Benefits of Real Estate

Real estate is a lucrative industry that offers numerous advantages for investors and homeowners alike. In this article, we will explore the various benefits of real estate and how it can be a valuable asset in your investment portfolio.

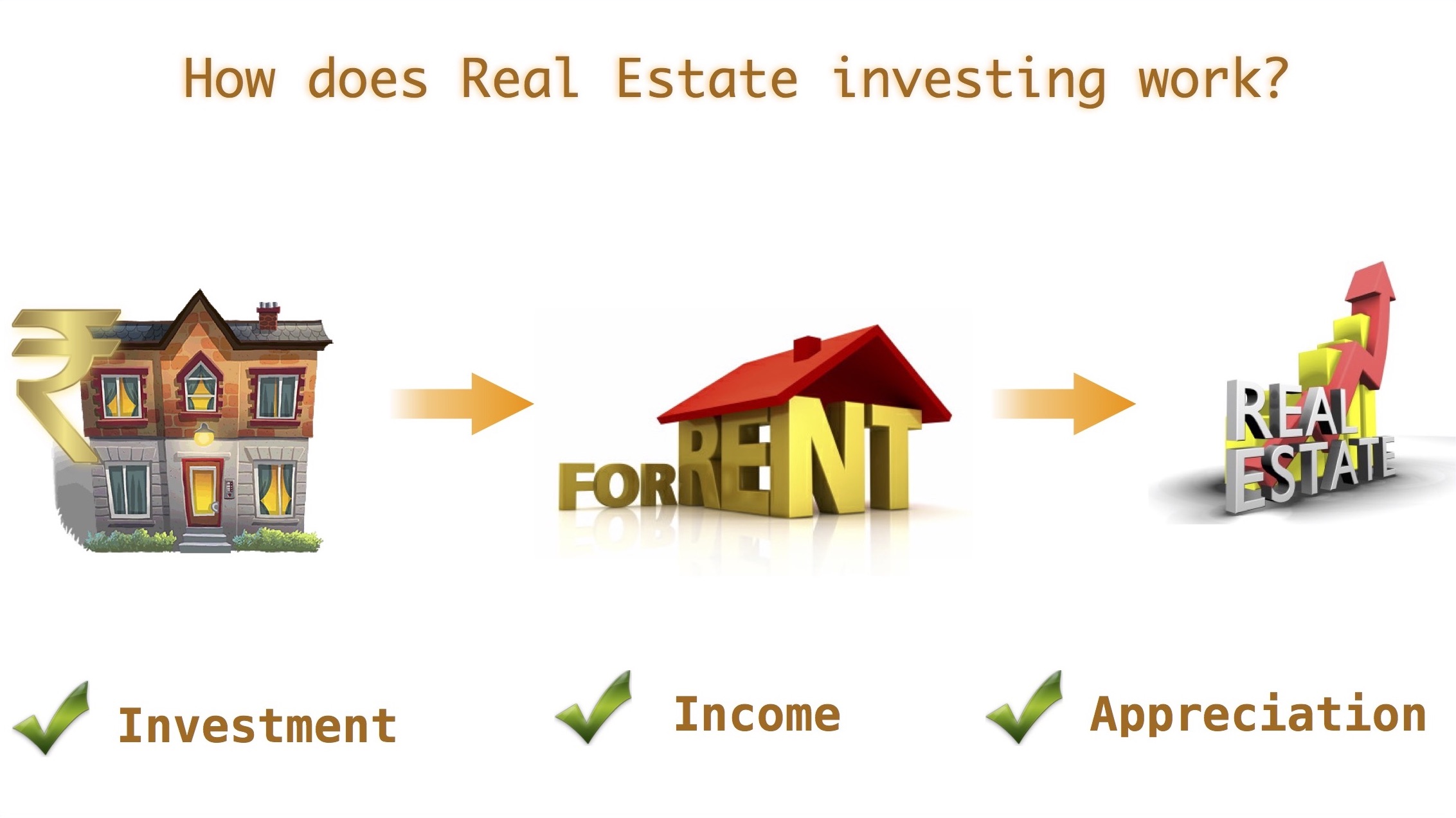

Long-Term Appreciation

One of the primary benefits of investing in real estate is the potential for long-term appreciation. Unlike other assets that may depreciate over time, real estate has historically shown a tendency to increase in value. This appreciation can lead to significant wealth accumulation, making real estate a smart investment choice.

