The US Securities and Exchange Commission filed a new lawsuit

Binance, the world’s largest cryptocurrency exchange, operated illegally in the US, the US Securities and Exchange Commission alleges in a new lawsuit. The lawsuit also includes the name of the founder of the exchange, Changpeng Zhao.

“Defendants enriched themselves by billions of dollars by exposing investors’ assets to significant risk,” the lawsuit says, which also alleges that Binance and Zhao illegally solicited investors, participated in several unregistered investment schemes, and “defrauded equity, retail and institutional investors regarding alleged surveillance and control of manipulative trading on the Binance.US platform.”

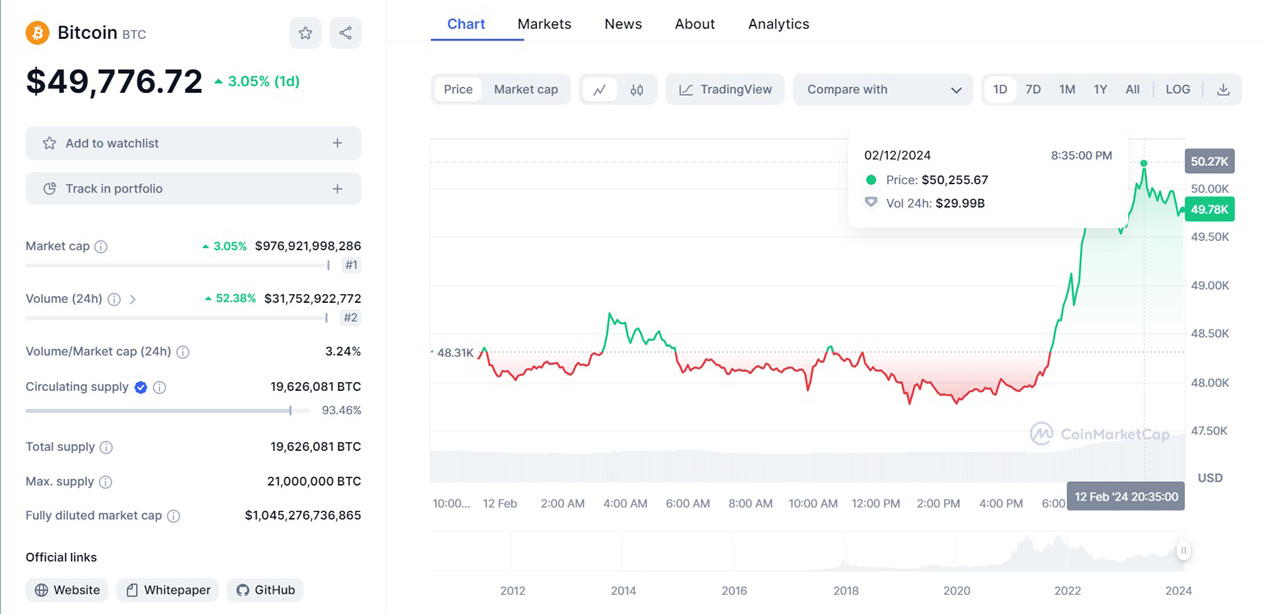

Bitcoin immediately reacted

“We are disappointed that the US Securities and Exchange Commission has decided to file a lawsuit against Binance,” Binance said in response. “From the very beginning, we have been actively cooperating with SEC investigations and have worked diligently to answer their questions and resolve their concerns.”

Binance’s statement does not refute most of the SEC’s allegations. Binance said the US Securities and Exchange Commission “decided to use brute force instead of the thoughtful approach required by this dynamic and complex technology.”

In the lawsuit, the SEC says that Binance was acting as a broker-dealer, exchange and clearing agency without proper registration. And the BUSD token, the Paxos-issued stablecoin, and the Binance BNB token were allotted by the agency as securities that were legally required to be registered with the agency. The SEC claims the main goal was to avoid regulatory oversight.

After the news broke, bitcoin fell to $25.7k.