Benefits of VA Loans

Welcome to our comprehensive guide on the benefits of VA loans. As experts in the field, we aim to provide you with detailed information about VA loans and why they are a great option for eligible veterans and active-duty military personnel.

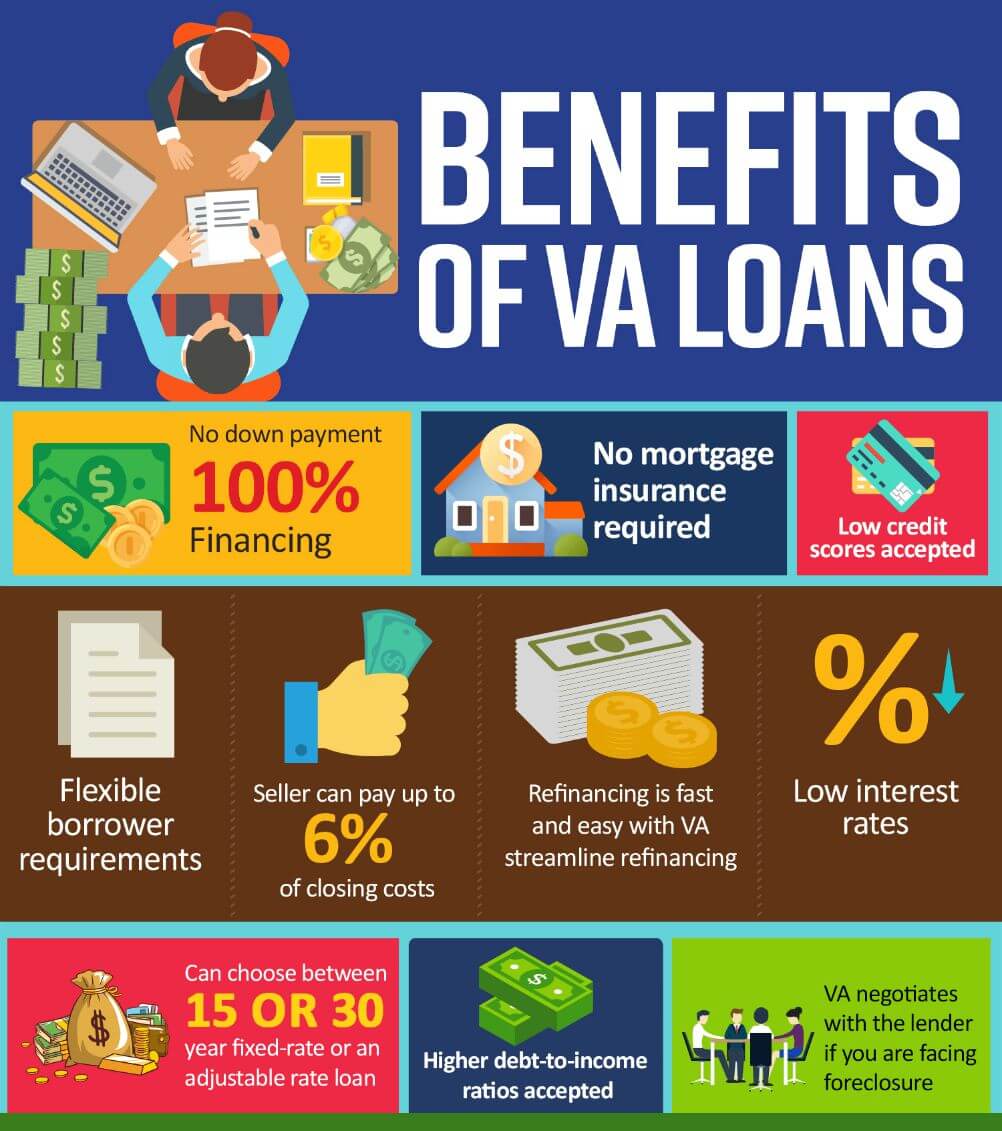

Low or No Down Payment

One of the most significant advantages of VA loans is the ability to purchase a home with little or no down payment. Unlike conventional loans that often require a 20% down payment, VA loans offer flexible options. This feature allows eligible borrowers to keep their savings intact or use them for other essential expenses.

