The Benefits of Using a VA Loan

When it comes to financing a home, there are various options available to potential buyers. One such option that stands out for military service members and veterans is the VA loan. In this article, we will delve into the numerous benefits of using a VA loan and why it can be a smart choice for those who qualify.

Streamlined Process and Lower Interest Rates

VA loans are known for their streamlined process, making it easier and quicker for eligible borrowers to secure financing. The Department of Veterans Affairs guarantees a portion of the loan, which reduces the risk for lenders. As a result, lenders are often willing to offer lower interest rates compared to conventional loans. This can lead to significant savings over the life of the loan.

No Down Payment and No Private Mortgage Insurance

One of the most attractive features of a VA loan is that it allows eligible borrowers to finance up to 100% of the home’s value without requiring a down payment. This can be a game-changer for those who may not have a substantial amount of savings for a down payment. Additionally, VA loans do not require private mortgage insurance (PMI), which is typically required for conventional loans with a down payment of less than 20%. This further reduces the monthly mortgage payment for VA loan borrowers.

Flexible Credit Requirements

Another advantage of VA loans is the flexibility in credit requirements. While a good credit score is always beneficial, VA loans tend to be more forgiving when it comes to credit history. This means that even if you have had some financial challenges in the past, you may still be able to qualify for a VA loan. This flexibility opens up homeownership opportunities for more individuals and families.

No Prepayment Penalty

VA loans also do not have prepayment penalties. This means that if you have the financial means to pay off your loan early, you can do so without incurring any additional fees. Being able to pay off your mortgage ahead of schedule can save you a significant amount of money in interest payments over time.

Assistance for Those in Financial Hardship

If you encounter financial hardship and struggle to make your mortgage payments, the VA offers assistance programs to help you avoid foreclosure. The VA has dedicated professionals who can work with you to explore options such as loan modifications or repayment plans. This added support can provide peace of mind and help you navigate challenging times.

In conclusion, the benefits of using a VA loan are numerous. From the streamlined process and lower interest rates to the flexibility in credit requirements and the ability to finance a home without a down payment, VA loans provide significant advantages to eligible borrowers. Additionally, the absence of private mortgage insurance and prepayment penalties further enhance the appeal of VA loans. If you are a military service member or veteran, exploring the option of a VA loan could be a wise decision on your path to homeownership.

Frequently Asked Questions about the Benefits of Using a VA Loan

1. What is a VA loan?

A VA loan is a mortgage loan program specifically designed for veterans, active-duty service members, and eligible surviving spouses. It is guaranteed by the U.S. Department of Veterans Affairs.

2. What are the benefits of using a VA loan?

The benefits of using a VA loan include:

No down payment required

Lower interest rates

No private mortgage insurance (PMI) required

Flexible qualification criteria

Ability to finance up to 100% of the home’s value

3. Who is eligible for a VA loan?

Eligibility for a VA loan is typically granted to veterans who have served at least 90 consecutive days of active service during wartime, or 181 days of active service during peacetime. Other eligibility criteria may apply.

4. Can I use a VA loan more than once?

Yes, in most cases, you can use a VA loan multiple times as long as you have full entitlement available and meet the eligibility requirements.

5. Are there any income limitations for VA loans?

No, there are no specific income limitations for VA loans. However, lenders may consider your income when determining your ability to repay the loan.

6. Can I use a VA loan to buy a second home or investment property?

No, VA loans are intended for primary residences only and cannot be used to purchase second homes or investment properties.

7. Do I need excellent credit to qualify for a VA loan?

No, VA loans generally have more flexible credit requirements compared to conventional loans. However, having a good credit score can still improve your chances of getting approved.

8. Can I refinance an existing mortgage with a VA loan?

Yes, you can refinance an existing mortgage with a VA loan through the VA’s Interest Rate Reduction Refinance Loan (IRRRL) program, also known as a VA streamline refinance.

9. Are there any prepayment penalties with VA loans?

No, VA loans do not have any prepayment penalties, allowing borrowers to pay off their mortgages early without incurring additional fees.

10. How do I apply for a VA loan?

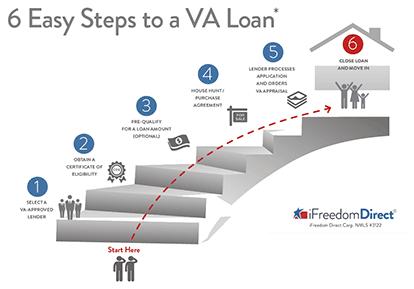

To apply for a VA loan, you can contact a VA-approved lender who will guide you through the application process. You will need to provide documentation to verify your eligibility and financial information.