Benefits of Refinancing Home

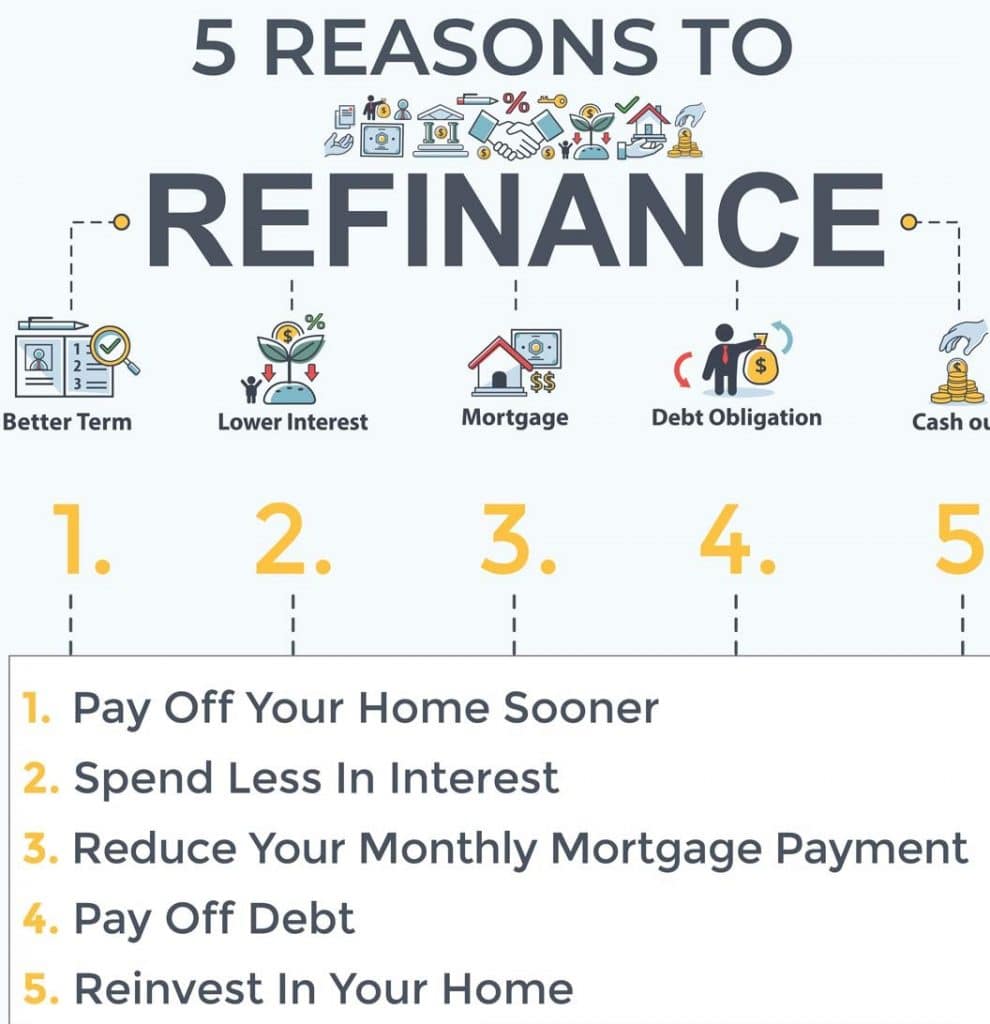

Refinancing your home can offer numerous advantages, allowing you to save money, reduce your monthly mortgage payments, and achieve your financial goals. In this article, we will discuss the key benefits of refinancing your home and how it can help you improve your financial situation.

Lower Interest Rates

One of the primary reasons homeowners choose to refinance their homes is to take advantage of lower interest rates. By refinancing at a lower rate, you can significantly reduce the amount of interest you pay over the life of your mortgage. This can result in substantial savings, allowing you to allocate those funds towards other financial goals or investments.

Decreased Monthly Payments

Refinancing your home can also lead to lower monthly mortgage payments. When you refinance to a lower interest rate or extend the term of your loan, your monthly payments can become more affordable. This can free up additional cash flow, which you can use to pay off debts, save for the future, or cover other expenses.

