanks to its renowned universities and research institutions. Businesses incorporated can tap into this pool of talent and benefit from the state’s strong network of resources and support services.

Incorporating in Delaware offers numerous benefits that can give your business a competitive edge. From favorable business laws and a flexible corporate structure to tax advantages and a business-friendly government, Delaware provides an environment that fosters growth and success. Consider the advantages outlined in this article when making the important decision of where to incorporate your business, and position yourself for long-term success.

Frequently Asked Questions

1. Why should I consider incorporating in Delaware?

Delaware offers many benefits for businesses, such as a favorable legal and tax environment, strong corporate law infrastructure, and a well-established court system.

2. What are the tax advantages of incorporating in Delaware?

When you incorporate in Delaware, you can take advantage of the state’s business-friendly tax policies, including no corporate income tax for companies that operate outside of Delaware.

3. How does incorporating in Delaware protect my parents?

By incorporating in Delaware, you create a separate legal entity for your business. This separation helps protect you from any liabilities or debts incurred by the company.

4. Can a small business benefit from incorporating in Delaware?

Absolutely! Delaware’s business-friendly environment and flexible corporate laws make it an attractive choice for businesses of all sizes, including small businesses.

5. What is the Court of Chancery in Delaware?

The Court of Chancery is a specialized business court in Delaware known for its expertise in handling corporate law matters. It provides a predictable and efficient legal system for businesses.

6. Are there any disadvantages to incorporating in Delaware?

While Delaware offers numerous benefits, there may be some drawbacks depending on your specific business needs and circumstances. It’s advisable to consult with a legal professional to determine the best course of action.

7. Do I need to have a physical office in Delaware to incorporate there?

No, you don’t need to have a physical office in Delaware to incorporate there. You can use a registered agent service to fulfill the state’s requirement of having a local representative.

8. Can I change my company’s state of incorporation to Delaware?

Yes, it is possible to change your company’s state of incorporation to Delaware. However, it involves a process called domestication, which requires compliance with specific legal requirements.

9. Is Delaware the only state with favorable corporate laws?

No, while Delaware is renowned for its corporate-friendly laws, other states like Nevada and Wyoming also offer attractive corporate environments. It’s essential to assess your business needs and consult with professionals to make an informed decision.

10. How long does it take to incorporate in Delaware?

The time required to incorporate in Delaware can vary depending on various factors. Typically, it takes a few days to a few weeks to complete the process, considering the necessary paperwork and legal procedures.