Explanation of Benefit – A Comprehensive Guide

Understanding the Importance of Explanation of Benefit

In the realm of insurance and healthcare, the term “Explanation of Benefit” (EOB) holds significant importance. It is a crucial document that provides a detailed breakdown of the services rendered by a healthcare provider and the corresponding coverage provided by an insurance company. This article aims to provide a comprehensive understanding of EOBs, their significance, and how they play a vital role in managing healthcare expenses.

What is an Explanation of Benefit?

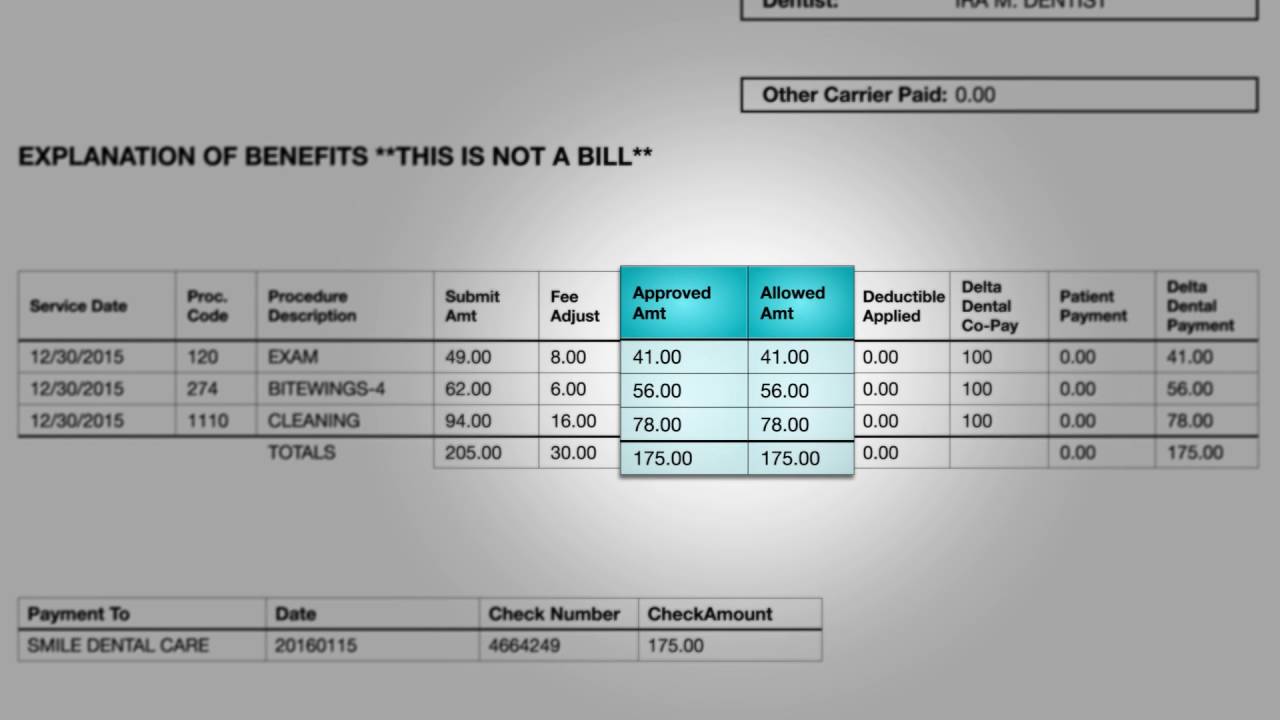

An Explanation of Benefit is a statement sent by an insurance company to an individual who has received healthcare services. It outlines the costs associated with the provided services, the amount covered by insurance, and the portion that the individual is responsible for paying out of pocket. EOBs serve as a transparent record of the financial aspects of healthcare transactions, ensuring individuals have a clear understanding of their coverage and expenses.

