Benefits of S Corp vs LLC

In this article, we will explore the benefits of choosing an S Corporation (S Corp) or a Limited Liability Company (LLC) as the legal structure for your business. Both S Corps and LLCs provide limited liability protection, but they differ in terms of taxation, ownership structure, and operational flexibility.

Taxation

One of the key differences between an S Corp and an LLC is how they are taxed.

S Corporation Taxation

An S Corp is a pass-through entity, which means that the profits and losses of the business are passed through to the shareholders and reported on their tax returns. This avoids double taxation, as the business itself does not pay federal income taxes.

Shareholders of an S Corp are required to pay themselves a reasonable salary, which is subject to payroll taxes. However, any remaining profits can be distributed to shareholders as dividends, which are not subject to self-employment taxes.

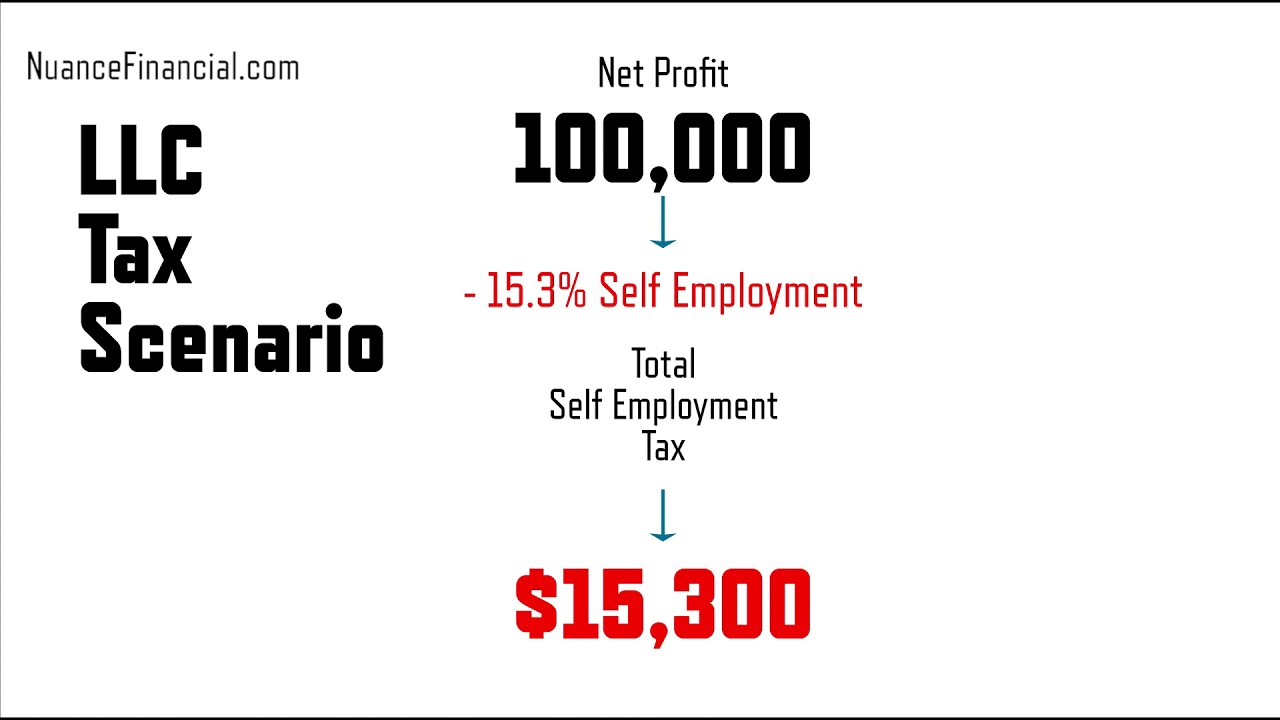

LLC Taxation

An LLC also has the option to be taxed as a pass-through entity, similar to an S Corp. By default, an LLC is taxed as a disregarded entity for single-member LLCs or as a partnership for multi-member LLCs. This means that the profits and losses of the business are reported on the owner(s) personal tax returns.

Alternatively, an LLC can elect to be taxed as an S Corp by filing Form 2553 with the IRS. This allows the LLC to take advantage of the pass-through taxation while also providing some of the benefits of an S Corp, such as the ability to pay a salary to owners.

