Benefits of Medicare Advantage Plan

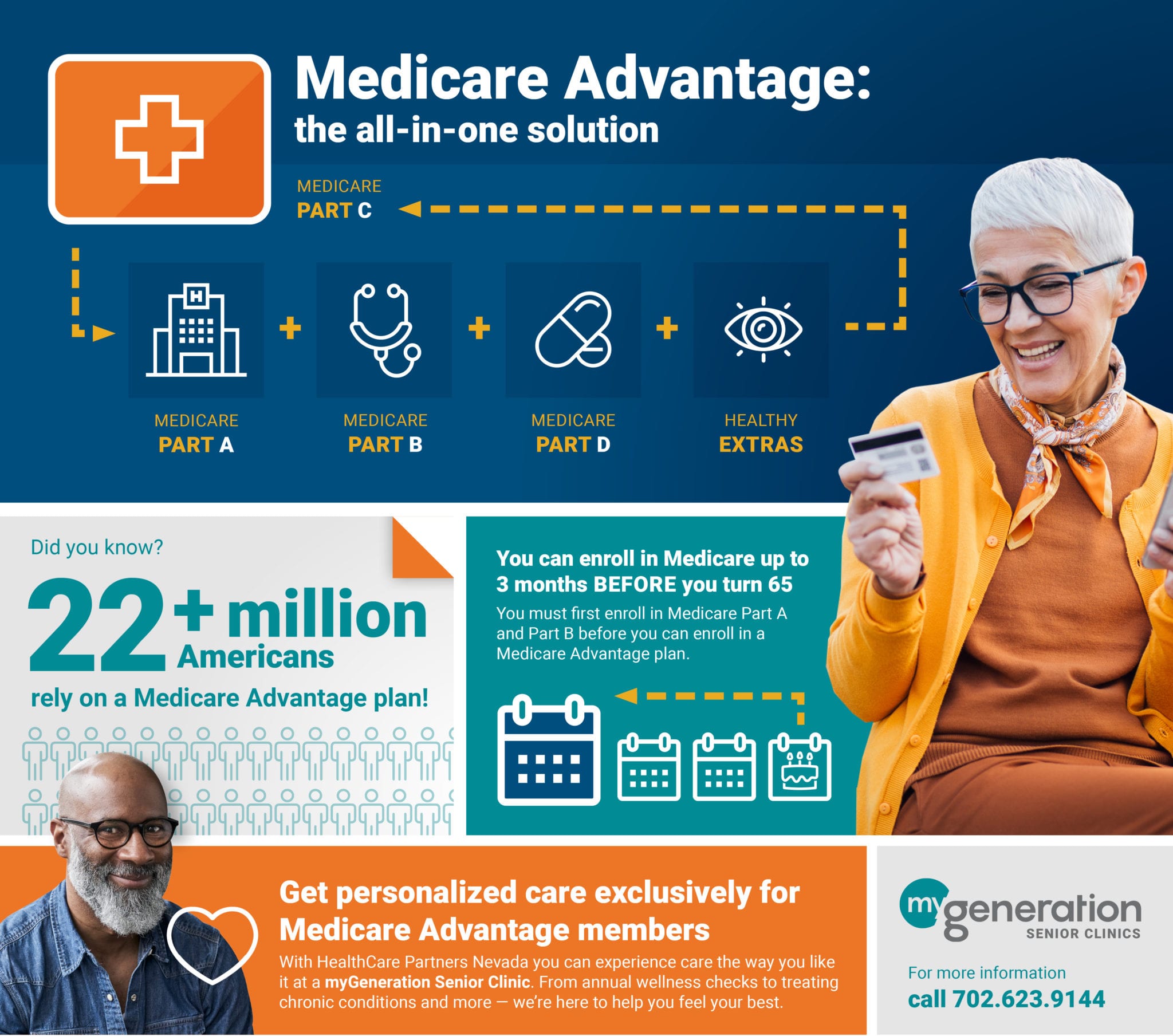

Medicare Advantage plans, also known as Medicare Part C, offer an alternative way to receive your Medicare benefits. These plans are offered by private insurance companies approved by Medicare, and they provide all the coverage of Original Medicare (Part A and Part B), along with additional benefits that can help you save money and improve your healthcare experience. In this article, we will explore the benefits of Medicare Advantage plans and how they can enhance your healthcare coverage.

Comprehensive Coverage

Medicare Advantage plans offer comprehensive coverage that includes all the benefits provided by Original Medicare, such as hospital insurance (Part A) and medical insurance (Part B). This means you will have coverage for hospital stays, doctor visits, preventive care, and other essential healthcare services.