No Private Mortgage Insurance (PMI)

Unlike other loan programs, VA loans do not require borrowers to pay for private mortgage insurance (PMI). PMI is typically required for conventional loans with a down payment of less than 20%. By eliminating the need for PMI, VA loans can save borrowers a significant amount of money each month.

Competitive Interest Rates

VA loans often come with competitive interest rates, making homeownership more affordable for veterans and active-duty military personnel. These low rates can result in substantial savings over the life of the loan, allowing borrowers to allocate their funds toward other financial goals.

Flexible Credit Requirements

VA loans are known for their more lenient credit requirements compared to conventional loans. While a good credit score is always beneficial, VA loans provide opportunities for individuals with less-than-perfect credit to become homeowners. This flexibility opens doors for many who may have been unable to qualify for other loan programs.

No Prepayment Penalties

With VA loans, borrowers have the freedom to make extra payments or pay off the loan entirely without incurring any prepayment penalties. This enables borrowers to save on interest and become mortgage-free sooner, providing greater financial stability and freedom.

Assistance in Avoiding Foreclosure

If a borrower with a VA loan faces financial hardship and struggles to make mortgage payments, the Department of Veterans Affairs offers assistance to help avoid foreclosure. This support includes loan modifications, repayment plans, and other options to ensure veterans and military personnel can keep their homes.

Streamlined Refinancing Options

VA loans also offer streamlined refinancing options, known as the Interest Rate Reduction Refinance Loan (IRRRL) program. This program allows borrowers to refinance their existing VA loan to obtain a lower interest rate or switch from an adjustable-rate mortgage to a fixed-rate mortgage, providing potential savings over time.

In conclusion, VA loans provide numerous benefits for eligible veterans and active-duty military personnel. From low or no down payments to competitive interest rates and flexible credit requirements, VA loans make homeownership more accessible and affordable. Additionally, the absence of private mortgage insurance, no prepayment penalties, and foreclosure avoidance assistance further contribute to the appeal of VA loans. If you are a veteran or active-duty military personnel looking to purchase a home, consider exploring the benefits of VA loans and take advantage of the opportunities they offer.

Frequently Asked Questions – Benefits of VA Loans

1. What are the benefits of VA loans?

VA loans offer benefits such as no down payment requirement, lower interest rates, no private mortgage insurance (PMI) requirement, and flexible qualification criteria.

2. Who is eligible for a VA loan?

Active duty service members, veterans, and surviving spouses may be eligible for a VA loan. Specific eligibility requirements can be obtained from the Department of Veterans Affairs (VA).

3. Can I use a VA loan more than once?

Yes, in most cases, you can use your VA loan benefit multiple times as long as you meet the eligibility criteria and have sufficient entitlement remaining.

4. Are there any loan limits with VA loans?

Yes, VA loan limits vary by county and are based on the conforming loan limits set by the Federal Housing Finance Agency (FHFA). However, in some high-cost areas, higher loan limits may be available.

5. Can I use a VA loan to buy a second home or investment property?

No, VA loans are intended for primary residences only and cannot be used to purchase second homes or investment properties.

6. Do VA loans require mortgage insurance?

No, VA loans do not require private mortgage insurance (PMI) as they are backed by the VA. This can result in significant savings over conventional loans.

7. Can I refinance an existing mortgage with a VA loan?

Yes, VA loans offer various refinancing options, such as the VA Interest Rate Reduction Refinance Loan (IRRRL) andIRLCash-Out Refinance Loan, allowing you to refinance your existing mortgage with a VA loan.

8. Are VA loans assumable?

Yes, VA loans are assumable, which means that if you sell your home, the buyer can take over your VA loan and assume the remaining balance, subject to VA approval.

9. Is there a prepayment penalty on VA loans?

No, VA loans do not have any prepayment penalties, so you can pay off your loan early without incurring any additional fees or charges.

10. How do I apply for a VA loan?

To apply for a VA loan, you can contact a VA-approved lender who will guide you through the application process and help you gather the necessary documentation to determine your eligibility.