Ownership Structure

The ownership structure of an S Corp and an LLC also differs.

S Corporation Ownership

An S Corp has more restrictions on ownership compared to an LLC. An S Corp can have a maximum of 100 shareholders, who must be U.S. citizens or residents and cannot be corporations or partnerships. Additionally, an S Corp cannot have nonresident alien shareholders.

Furthermore, S Corps has only one class of stock, meaning that all shareholders have the same rights and privileges. This structure can be beneficial for businesses that want to maintain a more formal ownership structure.

LLC Ownership

An LLC, on the other hand, has more flexibility in terms of ownership. It can have an unlimited number of members, who can be individuals, corporations, partnerships, or even foreign entities. LLCs can also have different classes of membership interests, allowing for more complex ownership arrangements.

This flexibility makes LLCs a popular choice for businesses with multiple owners or those seeking to attract outside investors.

Operational Flexibility

Both S Corps and LLCs offer operational flexibility, but there are some differences to consider.

S Corporation Operational Flexibility

An S Corp is required to follow more formalities compared to an LLC. This includes holding regular director and shareholder meetings, keeping minutes, and maintaining corporate bylaws. Failure to comply with these formalities may jeopardize the limited liability protection.

Additionally, an S Corp must allocate profits and losses to shareholders in proportion to their ownership percentage, regardless of the amount of capital contributed.

LLC Operational Flexibility

An LLC has fewer formalities and administrative requirements. While an operating agreement is highly recommended, an LLC is not required to hold regular meetings or keep extensive records.

Furthermore, LLCs have more flexibility in allocating profits and losses among members. This allows for more customized distribution arrangements based on the members’ contributions and agreements.

In summary, both S Corps and LLCs offer limited liability protection, but they differ in terms of taxation, ownership structure, and operational flexibility.

If you prefer pass-through taxation and a more formal ownership structure, an S Corp may be the right choice for your business. On the other hand, if you value flexibility in ownership and fewer administrative requirements, an LLC could be the better option.

It is important to consult with a qualified attorney or tax professional to determine the best legal structure for your specific business needs.

Frequently Asked Questions

1. What are the main benefits of forming an S Corporation?

One of the main benefits of forming an S Corporation is that it provides limited liability protection to its owners, just like an LLC. Additionally, S Corps offers potential tax savings through the pass-through taxation system.

2. How does an LLC differ from an S Corp in terms of taxation?

While both LLCs and S Corps offer pass-through taxation, S Corps have more strict requirements for shareholders and are subject to certain payroll taxes.

3. Can an S Corp or an LLC protect my assets from business debts?

Yes, both S Corps and LLCs provide limited liability protection, meaning your assets are generally protected from business liabilities and debts.

4. Are there any restrictions on who can be a shareholder or member in an S Corp or an LLC?

An S Corp has more restrictions on shareholders compared to an LLC. For example, S Corps cannot have more than 100 shareholders, and they must be U.S. citizens or residents.

5. Can an S Corp or an LLC choose how it wants to be taxed?

Yes, both S Corps and LLCs have the flexibility to choose their tax classification. By default, an LLC is taxed as a disregarded entity or a partnership, while an S Corp is taxed as a pass-through entity.

6. Do S Corps or LLCs offer better opportunities for raising capital?

LLCs generally have more flexibility in raising capital, as they can have an unlimited number of members and can attract investors more easily. S Corps, on the other hand, has restrictions on the types of shareholders and the number of shareholders.

7. Are there any specific advantages of an S Corp over an LLC?

One advantage of an S Corp over an LLC is the potential for tax savings. S Corps allows for the distribution of profits and losses to shareholders, potentially resulting in lower overall tax liability.

8. Can an S Corp or an LLC provide retirement benefits to its owners?

Both S Corps and LLCs can offer retirement benefits to their owners, such as 401(k) plans or Simplified Employee Pension (SEP) plans.

9. Are there any disadvantages of forming an S Corp or an LLC?

Some potential disadvantages of forming an S Corp include the additional administrative requirements, such as holding regular shareholder meetings and maintaining proper corporate records. For an LLC, disadvantages may include the self-employment tax on all income.

10. Can I convert my LLC to an S Corp or vice versa?

Yes, it is possible to convert your LLC to an S Corp or vice versa, but it requires meeting certain eligibility criteria and filing the necessary paperwork with the appropriate government agencies.