The Benefits of Index Funds

Index funds have gained significant popularity among investors in recent years due to their numerous benefits. In this article, we will explore the advantages of investing in index funds and how they can help you achieve your financial goals.

What are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. Unlike actively managed funds, index funds do not rely on fund managers to select individual securities. Instead, they hold a diversified portfolio of stocks or bonds that mirror the composition of the chosen index.

Low Costs

One of the primary benefits of index funds is their low costs. Since index funds aim to replicate the performance of a specific index, they do not require active management by fund managers. This results in lower expenses compared to actively managed funds, which often charge higher fees for their expertise. By investing in index funds, you can minimize the impact of fees on your investment returns.

Diversification

Index funds provide investors with instant diversification. By holding a wide range of securities that represent the overall market or a specific sector, index funds spread the investment risk across multiple companies. This diversification helps reduce the impact of any individual stock’s poor performance on the overall portfolio. It also allows investors to gain exposure to various industries and sectors without the need for extensive research.

Consistent Performance

Over the long term, index funds have demonstrated consistent performance. Since they aim to replicate the performance of an index, they tend to closely track the overall market. While there may be short-term fluctuations, historical data has shown that broad market indexes, such as the S&P 500, have delivered positive returns over extended periods. By investing in index funds, you can benefit from the overall growth of the market.

Tax Efficiency

Index funds are known for their tax efficiency. Due to their low turnover, which is the buying and selling of securities within the fund, index funds generate fewer capital gains distributions compared to actively managed funds. This can result in lower tax liabilities for investors. Additionally, index funds tend to have a buy-and-hold strategy, minimizing the realization of short-term capital gains.

Flexibility and Accessibility

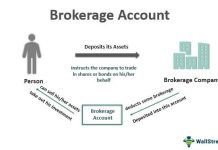

Index funds offer flexibility and accessibility to investors of all levels. They are available in various investment structures, including mutual funds and ETFs, allowing you to choose the option that best suits your preferences. Additionally, index funds are widely available, making them easily accessible to individual investors through brokerage accounts or retirement plans.

Index funds provide numerous benefits, including low costs, diversification, consistent performance, tax efficiency, and accessibility. By investing in index funds, you can take advantage of these benefits and potentially achieve your long-term financial goals. Consider incorporating index funds into your investment strategy and consult with a financial advisor to determine the most suitable approach based on your individual.

Frequently Asked Questions

1. What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500.

2. How do index funds work?

Index funds work by investing in the same securities that make up the chosen index. This allows investors to gain exposure to a broad market or specific sector without the need for active management.

3. What are the benefits of investing in index funds?

Investing in index funds offers several benefits, including:

Diversification: Index funds provide instant diversification by investing in a wide range of securities.

Lower fees: Index funds typically have lower expense ratios compared to actively managed funds.

Consistent returns: Index funds aim to match the performance of the underlying index, providing consistent returns over time.

Passive management: Index funds do not require active decision-making, making them suitable for long-term investors.

4. Are index funds a good investment option for beginners?

Yes, index funds are often recommended for beginners due to their simplicity, diversification, and lower fees. They can be a great way to start building a well-rounded investment portfolio.

5. Can index funds outperform actively managed funds?

While it’s not guaranteed, index funds have historically outperformed many actively managed funds over the long term. This is mainly due to their lower fees and broad market exposure.

6. Are index funds suitable for retirement savings?

Yes, index funds can be an excellent choice for retirement savings. Their low fees and consistent returns make them a popular option for long-term wealth accumulation.

7. Can I invest in index funds through my employer’s retirement plan?

Many employer-sponsored retirement plans, such as 401(k)s, offer index funds as investment options. Check with your employer or plan administrator to see if they are available in your plan.

8. Are index funds less risky than individual stocks?

Index funds are generally considered less risky than investing in individual stocks. By diversifying across multiple securities, they spread the risk and reduce the impact of any single stock’s performance.

9. Can I invest in international markets through index funds?

Yes, there are index funds that focus on international markets, allowing investors to gain exposure to global economies and diversify their portfolios beyond domestic markets.

10. How do I choose the right index fund for my investment goals?

When choosing an index fund, consider factors such as the index it tracks, expense ratio, fund size, and historical performance. It’s also important to align the fund’s investment objectives with your own goals and risk tolerance.