Consolidating Debt

Another benefit of refinancing is the ability to consolidate high-interest debt. If you have multiple loans or credit card balances with high-interest rates, refinancing your home can allow you to pay off those debts by rolling them into your mortgage. By consolidating your debt, you can simplify your finances and potentially reduce the overall interest you pay.

Access to Equity

Refinancing your home can provide you with access to the equity you have built over time. By refinancing, you can borrow against the equity in your home and use the funds for various purposes such as home improvements, education expenses, or starting a business. This can be a cost-effective way to access the money you need, as mortgage interest rates are often lower than other types of loans.

Change Loan Term

Refinancing also allows you to change the term of your loan. If you want to pay off your mortgage faster, you can refinance to a shorter term, such as switching from a 30-year mortgage to a 15-year mortgage. This can help you save on interest payments and achieve homeownership sooner. On the other hand, if you prefer lower monthly payments, you can extend the term of your loan, providing you with more flexibility in your budget.

Switching Loan Types

Refinancing your home allows you to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage or vice versa. If you currently have an ARM and want more stability in your monthly payments, refinancing to a fixed-rate mortgage can provide peace of mind. Conversely, if you have a fixed-rate mortgage and believe interest rates will decrease in the future, refinancing to an ARM can potentially save you money.

Remove Private Mortgage Insurance (PMI)

If you initially financed your home with less than a 20% down payment, you may be required to pay private mortgage insurance (PMI). However, as you build equity in your home, refinancing can allow you to eliminate PMI if your loan-to-value ratio meets the requirements. Removing PMI can result in significant savings, reducing your monthly mortgage payment.

Refinancing your home can offer a range of benefits, including lower interest rates, decreased monthly payments, debt consolidation, access to equity, flexibility in loan terms, the ability to switch loan types, and the removal of PMI. These benefits can help you save money, improve your financial situation, and achieve your long-term goals. If you are considering refinancing, it is essential to evaluate your options, compare offers from different lenders, and consult with a mortgage professional to determine the best course of action for your specific needs.

Frequently Asked Questions about the Benefits of Refinancing a Home

1. What is refinancing a home?

Refinancing a home is the process of replacing an existing mortgage with a new one, often to obtain better loan terms or interest rates.

2. What are the potential benefits of refinancing a home?

Some benefits of refinancing a home include lower monthly mortgage payments, reduced interest rates, access to home equity, and the ability to consolidate debt.

3. How can refinance lower my monthly mortgage payments?

Refinancing can lower monthly payments by securing a lower interest rate, extending the loan term, or both, resulting in reduced monthly mortgage obligations.

4. Can refinancing help me save money on interest?

Yes, refinancing at a lower interest rate can save you money on interest over the life of your loan, especially if you plan to stay in your home for a significant period.

5. What is cash-out refinancing?

Cash-out refinancing allows homeowners to borrow against their home equity by refinancing for an amount greater than the current mortgage balance. The excess funds can be used for various purposes.

6. How does refinancing help me access home equity?

Refinancing can provide access to home equity by allowing you to borrow against the increased value of your home, which can be used for home improvements, debt consolidation, or other financial needs.

7. Can refinancing help me consolidate debt?

Yes, refinancing can be used to consolidate high-interest debts, such as credit card balances or personal loans, into a single, lower-interest mortgage payment, potentially saving you money in the long run.

8. Are there any costs associated with refinancing a home?

Yes, refinancing typically involves closing costs, which can include appraisal fees, application fees, title search fees, and other expenses. It’s important to consider these costs when evaluating the potential benefits of refinancing.

9. How do I know if refinancing is right for me?

Deciding if refinancing is right for you depends on various factors, such as your current interest rate, loan term, financial goals, and how long you plan to stay in your home. Consulting with a mortgage professional can help you make an informed decision.

10. Can I refinance my home multiple times?

Yes, it is possible to refinance your home multiple times, depending on your financial circumstances and goals. However, it’s essential to consider the costs and potential benefits of each refinancing opportunity.