Blue Cross Blue Shield Explanation of Benefits

Understanding Blue Cross Blue Shield Explanation of Benefits

When it comes to health insurance, Blue Cross Blue Shield (BCBS) is a well-known and trusted provider. One important aspect of using BCBS insurance is understanding the Explanation of Benefits (EOB). In this article, we will provide a comprehensive explanation of BCBS EOB, its purpose, and how to interpret it.

Purpose of Blue Cross Blue Shield Explanation of Benefits

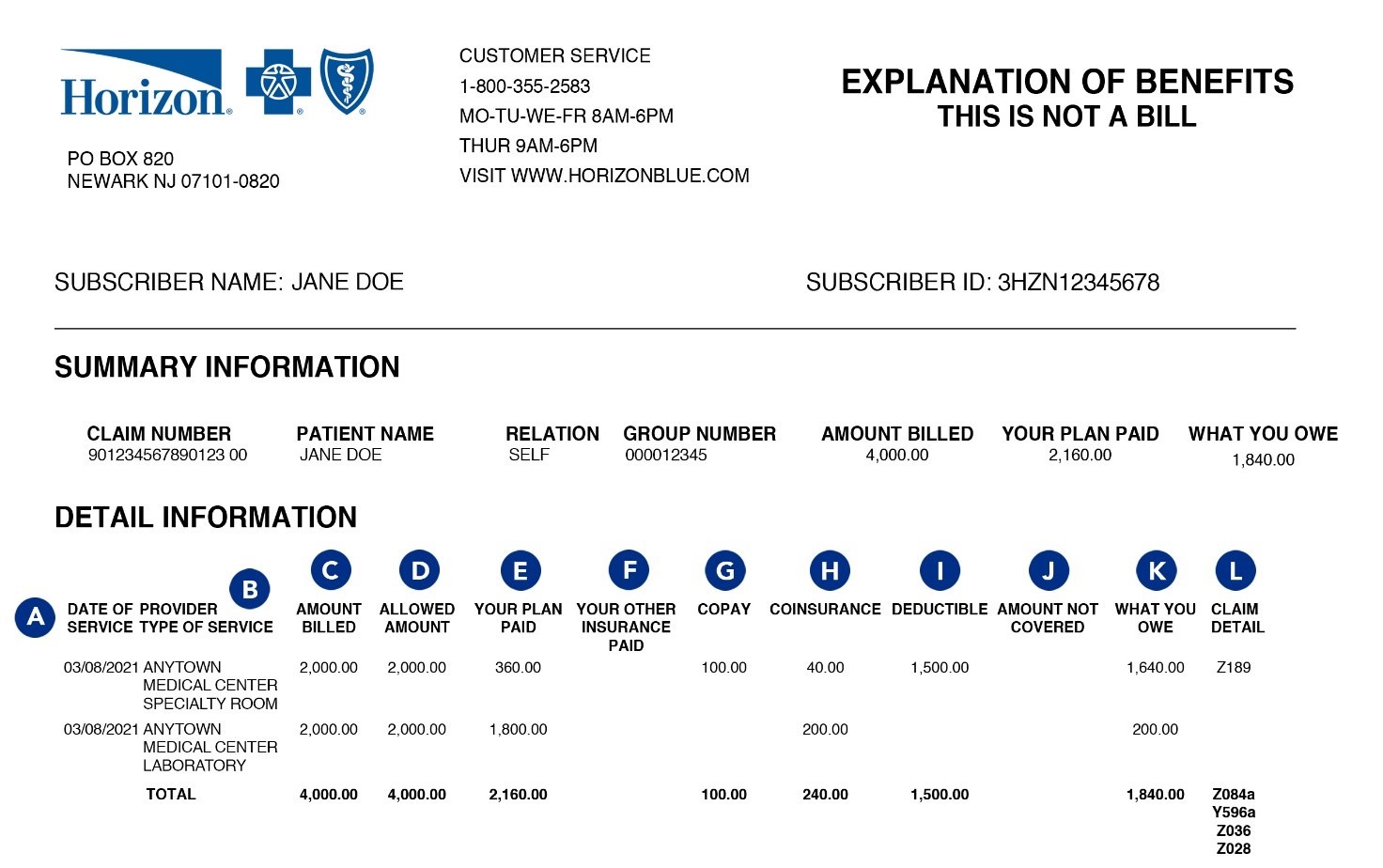

The Explanation of Benefits is a document provided by BCBS to its members after a healthcare service has been rendered. Its purpose is to outline the details of the medical service, including the cost, coverage, and any out-of-pocket expenses that the member may be responsible for. It serves as a summary of the insurance claim and helps members understand how their insurance coverage applies to the specific service received.

