The Benefits of Roth IRAs

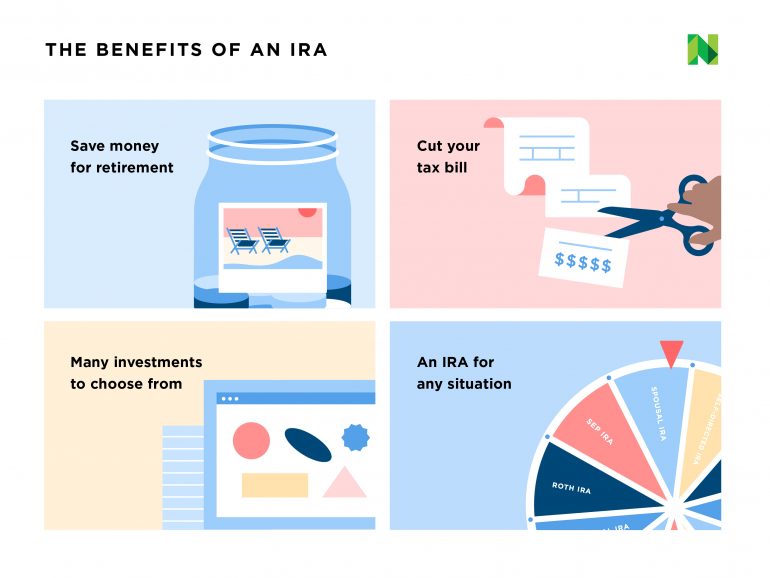

A Roth Individual Retirement Account (IRA) is a popular investment option for individuals looking to secure their financial future. In this article, we will explore the various benefits of Roth IRAs and why they are an excellent choice for long-term savings.

Tax-Free Growth

One of the key advantages of a Roth IRA is the potential for tax-free growth. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars. This means that any earnings within the account, including interest, dividends, and capital gains, can grow tax-free.

Tax-Free Withdrawals

Another significant benefit of Roth IRAs is the ability to make tax-free withdrawals in retirement. Since contributions have already been taxed, qualified distributions from a Roth IRA are not subject to federal income taxes. This can provide a substantial advantage during retirement, especially if tax rates increase in the future.

No Required Minimum Distributions

Unlike traditional IRAs, Roth IRAs do not have required minimum distributions (RMDs) during the account owner’s lifetime. This means that you can keep your money invested for as long as you want, allowing it to potentially grow even further. RMDs can be a burden for individuals who don’t necessarily need the funds and prefer to leave them untouched for future generations.

Flexibility and Accessibility

Roth IRAs offer flexibility and accessibility when it comes to accessing your funds. Since contributions are made with after-tax dollars, you can withdraw your original contributions at any time without penalty or taxes. However, it’s important to note that withdrawing earnings before age 59½ may result in taxes and penalties unless it’s for a qualified reason such as a first-time home purchase or higher education expenses.

Income Limits and Eligibility

While Roth IRAs offer numerous benefits, it’s essential to understand the income limits and eligibility requirements. In 2021, individuals with a modified adjusted gross income (MAGI) of $140,000 or more (or $208,000 or more for married couples filing jointly) are not eligible to contribute directly to a Roth IRA. However, there are strategies such as a backdoor Roth IRA conversion that can provide a workaround for high-income earners.

In summary, Roth IRAs offer a range of benefits that make them an attractive option for retirement savings. With tax-free growth, tax-free withdrawals, no required minimum distributions, and flexibility in accessing funds, individuals can secure their financial future while enjoying potential tax advantages. It’s important to consider your specific financial situation and consult with a financial advisor to determine if a Roth IRA is the right choice for you.

Frequently Asked Questions about the Benefits of Roth IRAs

1. What is a Roth IRA?

A Roth IRA is an individual retirement account that allows you to contribute after-tax income and potentially enjoy tax-free growth and withdrawals in retirement.

2. What are the main benefits of a Roth IRA?

The main benefits of a Roth IRA include tax-free withdrawals in retirement, the potential for tax-free growth, no required minimum distributions (RMDs), and flexibility in accessing contributions without penalties.

3. How much can I contribute to a Roth IRA?

For 2021, the maximum contribution limit for a Roth IRA is $6,000 ($7,000 if you are 50 years or older). These limits may be subject to income restrictions.

4. Are there income limits for contributing to a Roth IRA?

Yes, there are income limits for contributing to a Roth IRA. For 2021, the eligibility to contribute to a Roth IRA phases out for individuals with a modified adjusted gross income (MAGI) above $125,000 ($198,000 for married couples filing jointly).

5. Can I contribute to both a traditional IRA and a Roth IRA?

Yes, you can contribute to both a traditional IRA and a Roth IRA in the same year, but the total combined contributions cannot exceed the annual limits set by the IRS.

6. Are Roth IRA withdrawals taxed?

No, qualified withdrawals from a Roth IRA are tax-free. Since you contribute after-tax income to a Roth IRA, you won’t owe taxes on qualified distributions in retirement.

7. Can I convert a traditional IRA to a Roth IRA?

Yes, you can convert a traditional IRA to a Roth IRA through a process called a Roth IRA conversion. However, the converted amount will be subject to income taxes in the year of conversion.

8. Are there penalties for early withdrawals from a Roth IRA?

There are generally no penalties for withdrawing your contributions from a Roth IRA at any time. However, if you withdraw earnings before reaching age 59½ and before the account has been open for at least five years, you may owe taxes and penalties on the earnings portion.

9. Can I contribute to a Roth IRA if I have a 401(k) at work?

Yes, you can contribute to a Roth IRA even if you have a 401(k) or other retirement plan at work. However, your ability to deduct traditional IRA contributions may be limited based on your income and participation in an employer-sponsored plan.

10. Are there any age restrictions for contributing to a Roth IRA?

No, there are no age restrictions for contributing to a Roth IRA as long as you have earned income. Unlike traditional IRAs, Roth IRAs do not have age limits for contributions.