Benefits of IRA vs 401k

When it comes to retirement planning, two popular options that often come up are Individual Retirement Accounts (IRAs) and 401(k) plans. Both of these investment vehicles offer unique advantages and can play a crucial role in securing your financial future. In this article, we will explore the benefits of IRA vs 401k, helping you make an informed decision based on your specific needs and circumstances.

Flexibility and Control

One of the key benefits of an IRA is the flexibility and control it provides. With an IRA, you have a wide range of investment options, including stocks, bonds, mutual funds, and even real estate. This allows you to tailor your investment strategy to align with your risk tolerance and financial goals. On the other hand, 401(k) plans typically offer a limited selection of investment options chosen by your employer.

Tax Advantages

Both IRAs and 401(k) plans offer tax advantages, but they differ in their tax treatment. Traditional IRAs and 401(k) plans provide tax-deferred growth, meaning your contributions are made with pre-tax dollars, and you only pay taxes when you withdraw the funds in retirement. This can result in immediate tax savings. Roth IRAs, on the other hand, are funded with after-tax dollars, allowing for tax-free withdrawals in retirement.

Employer Contributions

If you have access to a 401(k) plan through your employer, one significant advantage is the potential for employer contributions. Many employers offer matching contributions, which means they will match a portion of your contributions, effectively providing free money toward your retirement savings. This can significantly boost your retirement nest egg and is not typically available with IRAs.

Required Minimum Distributions (RMDs)

When it comes to distributions, IRAs and 401(k) plans have different rules. Traditional IRAs and 401(k) plans require you to start taking required minimum distributions (RMDs) once you reach the age of 72. These distributions are subject to income tax. However, Roth IRAs do not have RMDs during the account owner’s lifetime, allowing for more flexibility in managing your retirement income.

Accessibility

Another factor to consider is accessibility to your funds. IRAs generally offer more flexibility in accessing your money before retirement age without penalties. While early withdrawals from both IRAs and 401(k) plans may incur taxes and penalties, IRAs often have more exceptions, such as for first-time homebuyers or higher education expenses.

Choosing between an IRA and a 401(k) plan depends on your individual circumstances and financial goals. Both options offer unique benefits, including flexibility, tax advantages, employer contributions, and accessibility. By understanding the differences between the two, you can make an informed decision that aligns with your retirement objectives. Remember to consult with a financial advisor to determine the best approach for your specific situation.

Frequently Asked Questions about the Benefits of IRA vs 401k

1. What is an IRA?

An Individual Retirement Account (IRA) is a type of investment account that provides tax advantages for retirement savings.

2. What is a 401k?

A 401k is a retirement savings plan offered by employers that allows employees to contribute a portion of their salary to a tax-advantaged investment account.

3. What are the main benefits of an IRA?

Some benefits of an IRA include potential tax deductions, tax-deferred growth, and a wide range of investment options.

4. What are the main benefits of a 401k?

A 401k offers benefits such as employer matching contributions, higher contribution limits, and the ability to borrow against the account.