Key Components of an Explanation of Benefit

An EOB typically consists of several key components that are essential for understanding the financial aspects of healthcare transactions. These components include:

Service Details: The EOB provides a detailed description of the services received, including the date, type of service, and the healthcare provider’s name.

Charges: These include the total charges billed by the healthcare provider for the services rendered.

Insurance Coverage: The EOB outlines the amount covered by the insurance company for each service.

Out-of-Pocket Costs: This section specifies the portion of the expenses that the individual is responsible for paying.

Explanation Codes: EOBs often include explanation codes that provide additional information about the coverage and payment decisions.

Why are Explanation of Benefits Important?

Understanding EOBs is crucial for several reasons:

Financial Transparency: EOBs provide individuals with a clear breakdown of their healthcare expenses, ensuring transparency in financial matters.

Insurance Verification: By reviewing the EOB, individuals can verify that the insurance company has accurately processed and covered the services provided.

Dispute Resolution: In case of any discrepancies or errors in the EOB, individuals can reach out to the insurance company for clarification and resolution.

Budgeting and Planning: EOBs help individuals plan and budget for their healthcare expenses, as they provide insights into the out-of-pocket costs they may incur.

How to Read and Understand an Explanation of Benefit

Reading and understanding an EOB may seem daunting at first, but with a little guidance, it becomes easier. Here are a few steps to help you interpret an EOB:

Review the Service Details: Start by carefully examining the service details section to ensure accuracy in the description of the services received.

Check the Charges: Verify that the charges mentioned on the EOB match the healthcare provider’s bill.

Understand Insurance Coverage: Analyze the insurance coverage section to determine the amount covered by the insurance company for each service.

Calculate Out-of-Pocket Costs: Calculate the out-of-pocket costs mentioned in the EOB to understand your financial responsibility.

Refer to Explanation Codes: If your EOB includes explanation codes, refer to the provided legend to understand their meaning and implications.

Explanation of Benefit (EOB) is a crucial document that plays a significant role in managing healthcare expenses and ensuring transparency in financial matters. By understanding the key components of an EOB and how to interpret them, individuals can effectively manage their healthcare costs and make informed decisions regarding their insurance coverage. Stay proactive and review your EOBs carefully to ensure accuracy and address any discrepancies promptly.

Frequently Asked Questions about Explanation of Benefits

1. What is an Explanation of Benefits (EOB)?

An EOB is a statement sent by health insurance companies to policyholders that explains the costs covered and not covered for a specific medical service or treatment.

2. How can I obtain my EOB?

You can usually access your EOB through your health insurance company’s online portal or by requesting a physical copy via mail.

3. Why is it important to review my EOB?

Reviewing your EOB helps you understand the details of your healthcare expenses, verify that the insurance company has correctly processed your claims, and identify any potential billing errors.

4. What information does an EOB typically include?

An EOB usually includes the date of service, healthcare provider details, a description of the service rendered, the amount billed, the amount covered by insurance, and any patient responsibility.

5. How can I identify the insurance payments and patient responsibility on an EOB?

The insurance payments are usually listed as “Paid Amount” or “Allowed Amount,” while the patient responsibility is indicated as “Patient Responsibility” or “Amount Due from Patient.”

6. What should I do if I find an error on my EOB?

If you notice any errors on your EOB, such as incorrect billing or missing coverage, contact your health insurance company’s customer service to resolve the issue and get it corrected.

7. Can I appeal a denied claim mentioned in the EOB?

Yes, if a claim is denied or not fully covered, you have the right to appeal the decision. The EOB should provide instructions on how to initiate the appeals process.

8. How long should I keep my EOBs?

It is recommended to keep your EOBs for at least one year, or longer if necessary, as they serve as important records for tax purposes and potential future disputes.

9. Are EOBs the same as medical bills?

No, EOBs are not medical bills. EOBs explain the services and costs covered by your insurance, while medical bills are the actual invoices from healthcare providers requesting payment.

10. Can I access EOBs for my dependents?

Yes, as the policyholder, you can generally access and review the EOBs for all covered dependents under your health insurance plan.