Benefits of Renters Insurance

As experts in the field of SEO and copywriting, we understand the importance of creating high-quality content that can outrank other websites in search results. In this article, we will explore the benefits of renters insurance and provide you with comprehensive information to help you make an informed decision. Let’s dive in!

Protect Your Personal Belongings

One of the primary benefits of renters insurance is the protection it offers for your personal belongings. Whether you own expensive electronics, furniture, or valuable jewelry, renters insurance can provide coverage in case of theft, fire, or other covered perils. It’s crucial to have this protection, as your landlord’s insurance typically only covers the building structure, not your possessions.

Liability Coverage

Another significant advantage of renters insurance is liability coverage. Accidents can happen at any time, and if someone gets injured while visiting your rented property, you may be held responsible. Renters insurance can help cover medical expenses and legal fees in such situations, providing you with peace of mind and financial protection.

Temporary Living Expenses

In the unfortunate event that your rented property becomes uninhabitable due to a covered loss, renters insurance can help cover your temporary living expenses. This includes hotel bills, meals, and other necessary costs while your home is being repaired or rebuilt. It’s essential to review your policy to understand the specific limits and coverage provided.

Additional Living Expenses

Additionally, renters insurance can provide coverage for additional living expenses beyond temporary living expenses. If you have to move out of your rented property permanently due to a covered loss, your policy may cover the cost of finding a new place to live, moving expenses, and even storage fees. This can be a significant relief during a challenging time.

Medical Payments Coverage

Renters insurance often includes medical payments coverage, which can help pay for medical expenses if someone gets injured on your property, regardless of whether you were at fault. This coverage can help prevent potential lawsuits and ensure that medical bills are taken care of promptly.

Loss of Use Coverage

Loss of use coverage is another valuable aspect of renters insurance. If your rented property becomes uninhabitable due to a covered loss, this coverage can help reimburse you for any necessary increase in living expenses. It can cover costs like temporary rentals, hotel stays, and even transportation expenses.

Peace of Mind

Ultimately, one of the greatest benefits of renters insurance is the peace of mind it provides. Knowing that you have financial protection in case of unexpected events can alleviate stress and allow you to focus on other aspects of your life. Renters insurance offers a safety net that can provide comfort and security.

Renters insurance offers a wide range of benefits, including protecting your personal belongings, providing liability coverage, and offering financial assistance for temporary living expenses. It also covers additional living expenses, medical payments, and loss of use. With renters insurance, you can have peace of mind knowing that you are protected against unforeseen circumstances. Don’t wait until it’s too late; consider getting renters insurance today!

Frequently Asked Questions

1. What is renters insurance?

Renters insurance is a type of insurance policy that provides coverage for your personal belongings and liability protection while renting a property.

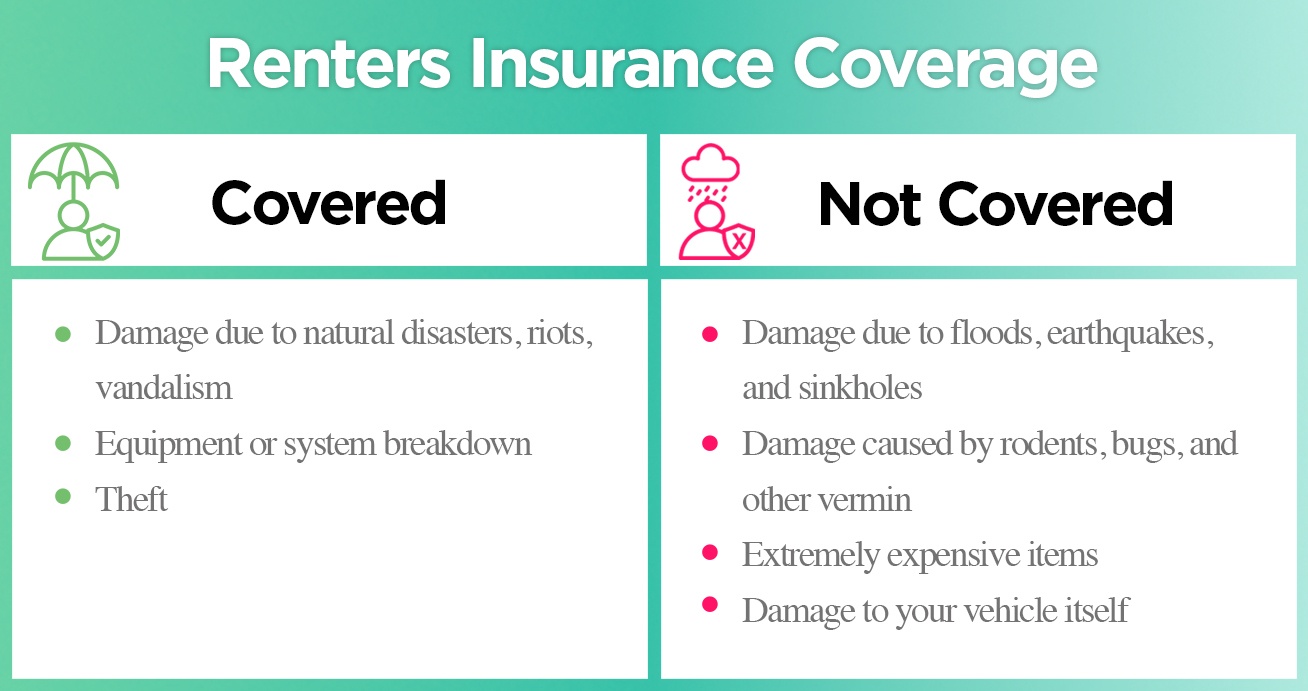

2. What does renters insurance cover?

Renters insurance typically covers your personal belongings against theft, fire, vandalism, and natural disasters. It also provides liability coverage if someone is injured in your rented property.

3. How much does renters insurance cost?

The cost of renters insurance can vary depending on factors such as your location, the value of your belongings, and the coverage limits you choose. On average, renters insurance can cost between $15 and $30 per month.

4. Do I need renters insurance?

While renters insurance is not legally required, it is highly recommended. Without renters insurance, you would be responsible for replacing your belongings and covering any liability claims out of pocket, which can be costly.

5. Can I get renters insurance if I live in an apartment?

Absolutely! Renters insurance is available for all types of rental properties, including apartments, condos, townhouses, and single-family homes.

6. Does renters insurance cover my roommate’s belongings?

No, renters insurance typically only covers your personal belongings. If your roommate wants coverage, they would need to get their own renter’s insurance policy.

7. Can I add additional coverage to my renter’s insurance policy?

Yes, you can often add additional coverage options to your renter’s insurance policy, such as coverage for expensive jewelry, electronics, or high-value items.

8. Does renters insurance cover damage caused by pets?

It depends on the policy. Some renter’s insurance policies may provide coverage for certain types of pet-related damages, while others may exclude such coverage. It’s important to review the policy details and discuss them with your insurance provider.

9. Will renters insurance cover temporary living expenses if I have to move out due to a covered loss?

Yes, many renters insurance policies include coverage for additional living expenses if you are temporarily displaced from your rented property due to a covered loss, such as fire or water damage.

10. How do I file a claim with my renter’s insurance?

To file a claim, you should contact your insurance provider as soon as possible. They will guide you through the process and provide the necessary forms and documentation requirements to submit your claim.