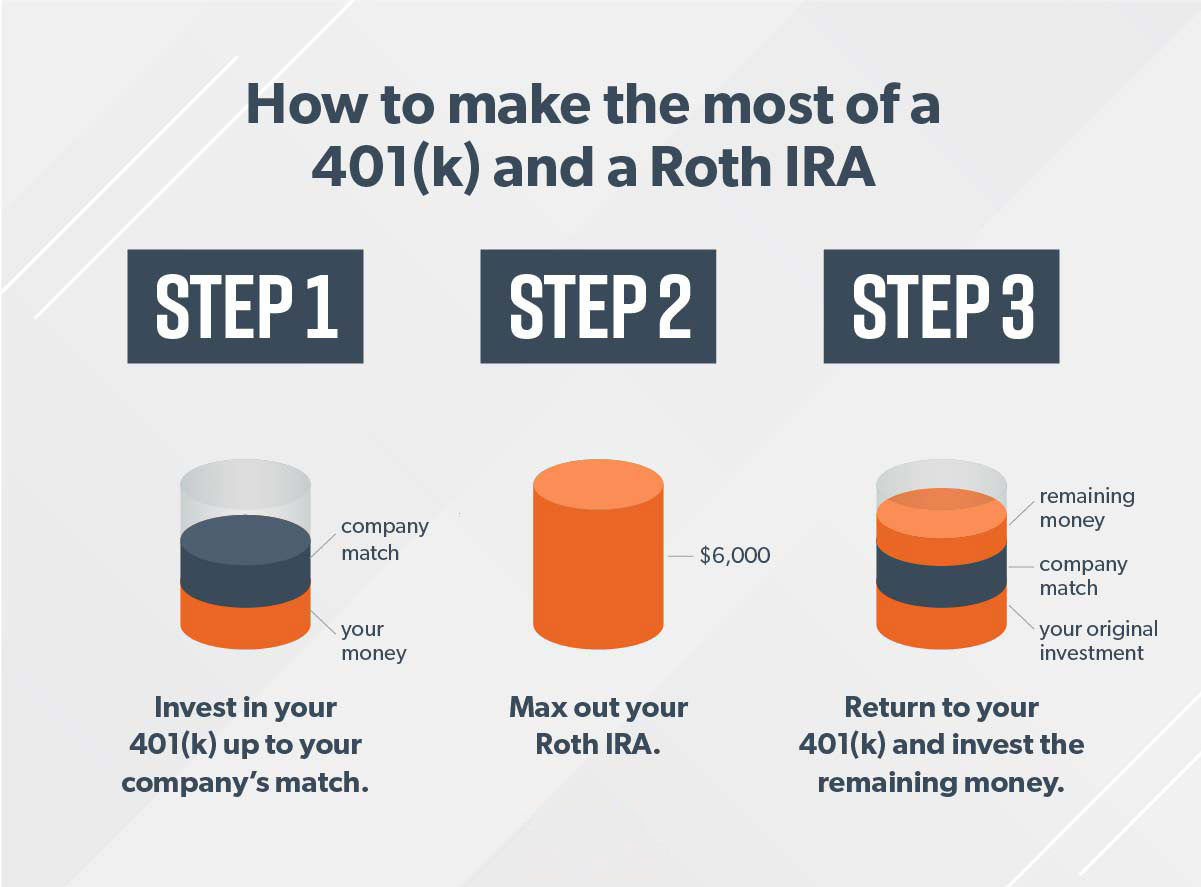

5. Can I have both an IRA and a 401k?

Yes, you can have both an IRA and a 401k. However, there may be certain income limits or contribution limits to consider.

6. Which one is better, an IRA or a 401k?

The choice between an IRA and a 401k depends on various factors such as your employment situation, income level, and investment preferences. It is recommended to consult with a financial advisor to determine the best option for your circumstances.

7. Are there any penalties for withdrawing money from an IRA or a 401k?

Yes, there may be penalties for early withdrawals from both an IRA and a 401k, depending on your age and the specific circumstances. These penalties are in place to discourage early withdrawals and encourage long-term retirement savings.

8. Can I rollover funds from a 401k into an IRA?

Yes, you can rollover funds from a 401k into an IRA. This allows you to have more control over your investments and potentially access a wider range of investment options.

9. Are contributions to an IRA or a 401k tax-deductible?

Contributions to a traditional IRA or a traditional 401k are often tax-deductible, meaning they can lower your taxable income for the year. However, Roth IRA contributions are made with after-tax dollars.

10. Can I contribute to both a traditional IRA and a Roth IRA?

Yes, you can contribute to both a traditional IRA and a Roth IRA. However, there may be certain income limits and contribution limits to consider. It is advisable to consult with a financial advisor to understand the rules and benefits of each type of IRA.