Example of Cost Benefit Analysis

In this article, we will provide a comprehensive example of a cost-benefit analysis. A cost-benefit analysis is a financial tool used to evaluate the potential benefits and costs of a project or decision. By analyzing the costs and benefits, businesses and individuals can make informed choices and determine the feasibility of a particular endeavor.

Understanding Cost Benefit Analysis

Cost-benefit analysis is a systematic approach that compares the expected costs and benefits of a project or decision. It helps in quantifying and evaluating the financial impact of different options. By considering both the positive and negative aspects, cost-benefit analysis provides a clear picture of the potential outcomes.

Example Scenario

Let’s consider an example scenario to illustrate the process of cost-benefit analysis. Imagine a company is considering implementing a new software system to streamline its operations. The cost-benefit analysis will help determine if the benefits outweigh the costs.

Step 1: Identifying Costs

The first step in a cost-benefit analysis is to identify and quantify all the costs associated with the project. In this case, the costs may include the initial investment for purchasing the software, training costs for employees, and any additional hardware or infrastructure required.

Step 2: Identifying Benefits

Next, we need to identify and quantify the benefits that the company expects to gain from implementing the software system. These benefits may include increased productivity, reduced errors, improved customer satisfaction, and cost savings in the long run.

Step 3: Assigning Monetary Value

Once the costs and benefits are identified, we need to assign a monetary value to each of them. This step can be challenging as some benefits are not easily quantifiable. However, it is essential to estimate the monetary value as accurately as possible to ensure an objective analysis.

Step 4: Calculating Net Benefits

After assigning monetary values, we calculate the net benefits by subtracting the total costs from the total benefits. If the net benefits are positive, it indicates that the benefits outweigh the costs, making the project financially viable.

Example Calculation:

Total Costs: $50,000

Total Benefits: $80,000

Net Benefits: $80,000 – $50,000 = $30,000

Step 5: Considering Intangible Factors

In addition to the quantifiable costs and benefits, it is crucial to consider intangible factors that may impact the decision. These factors may include employee satisfaction, brand reputation, and future growth opportunities.

In conclusion, a cost-benefit analysis is a valuable tool for evaluating the financial feasibility of a project or decision. By quantifying the costs and benefits, businesses can make informed choices and prioritize their resources effectively. In our example scenario, if the net benefits were positive, the company could proceed with implementing the software system, knowing that the benefits outweigh the costs.

Frequently Asked Questions about Cost Benefit Analysis

1. What is cost-benefit analysis?

Cost-benefit analysis is a systematic process used to evaluate the potential benefits and costs of a project or decision. It helps determine whether the benefits outweigh the costs.

2. Why is cost-benefit analysis important?

Cost-benefit analysis is important because it provides a structured approach to decision-making by quantifying the costs and benefits associated with a project. It helps in comparing different alternatives and selecting the one that maximizes overall value.

3. What are the key steps in conducting a cost-benefit analysis?

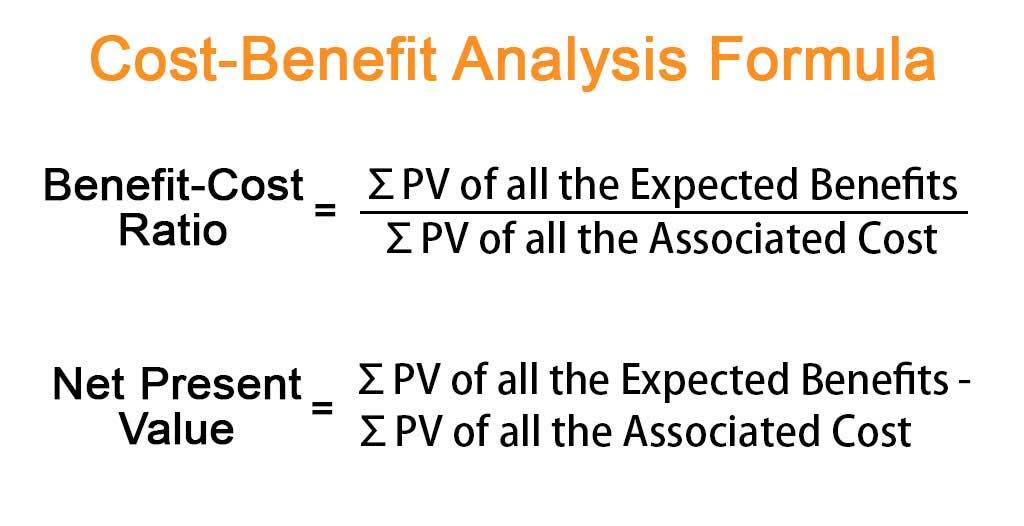

The key steps in conducting a cost-benefit analysis include identifying all relevant costs and benefits, assigning monetary values to them, discounting future values, and calculating the net present value or benefit-cost ratio.

4. What types of costs and benefits should be considered in a cost-benefit analysis?

A cost-benefit analysis should consider both tangible and intangible costs and benefits. Tangible costs include direct expenses like labor and materials, while intangible costs may include factors like environmental impact or social welfare.

5. How is the monetary value assigned to costs and benefits?

The monetary value assigned to costs and benefits can be determined through various methods such as market prices, surveys, historical data, or expert opinions. It is important to use reliable and consistent sources for accurate valuation.

6. What is the discounting of future values in cost-benefit analysis?

Discounting of future values is the process of reducing the value of future costs and benefits to their present value. It is done to account for the time value of money, as future values are worth less than present values.

7. How is the net present value (NPV) calculated?

The net present value (NPV) is calculated by subtracting the total discounted costs from the total discounted benefits. A positive NPV indicates that the benefits outweigh the costs, while a negative NPV suggests the opposite.

8. What is the benefit-cost ratio (BCR) in cost-benefit analysis?

The benefit-cost ratio (BCR) is the ratio of total discounted benefits to total discounted costs. It helps in comparing different projects or alternatives, and a BCR greater than 1 indicates that the benefits exceed the costs.

9. What are some limitations of cost-benefit analysis?

Some limitations of cost-benefit analysis include difficulty in assigning monetary values to intangible factors, uncertainty in future projections, and potential bias in decision-making. It is important to consider these limitations while interpreting the results.

10. How can cost-benefit analysis be applied in real-life situations?

Cost-benefit analysis can be applied in various real-life situations such as evaluating infrastructure projects, assessing environmental regulations, or making investment decisions. It provides a structured framework for decision-making based on economic analysis.