Bitcoin Price Today: Dips Below $112K as Ethereum Nears $4,450

Overview of Bitcoin and Ethereum Price Movements

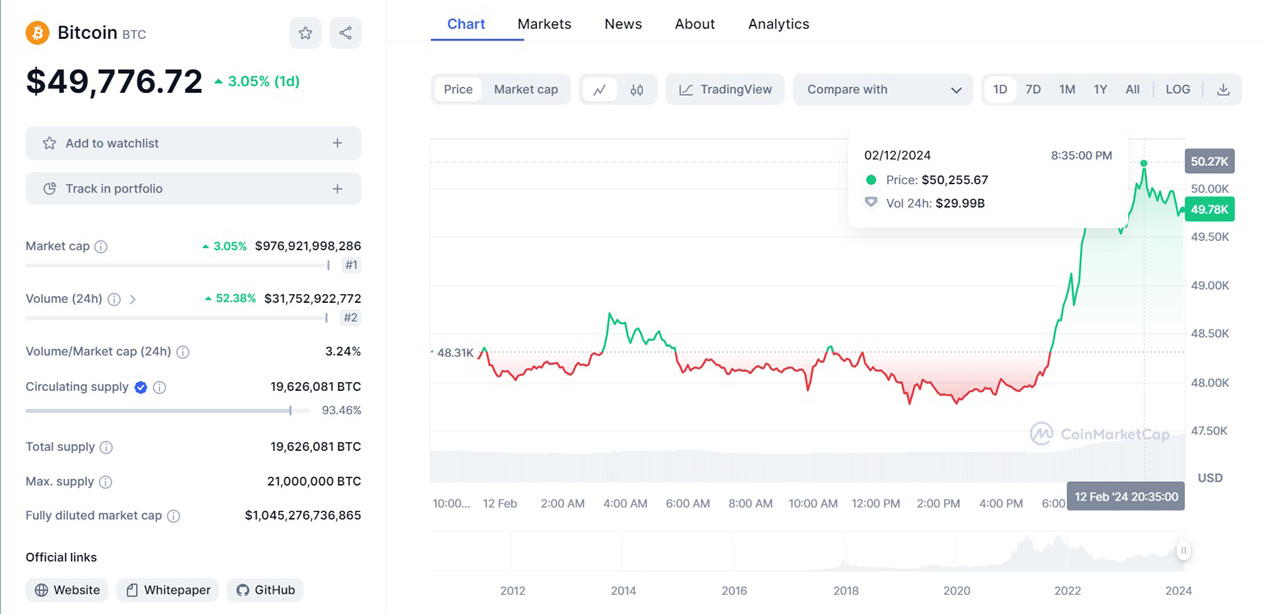

The crypto market experienced fresh pressure on Friday, with Bitcoin price today dropping below the $112,000 mark. At the time of writing, Bitcoin hovered around $111,920 (approx. ₹98.06 lakh), reflecting a slight dip of 0.3% over the past 24 hours. Meanwhile, Ethereum traded near $4,452 (₹3.9 lakh), recording a 1.4% decrease. Despite the pullback, Bitcoin ETFs managed to pull in $115 million (₹100 crore) in inflows, marking their fourth consecutive day of steady investments that softened overall losses.

Detailed Analysis of the Market Sentiment

Altcoins Showing Cautious Optimism Amid ETF Inflows

Several altcoins provided mixed signals, as investors appeared to tread carefully amid ongoing volatility:

-

Solana climbed 2%, trading close to $215, building on bullish momentum from earlier in the week.

-

Binance Coin (BNB) edged up 1.3%, reaching roughly $874.

-

XRP and Cardano (ADA) remained largely steady around $3.00 (₹264) and $0.86 (₹75), respectively.

-

Dogecoin stabilized near $0.22 (₹19), fueling speculation about an upcoming breakout.

As many altcoins sustain gains, the inflow of institutional funds into Ethereum ETFs has helped underwrite confidence across the sector.

Voice of Industry Experts

Edul Patel, CEO of Mudrex, observed, “Bitcoin is trading within a range of $111,500 to $113,000, while capital flows are moving towards altcoins like Ethereum and Solana. Spot Ether ETFs attracted $1.83 billion in five days versus $171 million for Bitcoin, signaling a clear shift in investor interest.”

Similarly, the CoinDCX research team noted Bitcoin’s consolidation between $111,500 and $112,000 and highlighted Ethereum’s resilience near $4,500. They also pointed out Solana’s rise above critical resistance levels with BNB following bullish trends, whereas XRP and ADA face resistance under $3 and $0.9.

Avinash Shekhar, Co-Founder of Pi42, added, “Bitcoin’s struggle to stay above $112,000 reflects miner selling pressure amounting to about $485 million recently, which impacts market supply. However, Ethereum stands out due to robust smart contract activity, eyeing a future move towards $5,000 despite short-term corrections.”

Regulatory Shifts and Broader Market Impact

The US regulatory landscape sees ongoing developments, especially with the Commodity Futures Trading Commission (CFTC) announcing that offshore crypto exchanges can now register as Foreign Board of Trade (FBOT) entities and legally serve US customers. This regulatory clarity may pave the way for enhanced institutional participation in crypto markets.

Additionally, Binance Australia is under audit by authorities over anti-money laundering (AML) concerns, illustrating ongoing regulatory scrutiny globally.

What to Watch: Key Price Levels and Upcoming Catalysts

Market participants are keenly observing whether Bitcoin can regain the $113,000 level and if Ethereum can push past $4,700 (approximately ₹4.14 lakh). These hurdles will influence market sentiment as new regulations and institutional flows continue to shape crypto’s trajectory.

Volatile Yet Promising Crypto Market

While Bitcoin and Ethereum face headwinds amid fresh selling pressures, ETF inflows and innovations in blockchain technologies promise sustained interest and growth. As major players adapt to evolving regulations and market dynamics, investors and traders alike must keep a close eye on price movements, regulatory developments, and institutional trends shaping the global crypto landscape.