Additional Benefits

One of the main advantages of Medicare Advantage plans is the additional benefits they offer beyond what Original Medicare provides. These additional benefits can vary depending on the plan and the insurance company, but some common examples include:

Prescription drug coverage (Part D): Many Medicare Advantage plans include prescription drug coverage, which can help you save money on your medications.

Vision and dental coverage: Some plans may offer coverage for routine vision and dental care, including exams, cleanings, and even eyeglasses or dentures.

Hearing aids: Medicare Advantage plans may provide coverage for hearing aids and related services, which can be a significant benefit for individuals with hearing impairments.

Wellness programs: Some plans offer access to wellness programs and gym memberships, promoting a healthy lifestyle and preventive care.

Cost Savings

Medicare Advantage plans can also help you save money on your healthcare expenses. While you still need to pay your Medicare Part B premium, some Medicare Advantage plans have low or even zero monthly premiums. Additionally, these plans often have annual out-of-pocket maximums, limiting the amount you have to spend on healthcare services each year.

Moreover, Medicare Advantage plans may have lower copayments and coinsurance for certain services compared to Original Medicare. This can be particularly beneficial if you require frequent doctor visits, specialist care, or hospital stays.

Network of Providers

When you enroll in a Medicare Advantage plan, you typically need to use the plan’s network of healthcare providers. These networks can include doctors, hospitals, pharmacies, and specialists. By using network providers, you can often receive care at a lower cost compared to going out-of-network.

Coordination of Care

Another advantage of Medicare Advantage plans is the coordination of care they provide. These plans often have care management programs and care coordination services to ensure that all your healthcare needs are met. They can help streamline your healthcare experience by coordinating appointments, medications, and treatments among different providers.

Enrollment Flexibility

Medicare Advantage plans have specific enrollment periods, but they also offer flexibility when it comes to switching plans. Each year, during the Annual Enrollment Period (October 15 to December 7), you have the opportunity to review and change your Medicare Advantage plan if needed. This allows you to reassess your healthcare needs and choose a plan that best suits your current situation.

Medicare Advantage plans offer a range of benefits that can enhance your healthcare coverage. From comprehensive coverage and additional benefits to cost savings and coordinated care, these plans provide a valuable alternative to Original Medicare. If you are eligible for Medicare, it’s worth exploring the options available in your area and considering a Medicare Advantage plan that aligns with your healthcare needs and preferences.

Frequently Asked Questions about Medicare Advantage Plans

1. What is a Medicare Advantage plan?

A Medicare Advantage plan, also known as Medicare Part C, is an all-in-one alternative to Original Medicare. It is offered by private insurance companies approved by Medicare.

2. What are the benefits of a Medicare Advantage plan?

A Medicare Advantage plan offers additional benefits beyond Original Medicare, such as prescription drug coverage, vision, dental, and hearing services, and sometimes even fitness programs.

3. Can I keep my doctor with a Medicare Advantage plan?

Most Medicare Advantage plans have a network of doctors and healthcare providers. It’s important to check if your preferred doctor is included in the plan’s network.

4. Are prescription drugs covered under Medicare Advantage?

Yes, most Medicare Advantage plans include prescription drug coverage (Medicare Part D) as part of their benefits package.

5. What is the cost of a Medicare Advantage plan?

The cost of a Medicare Advantage plan varies depending on factors such as the plan’s coverage, location, and the insurance company offering the plan. Some plans may have low or no monthly premiums, but there may be copayments or coinsurance for certain services.

6. Can I switch from Original Medicare to a Medicare Advantage plan?

Yes, during the annual enrollment period (October 15 to December 7), you can switch from Original Medicare to a Medicare Advantage plan if it suits your healthcare needs better.

7. Are there any restrictions on Medicare Advantage plans?

Medicare Advantage plans may have restrictions such as requiring referrals to see specialists or obtaining services within a specific network. It’s important to review the plan’s details and restrictions before enrolling.

8. Can I have both Medicare and a Medicare Advantage plan?

No, you cannot have both Medicare and a Medicare Advantage plan. When you enroll in a Medicare Advantage plan, you are still part of the Medicare program, but your healthcare benefits are provided through the plan.

9. Are there any additional benefits for low-income individuals?

Yes, individuals with limited income and resources may qualify for Extra Help, a program that helps pay for Medicare prescription drug costs. Some Medicare Advantage plans may also offer additional benefits for low-income individuals.

10. Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can switch from a Medicare Advantage plan back to Original Medicare during the Medicare Advantage Disenrollment Period, which runs from January 1 to February 14 each year.