Explanation of Benefits: A Comprehensive Guide

Welcome to our comprehensive guide on the topic of “Explanation of Benefits.” In this article, we will delve into the intricacies of understanding and maximizing the benefits provided by various services and insurance plans. By the end of this guide, you will have a clear understanding of how to navigate through the complexities of benefits and make informed decisions. Let’s dive in!

Understanding Benefits

Benefits are an essential component of any service or insurance plan. They are designed to provide individuals with financial coverage, access to services, or other advantages. Understanding the benefits you are entitled to is crucial to make the most of your plan and optimize your experience.

Types of Benefits

Benefits can come in various forms, depending on the service or insurance plan you have. Some common types of benefits include:

Healthcare Benefits: These benefits typically cover medical expenses, including doctor visits, hospital stays, prescription medications, and more.

Insurance Benefits: Insurance benefits can include coverage for property damage, accidents, theft, or other unforeseen events.

Employee Benefits: Many companies offer benefits to their employees, such as health insurance, retirement plans, paid time off, and more.

Social Security Benefits: These benefits are provided by the government and can include retirement benefits, disability benefits, and survivor benefits.

Maximizing Your Benefits

Now that we have a basic understanding of benefits, let’s explore some strategies to maximize their value:

Review Your Plan

Start by thoroughly reviewing your plan or service agreement. Take note of the benefits included, any limitations or restrictions, and the process for accessing them. Understanding the fine print will empower you to make informed decisions.

Utilize Preventive Services

Many plans offer preventive services at no additional cost. These can include routine check-ups, vaccinations, screenings, and more. By taking advantage of these services, you can proactively maintain your health and potentially avoid costly medical treatments down the line.

Stay In-Network

If your plan has a network of preferred providers, make sure to utilize them whenever possible. In-network providers have negotiated rates with your insurance company, resulting in lower out-of-pocket costs for you. Be sure to confirm the network status of any healthcare provider before receiving services.

Keep Documentation

It’s essential to keep all documentation related to your benefits, including receipts, bills, and explanation of benefits (EOB) statements. These documents can serve as proof of services rendered and may be required for reimbursement or dispute resolution.

Ask Questions

If you have any doubts or concerns about your benefits, don’t hesitate to reach out to your service provider or insurance company. Asking questions can help clarify any confusion and ensure you are maximizing the benefits you are entitled to.

In conclusion, understanding and optimizing the benefits provided by various services and insurance plans is crucial for making informed decisions and maximizing your experience. By reviewing your plan, utilizing preventive services, staying in-network, keeping documentation, and asking questions, you can make the most of your benefits and enhance your overall well-being. We hope this comprehensive guide has provided you with valuable insights and empowered you to navigate the complexities of benefits effectively.

