The IMPS Transfer Limit:Secure and Swift Money Transfers

In the digital age, Immediate Payment Service (IMPS) has gained immense popularity for its ability to facilitate quick and convenient money transfers. Understanding the transfer limits associated with IMPS is crucial to ensure seamless transactions without any unexpected hurdles. This comprehensive guide aims to shed light on the IMPS transfer limits and provide insights into managing them effectively.

IMPS: A Primer

IMPS, introduced in the banking industry, is a service that enables individuals to transfer funds instantly. It offers numerous benefits, including real-time transfers, availability 24/7, and compatibility with various devices. IMPS incorporates robust security measures to ensure safe transactions, making it a reliable choice for digital banking.

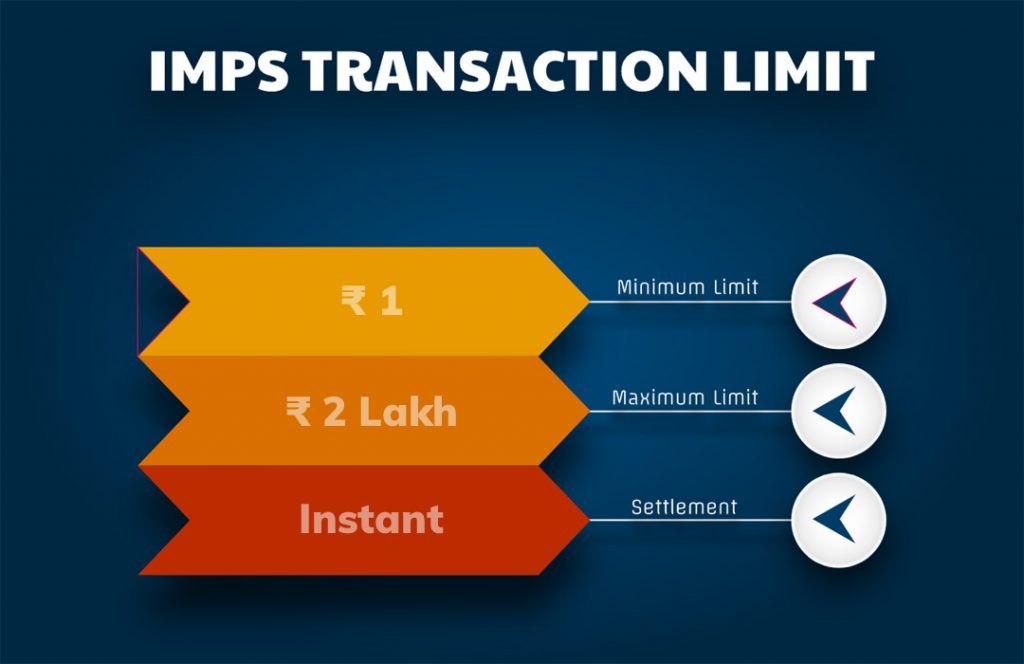

IMPS Transfer Limits

IMPS transfer limits refer to the maximum amount of funds that can be transferred through the IMPS service. These limits can vary across different banks and account types. There are three types of IMPS transfer limits:

Daily Limits:

This refers to the maximum amount that can be transferred in a single day. Banks typically set a specific limit to prevent any misuse or fraudulent activities.

Transaction Limits:

Transaction limits determine the maximum amount that can be transferred in a single transaction. It ensures that large sums of money are not transferred in one go, reducing the risk of unauthorized transactions.

Beneficiary Limits:

Beneficiary limits are specific to each payee or recipient. They define the maximum amount that can be transferred to a particular beneficiary within a specified time period. These limits are in place to safeguard against potential fraud or misuse of funds.

It is crucial to be aware of these transfer limits to avoid any disruptions during fund transfers. Let’s explore some examples to understand their impact on different transaction sizes:

Example 1:

If a bank sets a daily limit of $10,000 and a transaction limit of $5,000, you can transfer up to $5,000 per transaction, but not more than $10,000 in total within a day.

Example 2:

If a beneficiary limit is set at $20,000, you can transfer up to $20,000 to that specific recipient within the specified time period. However, you may still have remaining limits available for other beneficiaries.

Factors Influencing IMPS Transfer Limits

Several factors come into play when banks determine IMPS transfer limits. These factors include:

Account Type:

The type of account you hold, such as savings, current, or business account, can influence the transfer limits. Banks may have different limits for each account type based on their policies and risk assessment.

