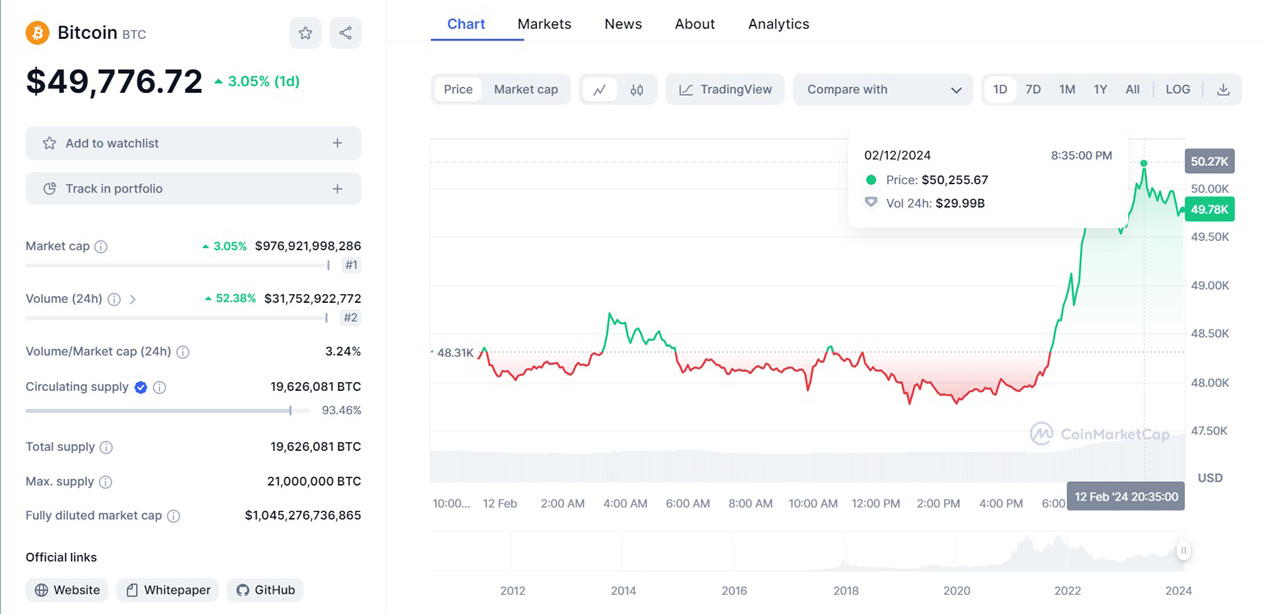

Analysts explain the interest in Bitcoin by investors’ hopes to get away from inflation

Yesterday we reported that the Bitcoin cryptocurrency hit the $ 20,000 mark and predicted further growth. He did not keep himself waiting. Today, more than $ 23,000 has already been given per unit of the most famous cryptocurrency. At the time of this writing, the rate has rolled back to about $ 22,500.

Bitcoin price exceeded $ 23,000

These figures are in line with year-to-date growth of more than 220%. According to Reuters, the growth is driven by demand from large investors who are attracted by both the get-rich-quick potential and the perceived opportunity to hedge inflation. The latter consideration is based on the fact that Bitcoin emission is fundamentally limited technically, which is not the case with traditional currencies losing weight, as governments and central banks try to use emission as an incentive to recover the economy from the impact of the COVID-19 pandemic.

“Due to the constant depreciation of paper money, there will be a search for alternative currencies,” analysts at Deutsche Bank said. “It looks like Bitcoin will continue to be in high demand.”

Cryptocurrencies emerged over a decade ago, but quickly became associated with crime, hacks, and price swings. Only in the last few years have they begun to attract investor interest. At the same time, the use of cryptocurrencies as a means of payment has not yet become widespread.