Interpreting Blue Cross Blue Shield Explanation of Benefits

When you receive your BCBS Explanation of Benefits, it’s important to review it carefully to ensure accuracy and understand the information provided. Here are the key elements to look for:

Service Details

The EOB will include information about the healthcare service, such as the date it was provided, the name of the healthcare provider, and a description of the service rendered. This section helps you identify the specific service that was covered by your insurance.

Cost Breakdown

BCBS EOB provides a breakdown of the total cost of the service and how it was covered by your insurance. It will show the amount billed by the healthcare provider, the allowed amount according to your insurance plan, and the portion covered by BCBS. Additionally, it will outline any deductibles, copayments, or coinsurance that you may be responsible for.

Coverage Details

In this section, the EOB will specify the coverage details of the service. It will indicate whether the service was fully covered, partially covered, or not covered at all. If any portion of the service was not covered, the EOB will explain the reason, such as limitations of the insurance plan or the need for prior authorization.

Out-of-Pocket Expenses

BCBS EOB will clearly outline any out-of-pocket expenses that you may owe. This includes deductibles, copayments, and coinsurance. It’s essential to understand these costs to effectively manage your healthcare expenses.

Using Blue Cross Blue Shield Explanation of Benefits Effectively

Understanding and utilizing your BCBS Explanation of Benefits can help you make informed decisions about your healthcare and manage your expenses. Here are some tips to make the most of your EOB:

Review for Accuracy

Always review your EOB for accuracy. Check that the service details, cost breakdown, and coverage information align with the healthcare service you received. If you notice any discrepancies, contact BCBS customer service for clarification.

Track Your Expenses

Keep track of your out-of-pocket expenses mentioned in the EOB. This will help you budget for future healthcare needs and ensure that you are not overcharged.

Understand Coverage Limitations

Pay close attention to the coverage details section of the EOB. It will provide insights into any limitations or exclusions in your insurance plan. Understanding these limitations can help you make informed decisions about your healthcare.

Communicate with BCBS

If you have any questions or concerns about your EOB, don’t hesitate to reach out to BCBS customer service. They can provide clarifications, explain coverage details, and assist you in navigating the complexities of your insurance benefits.

The Blue Cross Blue Shield Explanation of Benefits is a crucial document for understanding how your insurance coverage applies to specific healthcare services. By familiarizing yourself with the EOB and effectively interpreting its contents, you can make informed decisions about your healthcare and manage your expenses more efficiently. Remember to review your EOB for accuracy, track your expenses, understand coverage limitations, and communicate with BCBS when needed. With this knowledge, you are empowered to navigate your health insurance benefits effectively.

Frequently Asked Questions

1. What is an Explanation of Benefits (EOB)?

An Explanation of Benefits (EOB) is a document that provides a detailed breakdown of the healthcare services you received, the amount billed by the healthcare provider, the amount covered by your Blue Cross Blue Shield insurance, and any out-of-pocket expenses you may owe.

2. How can I access my Explanation of Benefits?

You can access your Explanation of Benefits (EOB) by logging into your Blue Cross Blue Shield member portal and navigating to the EOB section. Alternatively, you can also receive your EOBs via mail.

3. What information does an EOB contain?

An EOB typically includes the date of service, the healthcare provider’s name, the service or treatment received, the billed amount, the allowed amount, the amount covered by insurance, any deductible or copayment, and the amount you may owe.

4. How can I understand the codes mentioned in my EOB?

Your EOB may include various codes such as procedure codes, diagnosis codes, and insurance codes. You can refer to the Blue Cross Blue Shield website or contact their customer service for assistance in understanding these codes.

5. Can I dispute the information on my EOB?

If you believe there is an error or discrepancy in the information provided on your Explanation of Benefits (EOB), you can contact Blue Cross Blue Shield customer service to initiate a dispute and seek clarification.

6. How long should I keep my EOBs?

It is recommended to keep your Explanation of Benefits (EOBs) for at least one year, as they can serve as important records for tax purposes, insurance claims, and any potential disputes.

7. Can I request a copy of an older EOB?

Yes, you can request a copy of an older Explanation of Benefits (EOB) by contacting Blue Cross Blue Shield customer service. They will assist you in obtaining the necessary information.

8. Are EOBs the same as medical bills?

No, an Explanation of Benefits (EOB) is not the same as a medical bill. EOBs provide a summary of the services rendered and the insurance coverage, while medical bills are the actual invoices from healthcare providers requesting payment.

9. How often will I receive an EOB?

The frequency of receiving Explanation of Benefits (EOBs) depends on your specific insurance plan and the number of healthcare services you utilize. Typically, you will receive an EOB after each claim is processed.

10. What should I do if I disagree with the amount I owe on my EOB?

If you disagree with the amount mentioned in your Explanation of Benefits (EOB) that you are responsible for, you can contact Blue Cross Blue Shield customer service to discuss the matter and seek clarification. They will guide you through the process of resolving any discrepancies.