Benefits of Revocable Trusts

A revocable trust, also known as a living trust, is a legal document that allows individuals to transfer their assets into a trust during their lifetime. This type of trust provides numerous benefits and can be an effective tool for estate planning. In this article, we will explore the various advantages of revocable trusts and how they can benefit individuals and their families.

Asset Management and Probate Avoidance

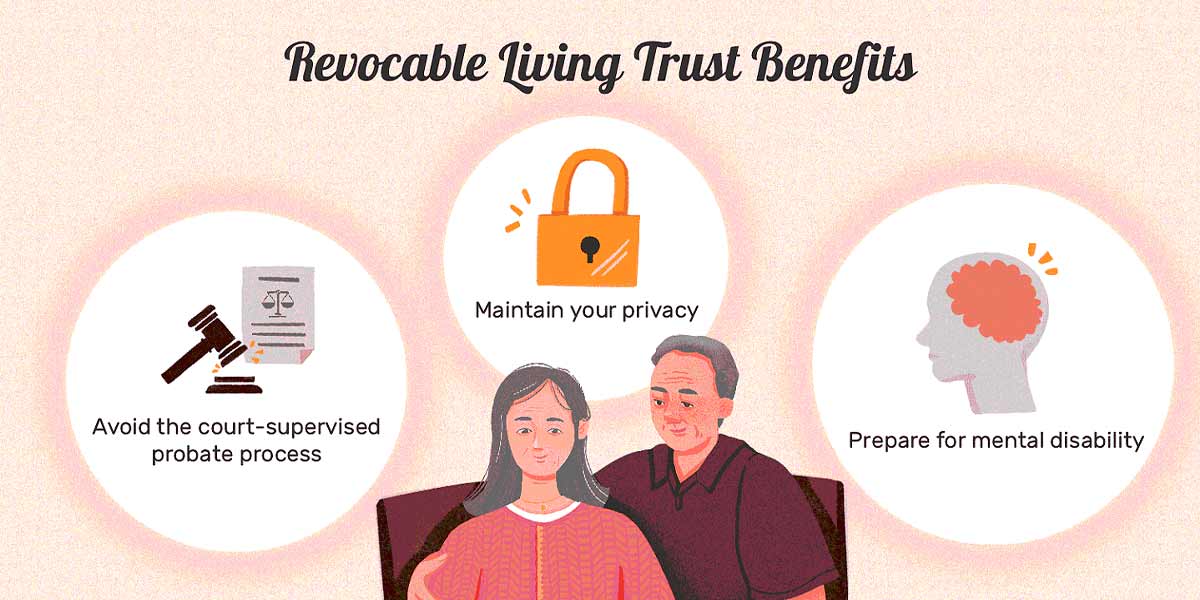

One of the key benefits of a revocable trust is the ability to efficiently manage and distribute assets. By transferring assets into the trust, individuals can maintain control over their assets during their lifetime while designating specific beneficiaries to receive those assets upon their death. Unlike a will, which goes through the probate process, assets held in a revocable trust can bypass probate, saving time and costs associated with the court process.

Privacy and Confidentiality

Another advantage of a revocable trust is the ability to maintain privacy and confidentiality. Unlike a will, which becomes a public document upon probate, a revocable trust allows for the private transfer of assets. This means that details of the trust, including its terms and beneficiaries, can remain confidential, providing individuals with a greater level of privacy and control over their estate.

Flexibility and Control

A revocable trust offers individuals the flexibility to make changes or revoke the trust entirely during their lifetime. This flexibility allows individuals to adapt to changing circumstances, such as changes in family dynamics, financial situations, or estate planning goals. By retaining control over the trust, individuals can ensure their assets are managed according to their wishes.

Disability Planning

Revocable trusts also provide a mechanism for disability planning. In the event an individual becomes incapacitated or unable to manage their affairs, a successor trustee can step in and manage the trust assets on their behalf. This can help avoid the need for a court-appointed guardian or conservator, providing a seamless transition of asset management during times of incapacity.

Tax Efficiency

Revocable trusts do not provide direct tax benefits, as they are considered “grantor trusts” for income tax purposes. However, they can be structured to provide potential estate tax planning benefits. By including specific provisions within the trust, such as the use of marital or charitable deductions, individuals can minimize estate taxes and maximize the value of assets passed on to their beneficiaries.

In summary, a revocable trust offers numerous benefits for individuals and their families. From efficient asset management and probate avoidance to privacy, flexibility, and disability planning, a revocable trust can be a valuable tool in estate planning. By understanding the advantages of revocable trusts, individuals can make informed decisions to protect and distribute their assets according to their wishes.

Frequently Asked Questions about the Benefits of Revocable Trusts

1. What is a revocable trust?

A revocable trust, also known as a living trust, is a legal arrangement where an individual (the grantor) transfers their assets into a trust, which is managed by a trustee. The grantor retains the ability to modify or revoke the trust during their lifetime.

2. What are the main benefits of a revocable trust?

The main benefits of a revocable trust include avoiding probate, maintaining privacy, providing for incapacity, and enabling efficient asset distribution upon death.

3. How does a revocable trust help avoid probate?

When assets are held in a revocable trust, they do not go through the probate process, which can be time-consuming and costly. The trust allows for a smooth transfer of assets to beneficiaries upon the grantor’s death.

4. Can a revocable trust provide privacy?

Absolutely. Unlike a will, which becomes a public record after probate, a revocable trust keeps your asset distribution private. It allows you to maintain confidentiality and avoid public scrutiny.

5. How does a revocable trust help in case of incapacity?

If the grantor becomes incapacitated, the revocable trust ensures a seamless transition of management of assets. The successor trustee, named by the grantor, can take over without the need for court intervention.

6. Can a revocable trust protect assets from creditors?

No, a revocable trust does not provide asset protection from creditors. However, it can be combined with other estate planning tools to achieve asset protection goals.

7. Are there any tax benefits associated with a revocable trust?

A revocable trust does not provide direct tax benefits. The trust is considered a pass-through entity for tax purposes, and the grantor continues to pay taxes on the trust’s income using their own tax identification number.

8. Can a revocable trust help minimize estate taxes?

No, a revocable trust does not offer estate tax minimization benefits. However, it can be used in conjunction with other estate planning strategies to reduce estate taxes, such as creating an irrevocable trust.

9. Is it possible to change or revoke a revocable trust?

Yes, the grantor has the power to modify or revoke the trust at any time as long as they are mentally competent. This flexibility is one of the key advantages of a revocable trust.

10. What happens to a revocable trust upon the grantor’s death?

Upon the grantor’s death, the revocable trust becomes irrevocable. The successor trustee then follows the instructions outlined in the trust document to distribute the assets to the beneficiaries.