Frequently Asked Questions – Explanation of Benefits

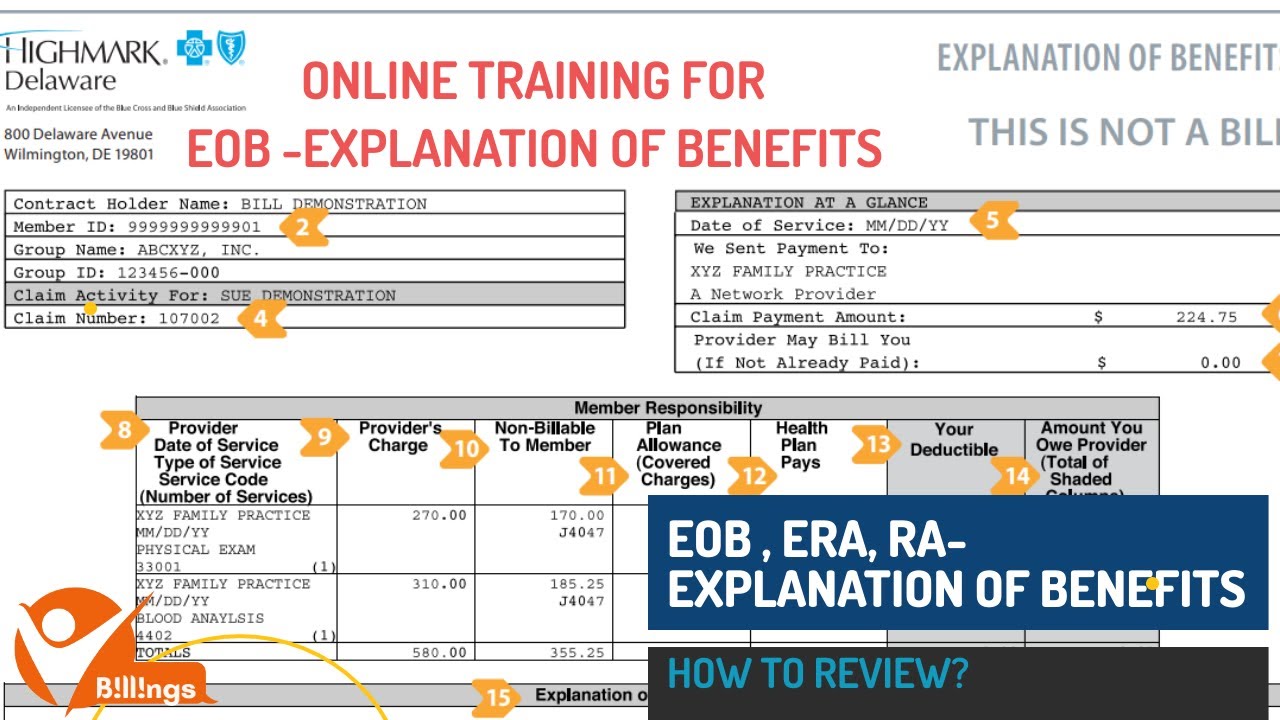

1. What is an Explanation of Benefits (EOB)?

An Explanation of Benefits (EOB) is a document that provides a detailed breakdown of the healthcare services you received, the amount billed by the healthcare provider, the amount covered by your insurance, and any out-of-pocket expenses you may owe.

2. How can I obtain a copy of my Explanation of Benefits?

You can usually access your Explanation of Benefits (EOB) through your insurance provider’s online portal. Alternatively, you can contact your insurance company’s customer service to request a copy.

3. What information does an Explanation of Benefits contain?

An Explanation of Benefits (EOB) typically includes the date of service, the healthcare provider’s name, the services rendered, the amount billed, the amount paid by insurance, any deductibles or co-pays, and a summary of your financial responsibility.

4. Why is it important to review my Explanation of Benefits?

Reviewing your Explanation of Benefits (EOB) is crucial to ensure that the services listed are accurate, the insurance payments are correct, and you are not being billed for any services you did not receive. It helps you detect any errors or potential fraud.

5. Can I dispute any charges listed on my Explanation of Benefits?

Yes, if you believe there is an error or discrepancy in your Explanation of Benefits (EOB), you can contact your insurance company’s customer service to dispute the charges and request a review of the claim.

6. How long should I keep my Explanation of Benefits for record-keeping purposes?

It is recommended to keep your Explanation of Benefits (EOB) for at least one year. However, if you have any ongoing medical issues or insurance claims, it is advisable to keep them for a longer period.

7. Can I use my Explanation of Benefits to file taxes?

No, an Explanation of Benefits (EOB) is not typically used for tax filing purposes. However, you may need to keep it as a supporting document if you plan to deduct medical expenses from your tax return.

8. Are Explanation of Benefits documents confidential?

Yes, Explanation of Benefits (EOB) documents contain sensitive personal and medical information. It is important to keep them confidential and only share them with relevant parties, such as healthcare providers or insurance companies.

9. What should I do if I never received an Explanation of Benefits?

If you did not receive an Explanation of Benefits (EOB) for a particular healthcare service, contact your insurance company to inquire about the missing document. It could be a simple oversight or an indication of a problem with your claim.

10. Can I access my Explanation of Benefits from previous years?

Yes, many insurance providers allow you to access and retrieve your Explanation of Benefits (EOB) from previous years through their online portals. If not available online, you can contact your insurance company to request older EOBs.