The Benefits of Opening an LLC

When it comes to starting a business, one of the most important decisions you need to make is choosing the right legal structure. One option that has gained significant popularity in recent years is opening a Limited Liability Company (LLC). In this article, we will explore the numerous benefits of opening an LLC and why it may be the ideal choice for your business.

Limited Liability Protection

One of the primary advantages of forming an LLC is the limited liability protection it offers. By establishing an LLC, you create a separate legal entity that is distinct from its owners. This means that the personal assets of the owners, such as their homes or savings, are protected in the event of any legal claims or debts incurred by the business. This limited liability shield provides peace of mind and ensures that your finances remain secure.

Pass-Through Taxation

LLCs enjoy a unique tax advantage known as “pass-through taxation.” Unlike corporations, which are subject to double taxation, LLCs are not taxed at the entity level. Instead, the profits and losses of the business pass through” to the owners’ tax returns. This means that the LLC itself does not pay taxes, and the owners only pay taxes on their share of the profits. Pass-through taxation simplifies the tax process and can result in significant tax savings for LLC owners.

Flexible Management Structure

Another benefit of opening an LLC is the flexibility it offers in terms of management structure. Unlike corporations, which must adhere to a strict hierarchy and formalities, LLCs have more relaxed management requirements. LLCs can be managed by their owners, known as “members,” or they can appoint managers to handle the day-to-day operations. This flexibility allows for a more adaptable and less bureaucratic business structure.

Enhanced Credibility and Professionalism

Forming an LLC can enhance the credibility and professionalism of your business. Having “LLC” in your company name demonstrates to clients, customers, and partners that you are a legally recognized and registered entity. This can instill confidence in your brand and help attract potential customers and investors. Additionally, an LLC structure can lend a sense of permanence and stability to your business, which may be appealing to stakeholders.

Easy Transfer of Ownership

LLCs offer a straightforward and hassle-free process for transferring ownership. If an owner wants to sell their interest or leave the business, they can easily transfer their ownership to another individual or entity. This flexibility ensures the continuity of the business and allows for smooth transitions in ownership without disrupting operations.

Opening an LLC comes with numerous benefits that can contribute to the success and growth of your business. From limited liability protection to pass-through taxation, flexible management structure, enhanced credibility, and easy transfer of ownership, an LLC provides a solid foundation for your entrepreneurial endeavors. Consider consulting with a legal professional or business advisor to determine if forming an LLC is the right choice for your specific circumstances. Take advantage of the benefits an LLC offers and position your business for long-term success.

Frequently Asked Questions about the Benefits of Opening an LLC

1. What is an LLC?

An LLC (Limited Liability Company) is a legal business structure that combines the benefits of a corporation and a partnership or sole proprietorship.

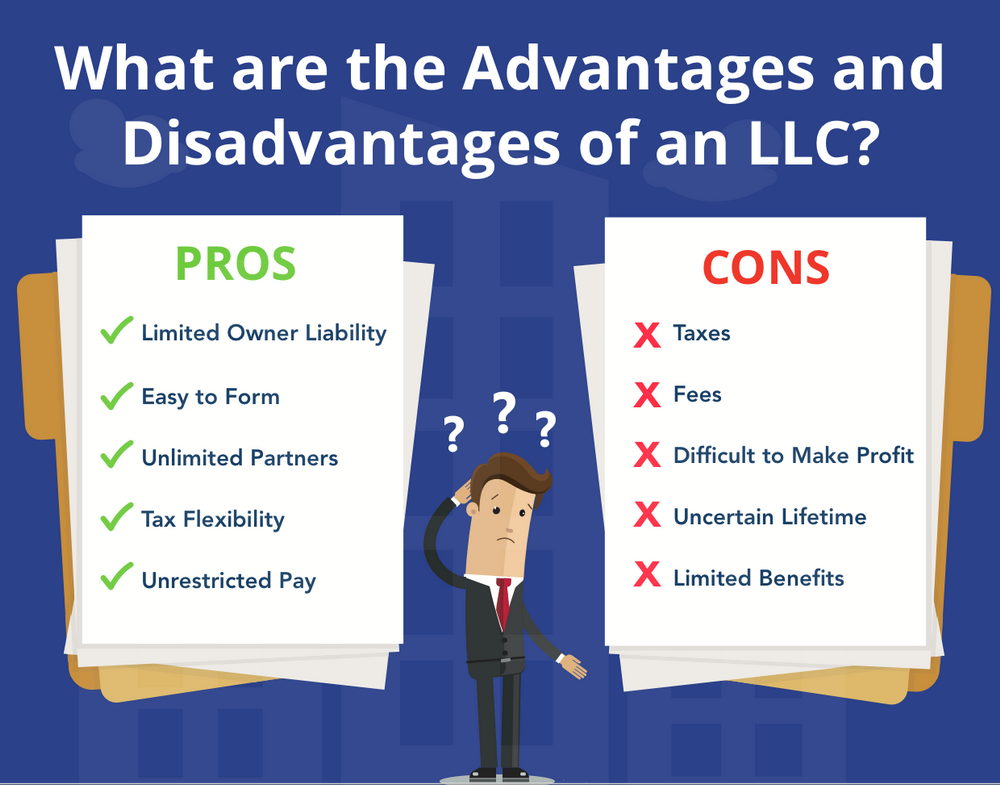

2. What are the advantages of opening an LLC?

Some benefits of opening an LLC include limited liability protection for owners, pass-through taxation, flexibility in management, and ease of formation.

3. How does limited liability protection work in an LLC?

When you open an LLC, your assets are separate from the business’s debts and liabilities. This means that your assets are generally protected if the LLC faces legal issues or bankruptcy.

4. Can an LLC have multiple owners?

Yes, an LLC can have multiple owners, known as members. This allows for shared responsibilities, pooled resources, and the ability to attract investment from multiple individuals.

5. What is pass-through taxation in an LLC?

LLCs are not subject to corporate income tax. Instead, the profits and losses of the LLC pass through” through to the owners’ tax returns, where they are taxed at the individual level.

6. Are there any restrictions on who can open an LLC?

No, LLCs can be formed by individuals, partnerships, corporations, or even other LLCs. There are generally no restrictions on residency or citizenship for LLC owners.

7. Can an LLC choose its management structure?

Yes, LLCs have flexibility in choosing their management structure. They can be managed by the owners themselves (member-managed) or by appointed managers (manager-managed).

8. How easy is it to form an LLC?

Forming an LLC is relatively straightforward. The process involves filing the necessary paperwork, paying the required fees, and complying with state-specific regulations. It is recommended to consult with an attorney or use online services to ensure compliance.

9. Are there any ongoing requirements for maintaining an LLC?

LLCs are generally required to file annual reports, pay state fees, and maintain proper records of business activities. These requirements vary by state, so it’s important to stay informed about your specific obligations.

10. Can an LLC be converted into another business structure later?

Yes, it is possible to convert an LLC into a different business structure, such as a corporation or partnership, if the needs of the business change over time. However, the process and requirements for conversion may vary depending on the state.