Passive Income Generation

Another advantage of real estate is the ability to generate passive income. Rental properties, for example, can provide a steady stream of income through monthly rent payments. This passive income can be used to cover mortgage payments, and property maintenance costs, and even contribute to your overall financial goals.

Tax Benefits

Real estate investments offer various tax benefits that can help reduce your overall tax liability. For instance, rental income is typically taxed at a lower rate compared to regular income. Additionally, real estate investors may be eligible for deductions on mortgage interest, property taxes, and depreciation expenses. These tax advantages can significantly improve your financial position.

Diversification

Adding real estate to your investment portfolio can provide diversification, which is crucial for minimizing risk. Real estate investments have a low correlation with other asset classes, such as stocks and bonds. This means that when other investments may be experiencing volatility, real estate can offer stability and act as a hedge against market fluctuations.

Inflation Hedge

Real estate investments have historically been considered an effective hedge against inflation. As the cost of living increases, so does the value of real estate. By investing in property, you can protect your purchasing power and preserve wealth in times of inflation.

Control and Tangible Asset

Unlike some other investment options, real estate provides you with a tangible asset that you can control. You can make improvements, increase its value, and have a direct influence on its performance. This level of control can be empowering and allows you to actively manage your investment for optimal returns.

Leverage

Real estate investments offer the opportunity to leverage your capital. By utilizing financing options such as mortgages, you can purchase properties with a relatively small initial investment. This allows you to amplify your returns and increase your overall wealth.

Retirement Planning

Investing in real estate can be an excellent strategy for retirement planning. A steady income from rental properties can provide a reliable source of funds during retirement. Additionally, if you decide to sell your properties, you can use the proceeds to fund your retirement lifestyle or reinvest in other income-generating assets.

Real estate offers a multitude of benefits, including long-term appreciation, passive income generation, tax advantages, diversification, inflation hedge, control over tangible assets, leverage, and retirement planning. By understanding and harnessing these advantages, you can position yourself for financial success and build wealth over time. Consider incorporating real estate into your investment strategy and take advantage of the many benefits it has to offer.

Frequently Asked Questions about the Benefits of Real Estate

1. What are the advantages of investing in real estate?

Investing in real estate offers several benefits such as potential for long-term appreciation, passive income through rental properties, diversification of investment portfolio, and tax advantages.

2. How does real estate provide a hedge against inflation?

Real estate investments tend to increase in value over time, which helps protect against inflation. As the cost of living rises, rental income and property values typically follow suit, ensuring that your investment keeps pace with inflation.

3. Can real estate be a source of regular income?

Absolutely! Owning rental properties allows you to generate regular income through monthly rental payments. This can provide a stable and consistent cash flow, especially if you have multiple properties.

4. Are there any tax benefits associated with real estate investments?

Yes, real estate investments offer various tax advantages. These may include deductions for mortgage interest, property taxes, depreciation, and operating expenses. Consult with a tax professional to understand how these benefits apply to your specific situation.

5. How does real estate diversify an investment portfolio?

Real estate investments have a low correlation with other asset classes like stocks and bonds. Adding real estate to your investment portfolio can help spread risk and potentially enhance overall returns.

6. Can real estate provide a sense of stability and security?

Real estate is often considered a tangible and physical asset that provides a sense of stability and security. Unlike other investment options, you can physically see and touch your real estate holdings, which can offer peace of mind to investors.

7. What are the potential long-term benefits of real estate investments?

Real estate has the potential for long-term appreciation, meaning the value of your property can increase over time. This can lead to significant wealth accumulation and financial security in the future.

8. How can real estate investments help with retirement planning?

Investing in real estate can be a smart strategy for retirement planning. Rental income from properties can serve as a reliable income stream during retirement, helping to cover living expenses and supplement other retirement savings.

9. What role does real estate play in building wealth?

Real estate has historically been a proven method for building wealth. Through property appreciation, rental income, and potential tax advantages, real estate investments can contribute to long-term wealth accumulation and financial independence.

10. Are there any risks associated with real estate investments?

Like any investment, real estate carries some risks. These may include property market fluctuations, potential vacancies, property damage, and changes in interest rates. However, with proper research, due diligence, and risk management, these risks can be minimized.