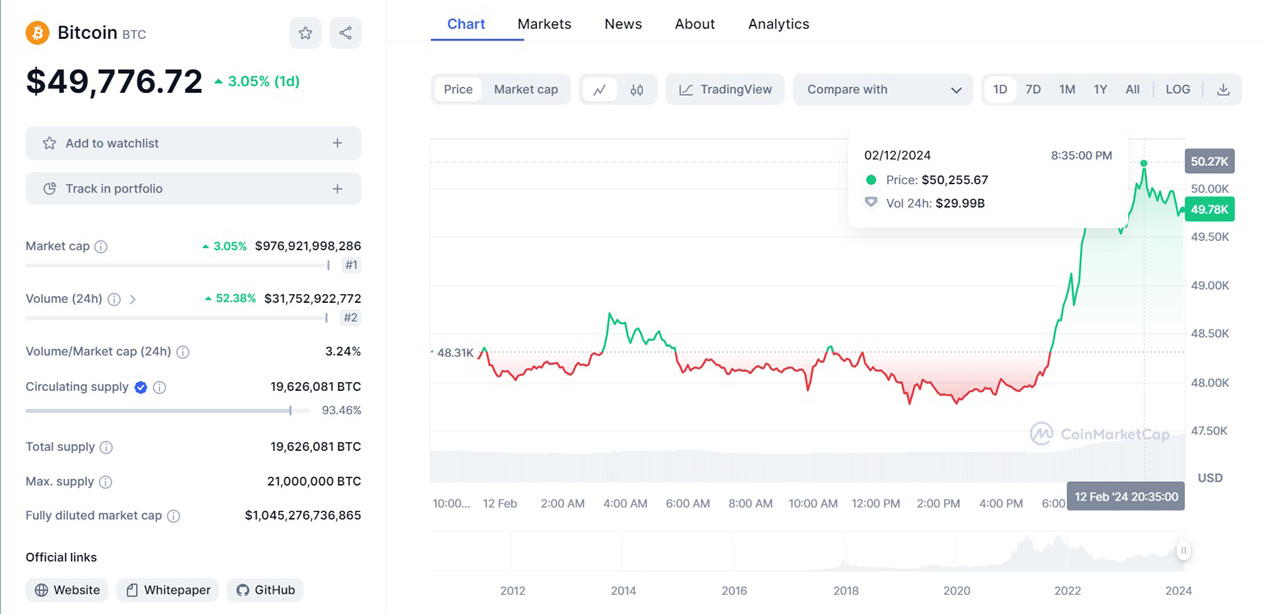

The crypto market fell amid statements by the head of the Fed about further rate hikes

The emerging stabilization of the crypto market turned out to be fragile: it was enough to speak to the head of the Fed, Jerome Powell, and talk about further (and rather tough) measures to curb American inflation, as the quotes of the world’s main cryptocurrencies rushed down.

Ethereum is not helped by the network merger scheduled for September 15 and the subsequent transition to the Proof-of-Stake algorithm: the cryptocurrency fell by 10.5% in a day and is now trading at $1,490. Bitcoin also fell, but not so much: minus 6% and the current rate is just over $20,000. The daily decline in the cost of other cryptocurrencies is in the range from 5 to 9 percent.

What did Jerome Powell say? He said easing US inflation is the Fed’s main goal and that restoring price stability will take time and tough central bank action. The Fed’s rate, he said, should reach a level that limits economic activity, and remain at this level for some time, so that the pace of consumer price growth slows down.

” We are purposefully moving our policies to a point where they will severely restrict economic activity ,” Powell said. Obviously, in such a situation, it is not up to investing in risky assets, which include cryptocurrency. However, not only the crypto market reacted to Powell’s words (it fell by almost 7% in a day, and capitalization again went below the trillion dollar mark) – the US stock market also fell. Judging by the words of the head of the Fed, the crypto market will be in the pit for quite a long time.