Exploring Opportunities in India’s Biosimilars Industry

As the global biologic products market prepares to lose patent protection for products worth $170 billion by 2030, the Indian biopharmaceutical sector stands at the brink of numerous opportunities. Dr. Cyrus Karkaria, President of biotechnology at Lupin Limited, sheds light on the growth potential and challenges in India’s biosimilar industry.

Rapid Growth and Current Valuation

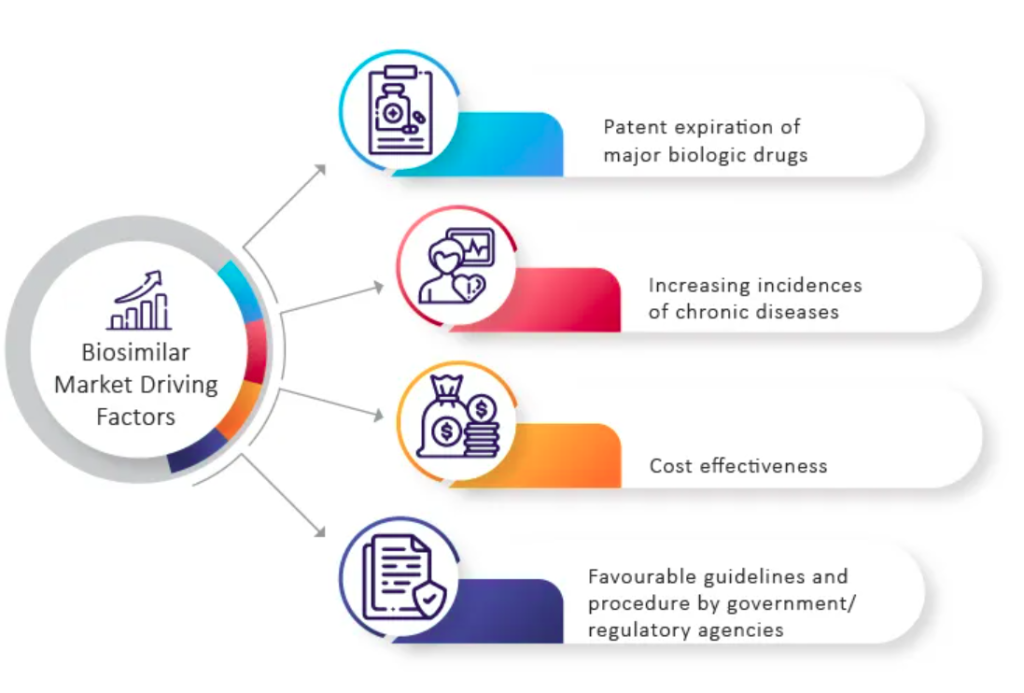

The Indian biopharmaceutical industry is experiencing remarkable growth, with a current valuation of $60 billion. In 2022, the biosimilars market reached $349 million and is projected to expand at a CAGR of 25.2% from 2022 to 2030, reaching $2.1 billion by 2030. This growth is fueled by factors such as cost competitiveness, robust manufacturing capabilities, intellectual capital, and strong domestic and international distribution networks.

Global Outsourcing and Market Trends

Indian biopharma companies are key outsourcing partners for global pharmaceutical firms. Their competitive advantages, combined with India’s large population, increasing health awareness, and improved access to quality medical care, position the domestic biopharmaceutical industry for continued growth.

Achievements and Challenges

Notable achievements in the sector include the approval of Trastuzumab biosimilar Ogivri and Neulasta biosimilar, both contributing to India’s global standing. However, challenges persist, as India holds a mere 3% share of the global biosimilar market. High development costs, complex clinical requirements, and the need for regulatory compliance hinder market growth.

Regulatory Landscape and Supply Chain

Establishing world-class manufacturing facilities and adhering to global regulatory standards are vital for successful biosimilar development. Challenges in gaining market authorization in regulated markets and the lack of clear guidelines in emerging markets impede progress. The supply chain also needs cold chain infrastructure for wider access.

Key Trends and Opportunities

The Asia-Pacific region presents immense opportunities for biosimilar manufacturing, with a projected 30% annual market growth. Countries like South Korea and Japan have made significant strides in biosimilar development. India, with its strong generics market and advanced biosimilar pipeline, is also well-positioned.

Government Initiatives and Market Shift

Governments in Asia-Pacific are encouraging biosimilar development. India’s “Make in India” initiative and the “National Bio-Pharma Mission” support biopharmaceutical growth. Japan and China have introduced policy changes to foster biosimilar adoption, while China’s Marketing Authorization Holder plan aims to expand the market.

Oncology Focus and Future Outlook

Oncology is a key focus for biosimilar development, particularly for top-selling monoclonal antibodies. Biosimilars offer cost-effective alternatives for cancer treatment. As cancer cases increase globally, biosimilar companies have an opportunity to improve the affordability and accessibility of life-saving drugs.

Roadmap to Success

India boasts 98 approved biosimilars, making it a strong player in the market. With biologic products worth $170 billion losing patent protection by 2030, Indian companies must invest in R&D, regulatory compliance, and sales capabilities. Early entry into the market and strategic development will determine long-term success.

Conclusion

The Indian biosimilar industry is poised for substantial growth, fueled by its competitive advantages, government support, and the global shift towards biosimilars. By addressing challenges, fostering innovation, and embracing strategic growth, India can establish itself as a global biotechnology hub.

FAQs:

Q1: What is the current valuation of India’s biopharmaceutical industry?

A: India’s biopharmaceutical industry is currently valued at $60 billion.

Q2: What is the growth projection for India’s biosimilars market by 2030?

A: The biosimilars market in India is estimated to expand at a CAGR of 25.2% from 2022 to 2030, reaching $2.1 billion by 2030.

Q3: What are the challenges faced by the Indian biosimilars industry?

A: High development costs, complex clinical requirements, and regulatory compliance are some of the challenges hindering the growth of the Indian biosimilars industry.

Q4: How is the Asia-Pacific region contributing to biosimilar manufacturing?

A: The Asia-Pacific region is witnessing significant growth in biosimilar manufacturing, with countries like South Korea and Japan leading the way.

Q5: What opportunities does oncology biosimilars development offer?

A: Oncology biosimilars offer cost-effective alternatives for cancer treatment, addressing the increasing demand for affordable and accessible treatment options.

Q6: How can Indian companies succeed in the biosimilars market?

A: Indian companies can succeed by investing in R&D, regulatory compliance