Customer Profile:

Your customer profile, including factors like your credit history, income level, and relationship with the bank, can impact the transfer limits. Banks may set higher limits for customers with a good track record and a long-standing relationship.

Transaction History:

Your transaction history, particularly with regards to IMPS transfers, can also play a role in determining the transfer limits. Banks may consider factors such as the frequency, size, and nature of your previous transactions.

Regulatory Guidelines and Compliance:

Banks need to adhere to regulatory guidelines and compliance requirements set by governing bodies. These guidelines may influence the transfer limits imposed by banks to ensure adherence to anti-money laundering (AML) and know your customer (KYC) norms.

Tips to Manage IMPS Transfer Limits

To effectively manage IMPS transfer limits and optimize your fund transfers, consider the following tips:

Check Current Transfer Limits:

Stay informed about your current transfer limits by accessing your online banking platform or contacting your bank directly. This will help you plan your transactions accordingly.

Plan Larger Transactions in Advance:

If you need to transfer a larger sum of money, plan ahead and ensure it falls within the set transfer limits. If necessary, you can split the amount into multiple transactions to stay within the limits.

Utilize Multiple Transactions:

If your transfer exceeds the transaction limit, consider splitting it into multiple transactions. However, keep in mind that each transaction may be subject to transaction fees, so factor that into your decision.

Track Transaction History:

Regularly review your transaction history to keep track of your remaining transfer limits. This will help you stay informed and avoid any surprises during fund transfers.

FAQs

Here are some frequently asked questions regarding IMPS transfer limits:

What is the maximum daily transfer limit for IMPS transactions?

The maximum daily transfer limit for IMPS transactions can vary depending on the bank and account type. It is advisable to check with your bank to determine the specific limit applicable to your account.

Are there any restrictions on the number of transactions allowed per day through IMPS?

Generally, there are no restrictions on the number of transactions allowed per day through IMPS. However, each transaction may be subject to transaction limits and cumulative daily limits set by your bank.

Can the transfer limits be increased temporarily for urgent requirements?

Some banks may allow temporary increases in transfer limits for urgent requirements. However, this is subject to the bank’s discretion and internal policies. It is recommended to contact your bank and discuss your specific needs to explore the possibility of a temporary limit increase.

Are the transfer limits the same for all account types?

No, transfer limits can vary depending on the account type. Banks may set different limits for savings accounts, current accounts, business accounts, and other types of accounts. It is best to check with your bank to understand the transfer limits applicable to your specific account type.

How can I check my current IMPS transfer limits?

You can check your current IMPS transfer limits by accessing your online banking platform or by contacting your bank’s customer service. They will be able to provide you with the specific transfer limits applicable to your account.

Can the transfer limits be customized as per customer preferences?

Transfer limits are typically determined by the bank based on various factors such as account type, customer profile, and regulatory guidelines. While some banks may allow for customization of transfer limits, it is not a common practice. It is recommended to check with your bank for any available options regarding customized transfer limits.

Do IMPS transfer limits differ between different banks?

Yes, IMPS transfer limits can vary between different banks. Each bank has its own policies and risk assessment measures, which may result in different transfer limits. It is important to be aware of the limits set by your specific bank to ensure smooth transactions.

Are there any charges associated with exceeding the transfer limits?

Exceeding the transfer limits set by your bank may result in additional charges or penalties. These charges can vary depending on the bank’s policies. It is advisable to stay within the prescribed limits to avoid any extra fees or consequences.

Can the transfer limits be decreased by the bank without prior notice?

While it is uncommon for banks to decrease transfer limits without prior notice, they have the authority to do so if they identify any suspicious activities or risk factors associated with your account. It is important to maintain a good banking relationship and follow the bank’s terms and conditions to avoid any unexpected changes to your transfer limits.

Are IMPS transfer limits applicable for international transactions?

No, IMPS transfer limits are typically applicable for domestic transactions within the country. For international transactions, different rules and limits may apply, depending on the specific remittance or money transfer service being used. It is advisable to check with your bank or the service provider for the transfer limits applicable to international transactions.

Conclusion

Understanding the IMPS transfer limits is essential for seamless and secure money transfers. IMPS provides a convenient and quick way to transfer funds, but being aware of the transfer limits helps you plan your transactions effectively. By considering factors such as account type, customer profile, and transaction history, banks determine the transfer limits. It is important to stay informed about your current transfer limits, manage them efficiently, and follow the tips provided to optimize your IMPS transactions. By doing so, you can make the most of IMPS for secure and swift money transfers.