Withdrawing your Provident Fund (PF) amount online has become a seamless process, thanks to the digital initiatives by the Employees’ Provident Fund Organisation (EPFO). Whether you need funds for a medical emergency, home purchase, education, or marriage expenses, the online withdrawal facility simplifies the process and eliminates the need for extensive paperwork. In this comprehensive guide, we will walk you through the step-by-step procedure to withdraw your PF amount online, ensuring a smooth and hassle-free experience.

Understanding PF Withdrawal Eligibility

Before initiating a PF withdrawal, it’s essential to understand the eligibility criteria. EPFO allows employees to withdraw their PF balance under the following conditions:

- Retirement – Employees who have reached 58 years of age can withdraw the full PF balance.

- Unemployment – If unemployed for over two months, employees can withdraw 75% of their PF balance after the first month and the remaining 25% after the second month.

- Medical Emergency – PF withdrawal is permitted for medical treatment for self or family members.

- Home Loan Repayment / House Purchase / Construction – A portion of the PF balance can be withdrawn for home-related financial needs.

- Marriage or Education Expenses – Employees can withdraw PF for their or their children’s marriage or education.

Prerequisites for PF Withdrawal Online

Before proceeding with the PF withdrawal, ensure the following requirements are met:

- Activated Universal Account Number (UAN): Your UAN must be active and linked to your EPF account.

- KYC Compliance: Aadhaar, PAN, and bank details should be updated and verified on the EPFO portal.

- Mobile Number Linked with Aadhaar: The registered mobile number should be linked for OTP verification.

- Valid Reason for Withdrawal: Withdrawal is only permitted for approved purposes under EPFO guidelines.

Step-by-Step Guide to Withdraw PF Amount Online

Step 1: Log in to the EPFO Portal

- Visit the EPFO Member Portal.

- Enter your UAN and password, then solve the captcha to log in.

Step 2: Navigate to the Online Claim Section

- Click on ‘Online Services’ in the top menu.

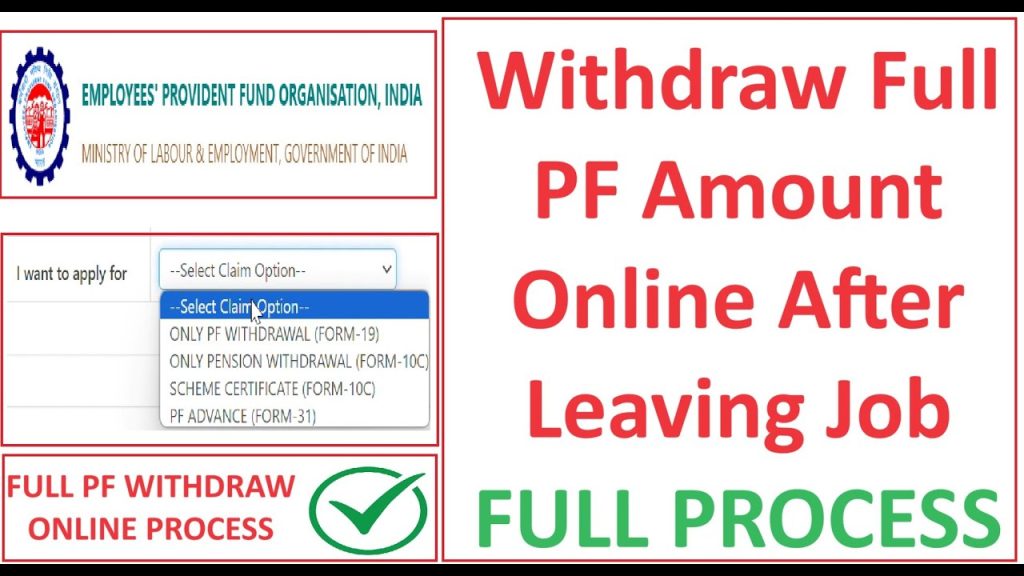

- Select ‘Claim (Form-31, 19, 10C & 10D)’ from the dropdown.

Step 3: Verify KYC and Select Withdrawal Type

- Ensure all KYC details are updated.

- Choose the appropriate withdrawal type based on your eligibility (Full withdrawal, Partial withdrawal, or Pension withdrawal).

Step 4: Fill Out the Online Withdrawal Form

- Enter the last four digits of your bank account linked with UAN.

- Click on ‘Verify’ and then proceed.

- Choose the reason for withdrawal from the options provided.

- Fill in the required details and upload supporting documents if necessary.

Step 5: Authenticate with OTP and Submit Request

- Agree to the terms and conditions.

- Click on ‘Get Aadhaar OTP’, and enter the OTP received on your registered mobile number.

- Click ‘Submit’ to complete the request.

Tracking Your PF Withdrawal Status

Once the withdrawal request is submitted, you can track its status through:

- EPFO Portal: Navigate to ‘Online Services’ > ‘Track Claim Status’.

- UMANG App: Log in with your UAN and check the status under ‘Track Claim’.

- SMS Alerts: EPFO sends regular updates on claim processing via SMS to the registered mobile number.

How Long Does PF Withdrawal Take?

- Online claims usually take 3-7 working days for approval.

- Once approved, the amount is credited to your bank account within 2-3 working days.

Common Issues and How to Resolve Them

1. KYC Not Updated

- Solution: Update Aadhaar, PAN, and bank details on the EPFO portal and get them verified by the employer.

2. Incorrect Bank Details

- Solution: Update the correct bank details through the employer and reapply.

3. Pending Employer Approval

- Solution: Follow up with your employer to approve the KYC and withdrawal request.

Offline PF Withdrawal Process

For those who prefer offline withdrawal, follow these steps:

- Download Composite Claim Form (Aadhaar or Non-Aadhaar) from the EPFO website.

- Fill out the form and attach supporting documents.

- Submit the form to the regional EPFO office.

- Once processed, the amount is credited to your account within 15-20 days.

Frequently Asked Questions:

1. Can I withdraw my PF without employer approval?

Yes, if your Aadhaar is linked and KYC is verified, you can withdraw PF online without employer approval.

2. What is the maximum amount I can withdraw from my PF account?

It depends on the purpose of withdrawal. For instance, you can withdraw 90% of the balance upon retirement or 50% for a medical emergency.

3. How many times can I withdraw PF?

Partial withdrawals are allowed multiple times for different reasons, but full withdrawal is only permitted after retirement or two months of unemployment.

4. Why is my PF withdrawal request rejected?

Common reasons include incorrect bank details, pending KYC verification, or missing documents. Ensure all details are updated before applying.

5. Can I withdraw my PF while still employed?

Yes, partial withdrawal is allowed for specific purposes like medical emergencies, marriage, education, or home loan repayment.